Overview of Payment Processing Trends and Top Solutions for Business

The most challenging thing about mobile payments is exacting users. They always seem ready to spend money, but leave once online payment processing falls short of their expectations. Safe, quick, and easy-to-use payment processing is the trump card to win in a game for mindshares.

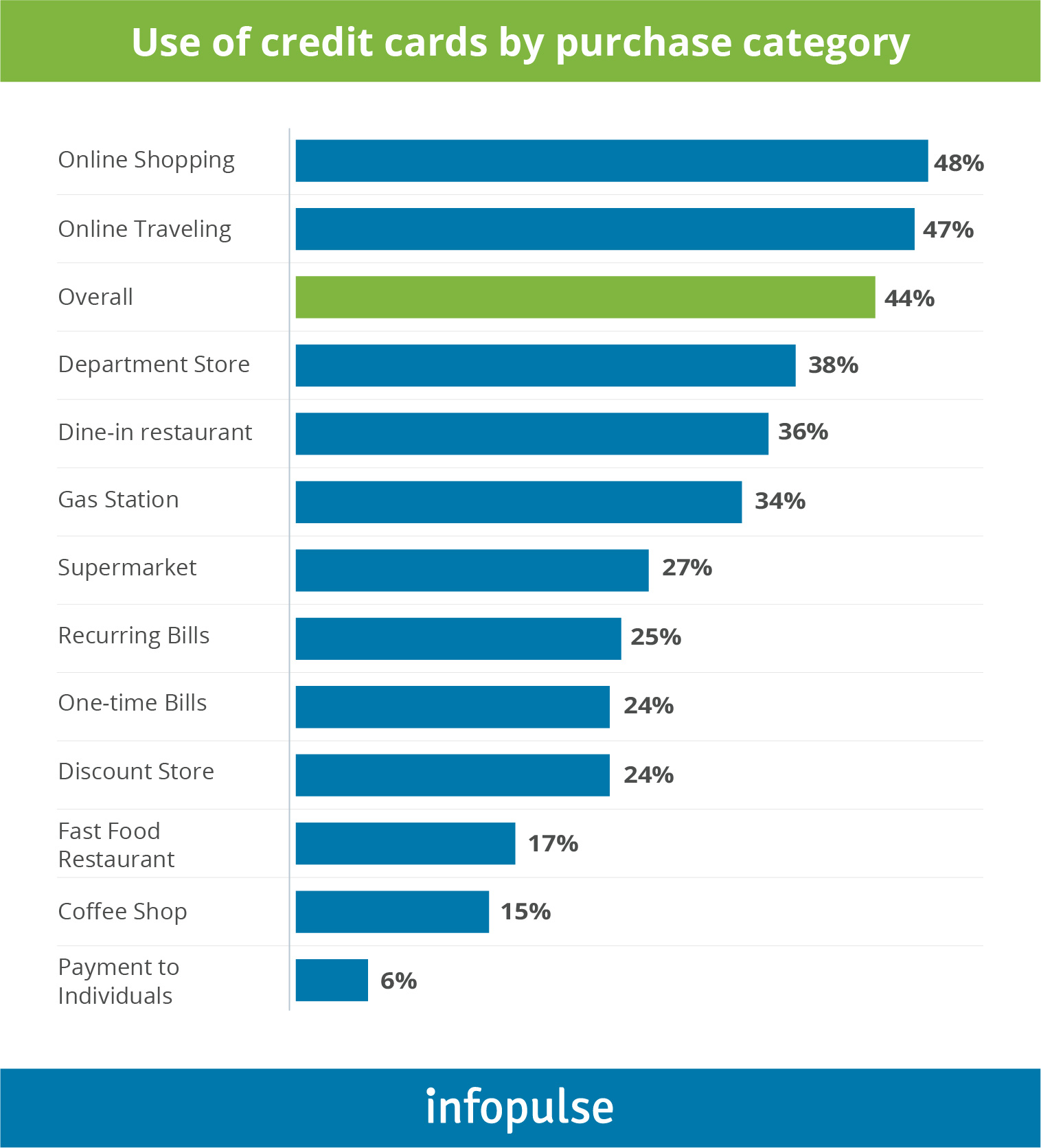

On average, a consumer uses more than one card at a time when shopping online, while in the U.S., credit cards are central to the financial lives of nearly 170 million consumers. Online payments are ubiquitous and grow faster than retail payments. This fact livens up the competition, which is good for users but challenging for business owners. Consumers won’t stand the inconvenience of the tedious payment processing procedures. But advanced and reliable turnkey payment processing solutions will keep user expectations up to par.

Payment Processing Stages

A comprehensive payment solution should work both ways. For businesses, it should offer transparent credit card processing fees, reliable customer support, and advanced features to stand out on the market. For users, it’s always about user experience, security, and time. There’s quite a variety of payment service providers. Whatever payment processing method you select, the mechanics behind the curtain should be safe and work like a charm.

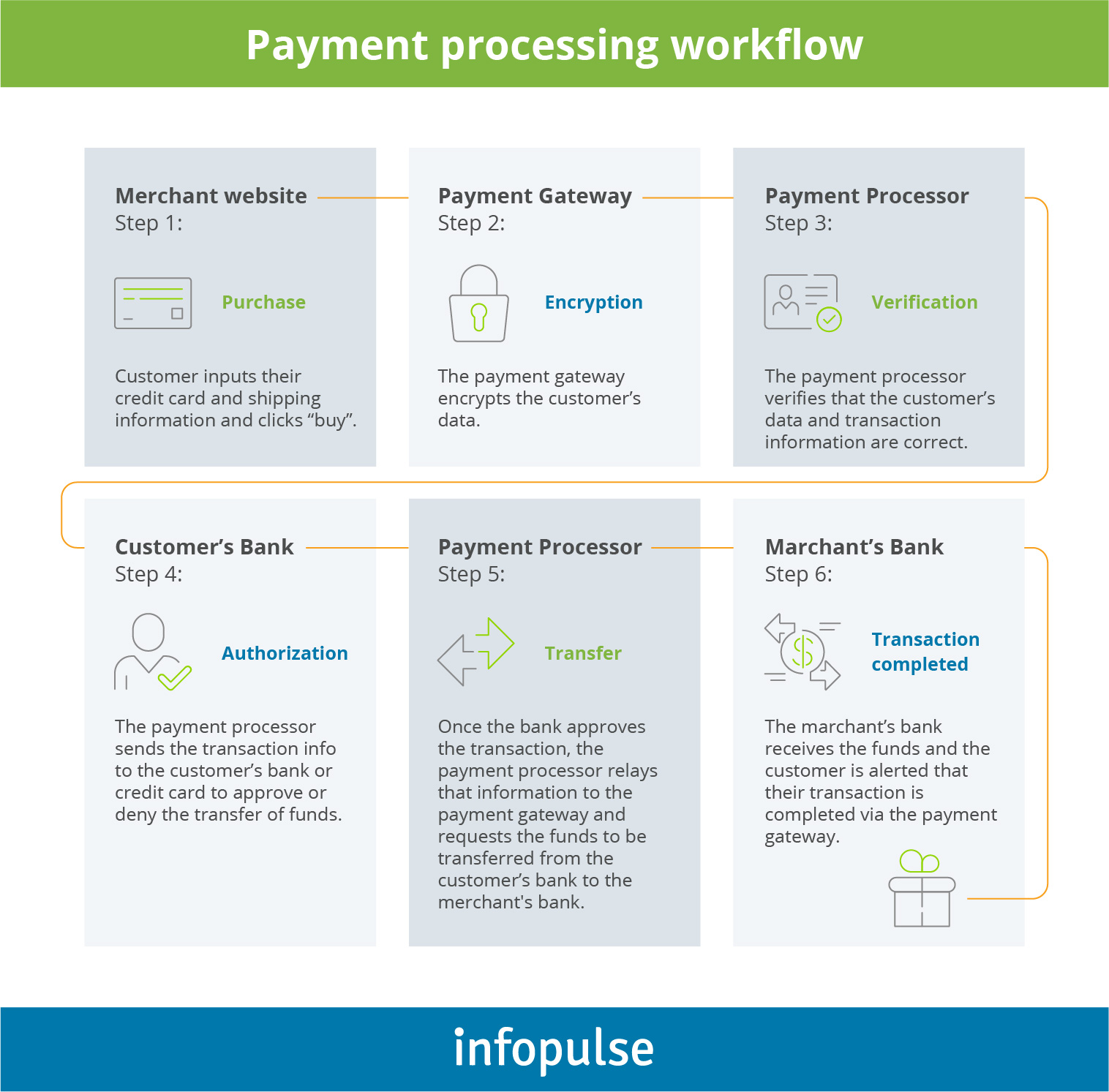

How exactly does online payment work? Let’s go through the steps.

- Step 1: A customer buys something online by submitting a payment request through their mobile device, computer, or mobile payment processor.

- Step 2: Payment gateway encrypts transaction data.

- Step 3: Payment processor verifies transaction details.

- Step 4: The payment service provider transmits the data via a secure connection to the customer’s bank or credit card company for verification of available funds or credit and subsequent authorization of the transaction, so that the transaction can be routed back to the payment provider for processing.

- Step 5: The payment processor requests the funds transfer to the merchant account.

- Step 6: The goods or services are now considered sent to the buyer, and the buyer’s bank sends the funds to the merchant account.

While the real-life interaction between a merchant and a customer would take several moments, the process seems cumbersome on paper. Especially with so many actors involved in a single transaction: a merchant, a customer, a payment processor, a payment gateway, various accounts. Let’s recall who is who among the critical components of online payment processing.

How the Components of Online Payment Processing Work Together

The crucial components of online payment processing are a payment gateway, a payment processor, and a merchant account. Together, they form the mechanics that separates buyers from the items in their carts and merchants from their fees. We’ll discuss each of them separately.

Payment Gateway

How it works. Imagine a payment gateway as a point-of-sale terminal from a retail store put in a digital dimension. A payment gateway is a secure bridge between a particular business website or a mobile app and the payment processing company. It’s busy with transferring data back and forth to the payment processor immediately after a user selects the payment method and enters their payment details. After the banks are done with their fraud screening procedures and route the transaction to the card networks, the payment gateway delivers the banks’ approval (hopefully) back to the website.

Security matters. The main feature of a payment gateway is being secure. Or at least it should be since businesses trust it with clients’ sensitive information: the credit card number, expiration date, and CVV code are all there. Statista claims that in 2018, U.S. merchants lost $6.4 billion in payment card fraud losses. A lot to lose, but not as much as your business reputation. To treat personal details securely, the gateway encrypts the payment information during transmission. Still, it’s not enough. You should be picky as to the gateway providers and check the PCI compliance level they offer. PCI DSS Level 1 is a good choice.

Other essentials. Security is not the only purpose a proper payment gateway should serve. Think of multiple payment methods. On top of everybody’s favorite credit cards, it should support any payment option that works for your business. Payment analytics, 24/7 support, and multi-currency transactions should also be under the hood of a reliable payment gateway.

Payment gateways can be non-hosted and hosted, with ready-to-integrate modules and custom-built solutions. In fact, payment gateways deserve a more in-depth discussion in our next blog post.

Payment Processor

You might think that the payment gateway is the busiest link in the payment processing workflow. In reality, it’s the payment processor that has a lot of hard work to do. You can look at payment processors as a mediator technology that handles the transactions between the buyer’s and the merchant’s banks. It takes transaction information from the payment gateway, verifies and executes it to deposit the funds into the business owner’s account. Then, the payment processor notifies the payment gateway whether the transaction was successful.

Security matters. Since payment processors deal with no less sensitive information than the payment gateway does, security is a vital aspect at this stage as well. Not to frighten you, but 75% of U.S. retailers have suffered at least one cybersecurity attack on their online stores. The payment processor handles customer’s personal and financial data, debits a customer, and credits the merchant account to finally transfer funds to it. For this reason, encryption, along with other security measures, is a must.

The business model. There are companies that provide payment processing services as third-party players. Alternatively, a payment processor may come with turnkey payment processing solutions. Mind that payment processing companies often do not work directly with merchants or consumers. That’s because of security and regulatory restrictions a particular merchant may face while partnering with a payment processor provider. Payment processors can even partner with payment gateways and other companies that deal directly with consumers or merchants.

Merchant Accounts

Finally, we’ve come to the part where a business is getting paid for the goods and services it offers. A merchant account is a bank account that lets businesses accept payments for their e-commerce activities through credit cards and other payment options.

Even though merchants may already have their banking accounts, the funds they receive as a result of payment processing can’t be sent there directly, only through a merchant account. There are several reasons for that, including risk mitigation on the part of banks and payment processors. Another reason is that in the buyer-seller relations, there is always a possibility that the funds will have to be returned to the buyer, which is easier to do from a merchant account. Either way, having a merchant account is a must.

On top of that, the merchant account acts as an agreement that obliges a merchant to follow all sorts of regulations that are often changing. Such regulations mainly concern card associations and PCI standards observation.

Types of merchant accounts. There are two: dedicated and aggregated. A dedicated merchant account is set up purposely for your online business, unlike the aggregated one, which is more of a collection of accounts grouped together. Now let’s dive into the details.

- Dedicated accounts are typically opened by banks and may entail time-consuming processes, underwriting procedures, and a lot of paperwork. If you make it to the end, your business will receive its own dedicated account and a unique merchant ID number. Business owners prefer dedicated accounts as they give more control over their funds and some kind of personalization. The most significant drawbacks of dedicated accounts are the high price and tiresome opening procedures.

- Aggregated merchant accounts often come in a package offered by payment processing solutions. PayPal, Stripe, Authorize.Net, and other payment processing businesses settle a merchant account to be shared with a group of other merchants. Businesses prefer aggregated accounts because of a simple application process and low downtime. They’re really easy to set up and start instant payment processing.

Unfortunately, aggregated accounts come with a higher risk. One of them is the nightmare of any online business: that your business operations could be put on hold. Because you’re sharing at least some part of your platform with sub-merchants, you shouldn’t rule out this possibility. For example, if any of your sub-merchants is suspected of fraud, the entire aggregated merchant account can get put on hold. Moreover, merchants actually surrender control over their funds. In fact, it’s only under the aggregator’s responsibility to transfer funds from the aggregated merchant account to the merchants’ personal bank account.

Payment Processing Trends

If you’re willing to keep up with the payment processing trends, here are the most critical ones to follow.

Variety of Payment Options

Although the customer-centric approach is nothing new to payment processing solutions, users and their payment experience will continue playing a vital role in the payment business. The task of the providers is to ensure a quick and rich payment experience. In practice, it means that the presence of a wide variety of payment options is essential. Payment processing companies will have to keep money infusions up to par to fortify their software capacities.

However, it doesn’t mean you have to put all your eggs in one basket with excessive digitalization efforts. Have a look at a reasonable explanation by Business Insider taken from their The Payments Ecosystem research report:

In-store payment methods are still on the rise in the US, comprising 89% of retail volume this year. Credit and debit cards continue to lead the segment, as cash and check usage slowly ticks downward. But surging contactless penetration is set to bring mobile in-store payments to prominence for the first time in the years ahead.

Flawless Payment Processing

Customer experience matters not only for the way people spend their money on your website. Painlessly and quickly – that is how buyers should part with their money. Lower the friction and eliminate technological stumbling blocks by partnering with advanced payment technology providers. According to the recent Global Payments Insight Survey by Ovum, more than 90% percent of merchants and billing companies and 82 % of banks have woken up to the fact that flawless payment processing is a dominant trend. That is why they’re investing in future payment technologies to add personalization to the customer experience.

Enhanced Security

Cybercriminals are on the dark side of the sophisticated payments-related technologies, and they’re up-and-doing. Tokenization remains a reliable countermeasure preferred by payment processing providers to fight security threats. Like a chip technology for in-person transactions, tokens prevent sensitive data from being exposed when a payment system of the user’s device is compromised. In mobile payment processing, companies continue investing in biometrics as an effective and user-friendly fraud protection measure.

Recurrent Billing and Other Payment Modes

Businesses are in a constant chase for loyal clients and make up new ways to squeeze out competitors. In this respect, they make headways with “Buy Now, Pay Later” or recurrent payment modes. Clients can put off paying for the goods or select a subscription model in return for some perks. Businesses, meanwhile, receive an opportunity to attract a wider audience and plan future income. Payment processing solutions should be able to support a complex recurring logic and support business rules specific to a particular company.

The Role of Mobile in Payment Processing

Online, in-store, or on-the-go payments are now possible thanks to mobile phones, and users appreciate this opportunity highly. The broader acceptance of mobile wallets, mobile in-app purchases, and peer-to-peer payments are just some of the factors that dictate the necessity to adopt a mobile-first strategy. Only in this way, businesses will be able to satisfy the expectations of a modern consumer fully.

7 Turnkey Payment Processing Solutions with Their Pros and Cons

1. PayPal

Pricing and fees. A flat 2.9% + $0.30 for every credit card transaction. You can find more information on PayPal pricing and fees here.

When someone mentions a payment processing platform, many have PayPal come to mind. No wonder: with 286 million active accounts, 22 million of which are merchant accounts, this provider does lead the pack. Even though your customers don’t need a PayPal account to purchase something from you, there are good odds they still have one. We might talk a lot about how great PayPal is, but for the sake of your time, let’s narrow it down to its benefits and flaws:

Pros:

- Payment processing is fast and secure

- Easy to set up and easy to use

- Integration with numerous platforms and websites along with good development tools

- Presence in more than 200 countries and multi-currency support

Cons:

- Account stability issues

- Frequent complaints on customer support

- Standard risks connected with the use of an aggregated merchant account

- Hefty fees for some services including chargebacks

- Clients are limited in terms of use and customization options

2. Stripe

Pricing and fees. A flat 2.9% + $0.30 for every credit card transaction. You can find more information on Stripe pricing and fees here.

Businesses choose Stipe as a payment processing solution because of its smooth integration with popular e-commerce stores and websites (Shopify, BigCommerce, Squarespace, and others). It’s also praised for flexibility, scalability, and customization options.

Pros:

- Flat price, so you know what to expect

- Customization: provided that there is a programing experience in-house, you can adjust Stripe to your particular business needs

- Good customer support

Cons:

- There are cases when Stripe can put your funds on hold or cancel your account without warning (although, it’s typical for all third-party processing providers, especially with aggregated merchant accounts).

- There were complaints about Stripe’s “Radar” fraud protection filter. Users claim that it had missed questionable payments but was too scrupulous about passing regular transactions.

3. Square

Pricing and fees. Processing fees are 2.65% per card-present transaction and 2.9% + 30 cents per Square invoice and online store sale. You can find more information on Square pricing and fees here.

Even though this company has built a reputation of a reliable point-of-sale processor, Square quickly gains a foothold in online payments. Starting from businesses that use Square to accept payments in offline locations, it now offers an intuitive and user-friendly experience to other merchants. An excellent choice for small businesses and the number one solution for mobile payment processing.

Pros:

- Intuitive user interface with a stellar mobile payment processing experience

- Quick setup and easy configuration

- Simple and transparent pricing

- Decent reporting system, easy templates, and automated invoicing process

Cons:

- It’s not the best choice for big and established middle-sized companies. The main reasons for that are lack of hands-on tech support and a bit expensive flat rates for businesses with a large number of clients.

- Standard risks connected with aggregated merchant accounts

4. Authorize.Net

Pricing and fees. The all-in-one option includes a gateway fee of $25/month plus a per-transaction fee of 2.9% + $0.30. You can find more information on Authorize.Net pricing and fees here.

The Visa-owned payment processing incumbent has been on the market for more than 20 years now. During this time, Authorize.Net has developed a sophisticated and secure payment infrastructure. The solution is swift and reliable, and the company can also brag of a loyal user community.

Pros:

- Extensive payment processing experience

- Simple and intuitive user interface

- Efficient customer service

Cons:

- A limited number of countries to accept international payment transactions from (the U.S., Canada, the UK, some European countries, and Australia)

- The number of supported currencies is limited to five

- Relatively high flat-rate processing fee for the gateway plus merchant account option

5. Amazon Pay

Pricing and fees. 2.9% plus $0.30 per domestic transactions and 3.9% plus $0.30 per cross-border transaction. You can find more information on Amazon Pay pricing and fees here.

Amazon Pay offers excellent pre-built shopping cart integrations and is quite explicit about its pricing policy. To start using Amazon Pay for payment processing, a merchant should have their bank account associated with the Amazon Seller Central account to receive funds from Amazon Pay. On top of that, your clients should have an Amazon account to use it as a form of payment.

Pros:

- Trustworthy fraud protection service

- Good reputation associated with Amazon as a well-known brand

- Integration with e-commerce platforms and business systems

- Pleasant user interface and ease of use

Cons:

- Additional fee for cross-border purchases

- Use of a reserve system, which means Amazon can hold the initial transactions in reserve for 14 days when you first begin processing payments

- Standard risks connected with aggregated merchant accounts

6. BlueSnap

Pricing and fees. 3.90% + $0.30 for every credit card transaction. You can find more information on BlueSnap pricing and fees here.

Businesses prefer BlueSnap because it’s customizable and integrates well. On top of that, it’s considered the right solution for international payments and cross-border trade. BlueSnap supports 110 payment types, 100 currencies, and 29 different languages. It is available in more than 180 countries and connects automatically to a global network of acquiring banks.

Pros:

- Smooth integration with other business platforms, shopping carts, ERP, and CRM systems

- Supports payments in many countries

- Supports multiple payment methods for both international and domestic clients

Cons:

- High rates compared to competitors

- Flaws in customer support

7. Skrill

Pricing and fees. Businesses making up to $3,000 in sales are charged a rate of 2.90% plus $0.29. Businesses with sales between $3,000 and $10,000 are charged a rate of 2.80% plus $0.29. You can find more information on Skrill pricing and fees here.

Skrill started making its name as a PayPal-like service targeted at the European market. They position themselves as PayPal competitors, trying to offer payment processing support to businesses or countries PayPal is not operating in. On top of that, it works as an online wallet.

Pros:

- Global reach with 200 countries and 40 currencies available

- Support for multiple payment methods, including the local ones

- Intuitive user interface and ease of use

Cons:

- Even though Skrill states global presence, it’s non-competitive on the U.S. market and is an option to consider mostly for Europe

- Intricate and high fees. There are hidden costs, so it’s better to be on the safe side and double-check how much you’re paying with each transaction

- Skrill users often complain about weak fraud prevention and late payments as well as excessive ID requirements

Conclusion

Payment solutions are evolving and pushing payment processing toward innovation. Market dynamics create opportunities but pose challenges for all the parties involved in payment processing. A high number of actors and third-party companies involved in payment processing, the need to set up numerous accounts, are more of a benefit than a problem. For now, it’s all about considering the aspects we’ve highlighted in this article when selecting partnerships for your business.

Rest assured, no matter what type of business you’re running within the banking, finance, e-commerce or other domains, Infopulse is more than competent enough to assist you. For international retailers and online banks, exchange and payment platforms, or FinTech startups, Infopulse knows how to develop or integrate a desired payment processing solution. Contact us today!

![Pros and Cons of CEA [thumbnail]](/uploads/media/thumbnail-280x222-industrial-scale-of-controlled-agriEnvironment.webp)

![Power Platform for Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-power-platform-for-manufacturing-companies-key-use-cases.webp)

![Agriculture Robotics Trends [Thumbnail]](/uploads/media/thumbnail-280x222-what-agricultural-robotics-trends-you-should-be-adopting-and-why.webp)

![ServiceNow & Generative AI [thumbnail]](/uploads/media/thumbnail-280x222-servicenow-and-ai.webp)

![Data Analytics and AI Use Cases in Finance [Thumbnail]](/uploads/media/thumbnail-280x222-combining-data-analytics-and-ai-in-finance-benefits-and-use-cases.webp)

![AI in Telecom [Thumbnail]](/uploads/media/thumbnail-280x222-ai-in-telecom-network-optimization.webp)