Self-Sovereign Identity: Use Cases, Level of Maturity, and Adoption

Fast-forward to 2020 and we still see a growing interest in self-sovereign identity models. Juniper Research estimated that the annual revenue of SSI providers is expected to hit $100 million by the end of 2020 and increase to $1.1 billion by 2024. Goode Intelligence research suggests similarly optimistic scenarios, predicting that by 2025, 20% of all digital IDs will be based on blockchain technology, up from 5% in 2020. Where will this growth come from?

An array of early cross-industry pilots in banking, e-commerce, and government services have already proven that blockchain-based SSIs can be a viable solution to eliminating third-party ‘verifiers’ from data exchanges.

The Current State of SSI Adoption and Maturity

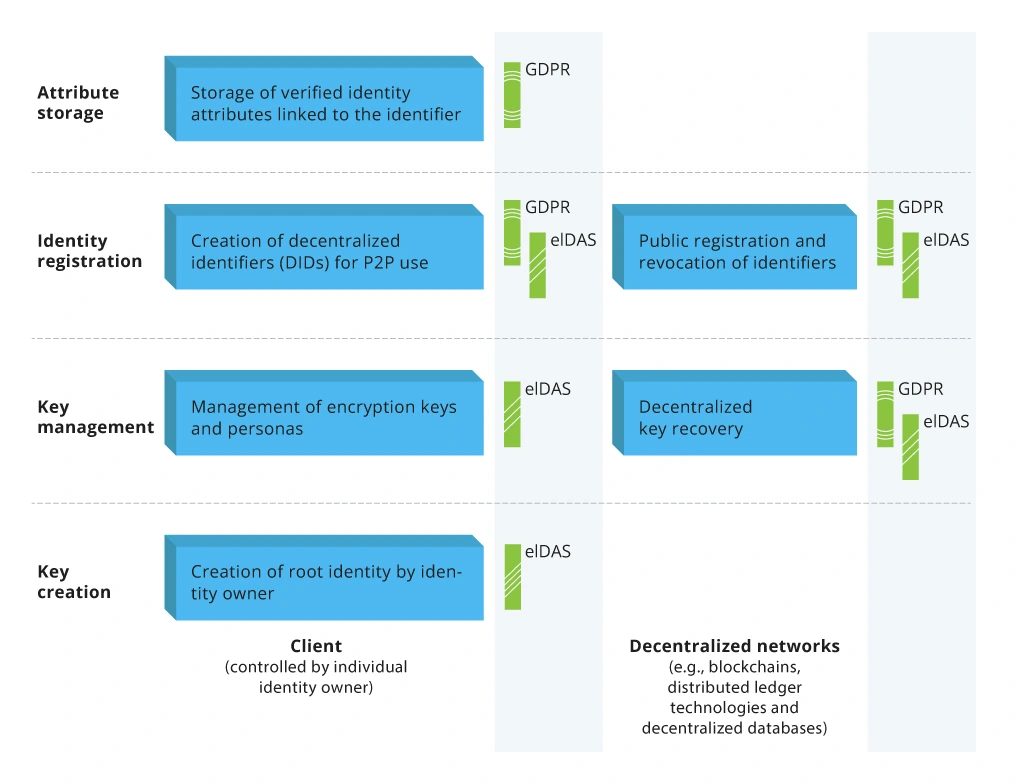

Self-sovereign Identity Building Blocks

The DACH region and the UK have been two hotbeds of Digital ID adoption. Local governments and a pool of private companies in the banking and telecom sectors are actively pursuing the adoption of Government and Federated Digital IDs. The UK government hosted a sandbox trial of SSI-based KYC solutions for onboarding users to the Financial Conduct Authority (FCA) portal. Users can store relevant Personal Identifiable Information (PII) in a secure mobile wallet app and grant or reject access to it when interacting with the authority. Furthermore, they could use their reusable credentials to sign up for multiple financial services and products. As the pilot was marked as successful both by the FCA and trial users, the institution is considering rolling out this scheme country-wide.

A group of 100+ private and public organizations formed a COVID Credentials Initiative (CCI) this spring as a response to the global pandemic. The main goal of CCI is to develop “privacy-preserving verifiable credential projects to mitigate the spread of COVID-19 and strengthen our societies and economies”. Contact tracing and health status reporting are popular tools for curbing the spread of the virus and enforcing quarantine measures. The problem, however, is that personal patient information often ends up being shared without the patient’s explicit permission or consent as the Guardian investigation recently found. Empowering users with the tools to store (and share) their personal health data could help prevent such unauthorized usage, and, at the same time, be put to better use — e.g. to create ‘immunity passports’ that would allow people to travel to various destinations without any restrictions.

Infopulse also believes that eIDs, containing certified self-sovereign identity credentials, can be game-changing for controlling and managing the spread of the virus. During a recent hackathon, we proposed a pilot solution for managing travel access with the help of digital certificates:

Lastly, SSI use cases are multiplying in the private sector as more and more organizations recognize the need to store and use customer data in a secure, ethical, and compliant manner.

Cross-Industry Use Cases of Self-Sovereign Identity (SSI) Solutions

Retail and E-commerce

In the retail sector, SSI can solve several pressing issues at once:

- Subdue the friction with onboarding and payments, especially for mobile purchases.

- Increase payment security, especially in cards-not-present (CNP) transactions.

- Help curb the rising levels of e-commerce fraud as the volume of online purchases went up during-COVID-19.

- Reduce the costs of storing sensitive customer information, especially payment data.

- Restore customers’ loyalty and trust levels regarding their privacy.

In this regard, Barclaycard teamed up with Everym to explore the benefits of using SSI for secure customer onboarding and payment validation for retailers. OpenBazaar is working on an SSI-based e-commerce protocol for payment authorization and processing for P2P transactions.

Tietoevry and Infopulse have also launched an MVP SSI solution for e-commerce companies that could replace third-party authentication apps and payment gateways. In particular, we focused on building a seamless solution for mobile commerce. Unlike other products that require 180+ taps to complete a transaction, our solution requires just 8. The MVP is now open for pilot programs and full-scale implementation – contact us to learn more.

Banking and Financial Services

Pressured by the mounting regulations on the one side and consumers’ demand for seamless, fast, and fully digital experience on the other, the financial industry can also largely benefit from a vaster adoption of self-sovereign identity standards. The benefits of doing so are as follows:

- Improved customer data security in omnichannel banking, paired with better overall CX.

- Traceable and auditable PII information processing that reduces the regulatory burden and compliance costs.

- Faster onboarding and KYC for new customers, fostering rapid growth without posing higher risks.

- Lower operational and back-office costs – a direct result of eliminating the ‘paper trail’ for new financial product applications.

- Higher customer satisfaction fostered by seamless access to a wider range of financial products.

Moreover, increased market penetration of Digital IDs and SSI-based credentials can largely reduce the current interoperability friction between financial services providers and help financial institutions embrace the marketplace banking and banking as a service (BaaS) business models – one of the dominating trends in the mobile banking space.

Considering the benefits above, it makes sense as to why companies like Mastercard and Microsoft are actively working on building a joint digital identity process. Mastercard also conducted an SSI-pilot in Australia, together with Australia Post and Deakin University, and joined the blockchain digital identity alliance ID2020 to further advance their Digital ID and Self Sovereign Identity vision.

Individual banks are following the lead too. For instance, Rabobank, one of the largest Dutch banks, has been researching Self-Sovereign Identities for KYC and mortgages applications. Last year, a group of five Canadian retail banks launched a blockchain-based app for customer identification.

Tietoevry also helped Infopulse launch a banking KYC system, powered by Hyperledger Fabric, for collecting, storing, and operationalizing customer information in a secure, auditable manner. You can learn more about the project from our case study.

Telecommunications

Telecoms have always been major ‘brokers’ when it comes to customer data and connectivity. However, most companies had modest success with finding how to sustainably capitalize on their ‘knowledge’ and ability to ‘connect the dots’. As blockchain gained more traction in the telecom industry over the past several years, leaders in the space have found a new foothold for innovation in SSI.

Last year, SK Telecom and Deutsche Telekom announced their plans to launch a pilot digital ID project that would rely on blockchain technological capabilities to help streamline access control management, contracts, and other dealings between the operator and their customers.

Furthermore, SK Telecom has major plans in its home market – South Korea. The company is planning to allow every subscriber to store their self-sovereign digital identity and personal data with them, and then use this data to deliver an authentication solution to its growing network of partners including Samsung Electronics, KEB Hana Bank, Woori Bank, and Koscom among others. The scope of potential use cases that the telecom is exploiting include:

- Certification of academic records and diplomas issued by Korean universities.

- Certification of treatment and compensation records that could be provided to insurers on demand.

- Storage of passes to entertainment facilities, resorts, and country clubs with additional marketing opportunities.

Samsung, who is also participating in the initiative, promised to ensure secure on-device PII data storage with Samsung Knox – an enterprise-grade mobile security solution, pre-installed on most of the brand’s devices. In June 2020, the company also placed its first blockchain-based smartphone model – KlaytnPhone – on sale in South Korea. The new gadget comes pre-furnished with a cryptocurrency wallet and distributed ledger technology (DLT) apps, built on Klaytn blockchain.

Becoming an SSI solutions provider is just one route telecoms can take when it comes to blockchain adoption. The benefits of relying on ‘homemade’ or third-party SSI solutions in telecom further extend towards:

- Faster remote KYC for new subscribers, especially in developing markets, where access to brick and mortar locations can be limited.

- Improved identity management that would allow existing subscribers to sign up for new services remotely and better handle their contracts.

- A stronger authentication process can also reduce the levels of voice fraud in telecom due to improved subscriber/device tracing.

Why Pursuing SSI Can Be Game-Changing for Businesses

Privacy invasion and data leakage have been eroding consumer trust and satisfaction with businesses. Indeed, a lot of corporations have been treating customer data security as an afterthought. As Gartner estimated, for 70% of organizations the backups and archrivals of personal data will be the largest area of privacy risk this year, up from 10% in 2018.

Global regulators also recognize that such a state of affairs is risky, to say the least. GDPR in Europe and CPA in the US were the early regulatory measures with new privacy and data protection laws are underway in 60 more jurisdictions. By 2023, as much as 65% of the global population can have its personal data protected by new privacy regulations.

Self-sovereign identities can become the businesses leeway into respecting customer privacy demands and regulatory requirements. At the same time, letting go of customers’ data and entrusting it to a decentralized blockchain-based ledger can also help businesses reduce data storage/management costs, neutralize cybersecurity risks and stay on the right side of compliance requirements.

Infopulse blockchain team is available to further advise you on the feasibility of SSI implementation in your company. Contact us to get a preliminary consultation on how you should approach the SSI adoption!

![Power Platform for Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-power-platform-for-manufacturing-companies-key-use-cases.webp)

![Agriculture Robotics Trends [Thumbnail]](/uploads/media/thumbnail-280x222-what-agricultural-robotics-trends-you-should-be-adopting-and-why.webp)

![ServiceNow & Generative AI [thumbnail]](/uploads/media/thumbnail-280x222-servicenow-and-ai.webp)

![Data Analytics and AI Use Cases in Finance [Thumbnail]](/uploads/media/thumbnail-280x222-combining-data-analytics-and-ai-in-finance-benefits-and-use-cases.webp)

![AI in Telecom [Thumbnail]](/uploads/media/thumbnail-280x222-ai-in-telecom-network-optimization.webp)

![Digital Twins and AI in Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-digital-twins-and-ai-in-manufacturing-benefits-and-opportunities.webp)