Lending Re-Imagined with Alternative Credit Score Data and Automation

Despite the not so good market conditions and remaining operational challenges by the end of 2020, financial companies cannot further delay the lending sector restart, especially if they want to maintain a balanced portfolio of solvent customers in the future. The response measures your organization will take in 2021 are crucial to future customer relationships, your public image, and future recovery of loan losses.

How can financial leaders navigate safely and sustainably out of the crisis? Hint: by accelerating the much overdue digital transformations in the lending sector, especially those pertaining to loan origination automation and alternative data usage.

How Alternative Lenders Are Taking over Traditional Players at the Lending Restart

While traditional financial institutions were focused on implementing emergency “defense measures”, digital-first lenders such as Kabbage (previously backed by SoftBank and Credit Suisse, recently acquired by American Express in August 2020) re-focused on growth. Despite a brief period of operational challenges, the digital lender proactively helped SMB customers access government-backed loans and provided US-based small businesses with over $7 billion in working capital in 2020. Kabbage was also among the few non-bank companies who were approved to participate in the $349 billion Paycheck Protection Program (PPP) in the US.

Unlike incumbent lenders, Kabbage provides credit decisions in under 10 minutes, using the company’s AI-based credit scoring engine. The entire process is fully digital and intuitive for first-time applicants. Apart from traditional credit scores, the company also uses alternative data – over 1.5 million alternative credit score data points per applicant – to make its decisions and minimize default rates.

Along with an array of other digital players, Kabbage has managed to amass a large and loyal customer base by leveraging emerging technologies and customer data, acquired outside of the credit reporting agencies (CRAs). Such inherent agility has enabled digital-first players to resume lending faster and adapt their infrastructure to benefit from PPP loan schemes as well as other governmental grants.

Traditional lenders and credit bureaus should borrow some lessons from their digital-first partners when it comes to streamlined decision-making, based on alternative data, loan origination automation, and digital customer experience. Alternatively, by the time financial conditions rebounds, legacy organizations may have already lost a significant portion of their customer bases to fintech competition.

Alternative Credit Data: What is It and How Lenders Can Profit

To issue fast and accurate lending decisions, mobile lenders are using sophisticated machine learning algorithms to build highly-accurate lender profiles for each applicant. However, unlike traditional lending institutions, they are looking beyond credit records and connecting extra data sources, to power their analytics for financial assessments.

Such ‘alternative’ credit score data can be conditionally grouped into:

- Rental payments serve as a strong proxy for a customer’s ability to meet payment obligations. CreditLadder, for example, leverages open banking APIs to connect to the applicant’s bank account and add rental payment data to their overall credit score.

- Self-reported financial data. The recently released UltraFICO scoring engine lets consumers provide extra personal checking and savings information to increase their total score. Newly released FICO10 also leverages historical data regarding the applicant’s credit usage and account balances over the last 2 years.

- Disposable income. Aire, a digital consumer reporting agency, runs Interactive Virtual Interviews (powered by conversational AI) to collect an array of data points across the customer lifecycle and assign an accurate score, based on their disposable income, asset ownership, and employment history among other factors. The latter is already a part of the credit decision-making process in France and Japan.

- POS and transactional data. Both give more insights into the consumers’ typical spending and can also indicate their levels of disposable income. Uulala, a LatAM blockchain-based digital lender, leverages such data for credit-thin applicants.

- Telecom and mobile data can also provide lenders with extra context into the applicants’ lives, especially in emerging markets, where traditional banking services penetration remains low, while mobile money usage keeps growing. Tala is a digital lender that built a sophisticated credit scoring model for consumers in emerging markets, based primarily on mobile data.

These data sources can help lenders get a more comprehensive view of the applicant’s financial life and ongoing behaviors, indicative of the outcome they would want to predict. In addition, extra data can help leaders establish connections between anonymized customers’ profiles and outcomes to create ‘lookalike’ personas of likely reliable lenders.

However, a greater volume of data can also result in more chaos over clarity, without a proper data management strategy. In particular, all the variable data points, used within the custom scoring algorithm, need to be properly cleansed, grouped and ranked in terms of their impact on the outcome. For example, regular rental payments may denote the applicant’s ability to make regular payments, but don’t quite explain if they could meet their obligations on larger on-time payments. As an extra step to make sense of all the data, banks and financial institutions turn to the latest technologies that reshape approaches to underwriting and risk scoring, including cloud, blockchain, and AI.

Ultimately, lenders will need to select between 10 to 20 of the most predictive variables and test the performance of the algorithms using them against the set benchmarks.

Suitable alternative credit data sources should:

- Be indicative of the borrower’s behavior

- Leverage borrower’s segment psychographics

- Take into account the context and pre-existing relationships.

Alternatively, lenders can also consider integrating a third-party fintech solution, rather than developing a custom scoring algorithm. With the rise of BaaS, several industry frontrunners (both fintechs and banks) provide lending and credit scoring APIs.

How Lenders Should Approach Loan Origination Automation

More diverse data is the fuel for better scoring. But some legacy lenders also need a new engine to power their operations since manual or rule-based systems no longer suffice for quick and accurate decision-making.

The emerging set of technologies – big data and predictive analytics, robotic process automation (RPA), and machine learning (ML) – have already proved to be strong contenders for increasing the efficacy of loan origination, underwriting, and risk evaluation.

Risk Evaluation

Traditional lending risk evaluations, based around Basel II standards and the Judgmental Method of the 5Cs (Character, Capital, Collateral, Capacity, Conditions), are gradually losing their effectiveness. Due to the inconsistent interpretability of the 5C factors, a lot of credit-thin or minority lenders ended up being at a disadvantage. Lending institutions, in turn, have also fallen prey to their bias towards borrowers ‘ticking all the compliance boxes’, but ending up being unable to meet their obligations.

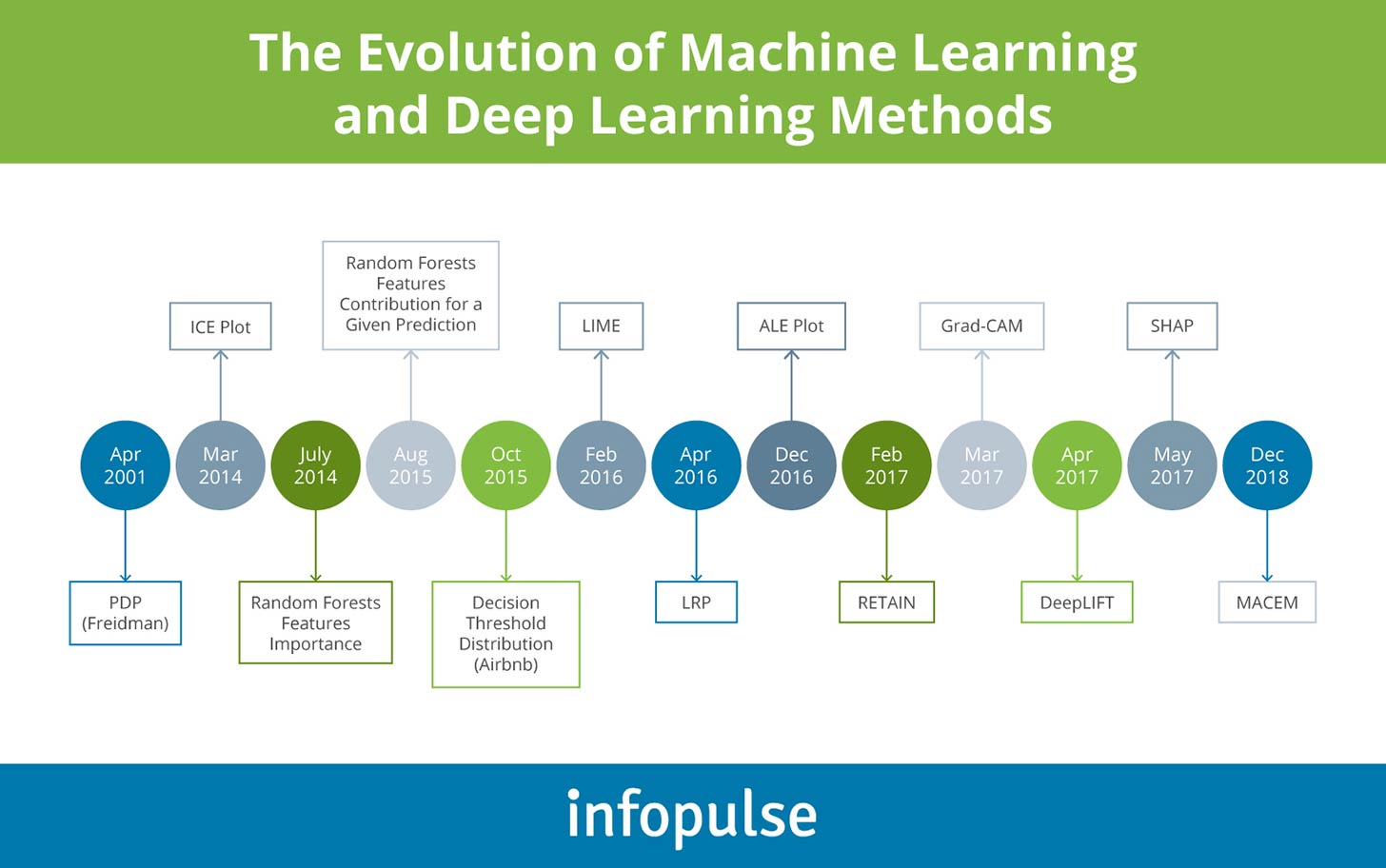

The newer grade of machine learning (and deep learning) algorithms, powered by traditional and alternative data, has proven to be effective at fairly operationalizing the available data to predict lending outcomes. Unlike human analysis, such systems utilize an array of statistical and mathematical methods against larger datasets to identify common patterns within data and make highly accurate predictions.

The current state-of-the-art risk engines can provide accurate risk predictions in a matter of minutes. This allows your company to extend credit faster without magnifying operational risks.

Loan Underwriting and Decision-Making

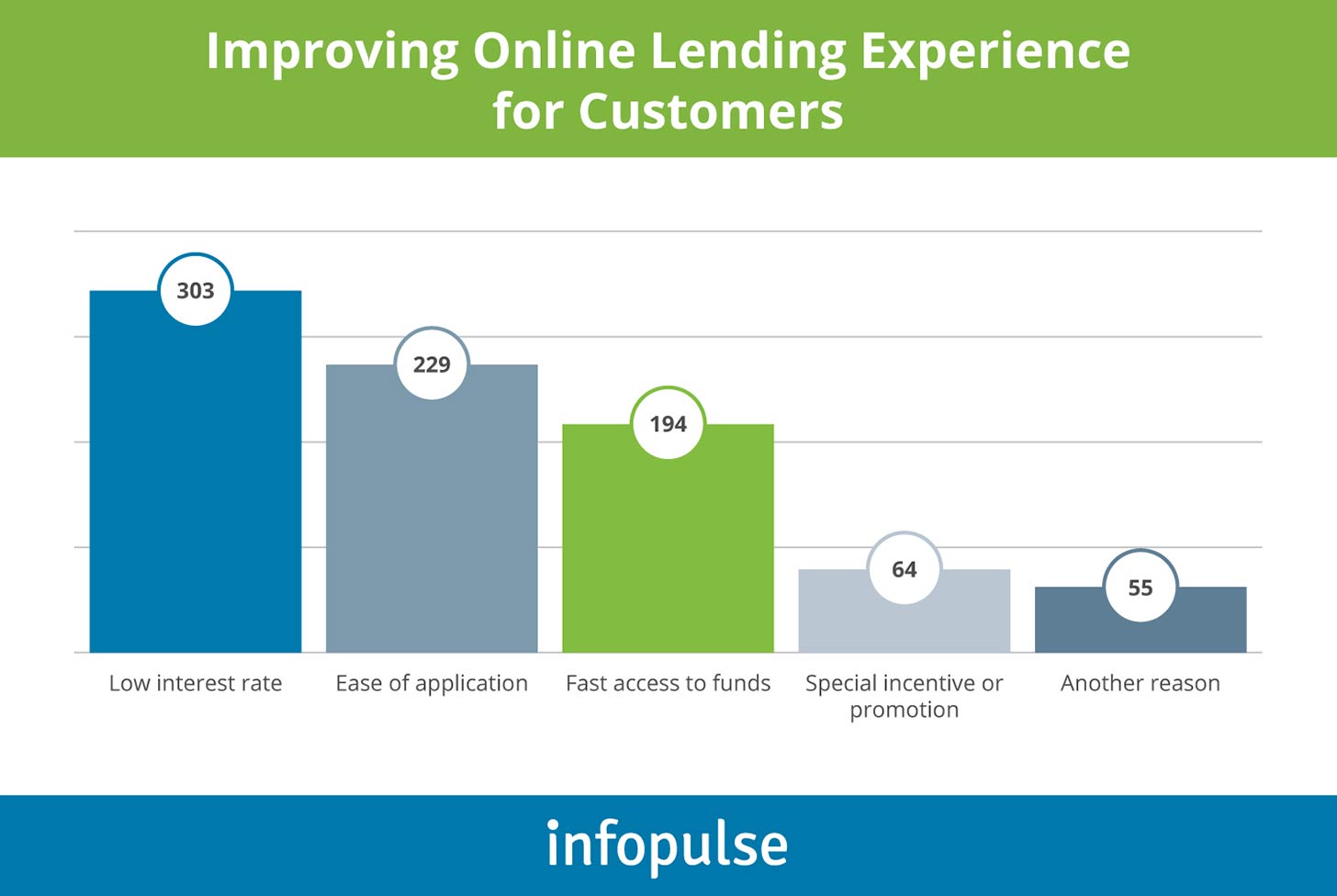

Underwriting is another manual process due for an overhaul. Given that a lot of the customers’ interactions have moved to the digital space, speed has become a paramount factor. Over 70% of the modern price-sensitive consumers reached out to 2+ lenders (including marketplace lenders and comparison websites) when seeking a loan. Clearly, lenders who could provide the optimal loan terms the fastest eventually closed the deal.

Apart from increasing speed and accuracy of loan underwriting, the new breed of automated solutions such as Intelligent Robotic Process Automation can also help improve compliance, plus improve the consistency of lending decisions. After implementing such robots as a service solution, a US-based mortgage lender managed to automate 85% of loan setup tasks and gain a 3X growth in loan origination volumes without increasing operational costs.

Infopulse has also helped a Big 4 Audit and Consultancy Company develop a proprietary predictive analytics solution for operationalizing big data and running real-time BI scenarios on SAP HANA. Review the full case study.

Modern borrowers are increasingly seeking a fast, convenient, affordable, and predominantly digital lending experience. Over 71% of borrowers indicate that they are comfortable with completing a lending application online; 65% have already done so – either fully or partially.

Enabling remote loan applications, featuring preliminary KYC, onboarding, and data collection could help banks attract a younger cohort of well-off Millennial consumers, as well as minimize errors and redundancies during the application process.

After implementing an automated loan origination system and improving online lending interfaces, one European bank increased its new SMB customer sign-up rates by a third and reduced the average margins by over 50%. In addition, they also reduced the average lending decision time from 20 days to less than 10 minutes.

Infopulse has also helped a large Nordic bank automate its decision-making process with a web-based employee application. The vendor-agnostic solution significantly boosted the speed of the decision-making process, improved compliance and the quality of performed credit analyses. Check the complete case study.

To Conclude

While lending process digitization is multifaceted and complex, improvements in one area – be it online customer onboarding, risk evaluation, or loan underwriting automation – can have a tangible impact on lenders’ ability to quickly expand into new areas of growth and remain as competitive as digital-first players in 2021.

Let’s restart your lending operations together! Infopulse mobile banking experts would be delighted to advise you on the optimal approach to modernizing your lending process and identify new pockets of growth, technology investments can usher. Contact us!

![Pros and Cons of CEA [thumbnail]](/uploads/media/thumbnail-280x222-industrial-scale-of-controlled-agriEnvironment.webp)

![Power Platform for Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-power-platform-for-manufacturing-companies-key-use-cases.webp)

![Agriculture Robotics Trends [Thumbnail]](/uploads/media/thumbnail-280x222-what-agricultural-robotics-trends-you-should-be-adopting-and-why.webp)

![ServiceNow & Generative AI [thumbnail]](/uploads/media/thumbnail-280x222-servicenow-and-ai.webp)

![Data Analytics and AI Use Cases in Finance [Thumbnail]](/uploads/media/thumbnail-280x222-combining-data-analytics-and-ai-in-finance-benefits-and-use-cases.webp)

![AI in Telecom [Thumbnail]](/uploads/media/thumbnail-280x222-ai-in-telecom-network-optimization.webp)