.svg)

Location:

Germany

Cooperation period:

2017 - present

Industry:

Banking & Finance

Employees:

150,000+

Website:

About the Customer:

The Santander Group was founded in 1857 and is now one of the world’s Top 20 banks with headquarters in Spain. With a rich presence across Europe as well as North and South Americas, the Banking Group is present in more than 10 countries and serves millions of people worldwide. Santander Group is among the world’s most technologically advanced financial enterprises and always strives to leverage cutting-edge technologies for its financial products and systems.

Since 2017, Infopulse has become a strategic supplier of key banking solutions for the risk management department of Santander Consumer Bank AG, the German branch of the Banking Group. Infopulse works on an extensive portfolio of solutions aiming to update and automate car-financing processes for Santander.

Executive Summary

Goal: Build a modern solution for the risk management department of Santander as a replacement for existing legacy solutions. Utilize modern technologies and approaches to the architecture of banking solutions, develop the solution within the bank development environments, and deploy it to the private cloud. Set up and establish proper development processes and approaches (Secure SDLC, Scrum, DevOps, etc.).

Solution: Design, development, integration, customization, and support of a portfolio of integrated decision-making solutions for the risk management department of a number of Santander’s branches.

Benefits:

- From a week to an hour faster decision-making

- Significantly lower probability of human errors

- Vastly reduced TCO

- Accelerated time-to-market

Services delivered: Custom Software Development, DevOps Processes Implementation, Web App Development, UX/UI Consulting, Software Product Modernization.

Business Challenge

In 2012, Santander Consumer Bank AG started looking into the development of a modern, complex, and functional solution to automate car lending and risk management processes. The solution had to facilitate work with dealers, partners, insurance companies, SMEs, and corporate clients, who need to obtain credit for bulk purchases of fleet vehicles. Support of legacy solutions at this point did not justify the costs since their maintenance required specific expertise, which was almost extinct from the market.

Besides, the outdated systems and approaches would not benefit bank business in a long-term strategy, as market & customer requirements called for optimizing the work of the risk management department. Decision-making and communication between multiple participants in the conciliation process had to be automated and accelerated to increase the speed of the approval of new credit limits and improve other related common banking procedures.

- The main aim was to create a modern solution that would be relevant for the next 20-30 years without any issues with further scalability, integration, maintenance, and support.

- Existing ready-made solutions did not suit the business growth model of Santander due to poor customization capabilities and the high price of support. The solution in question had to be developed fully from scratch.

- The project required a top level of technological expertise in the architecture of banking systems.

- As a core requirement, the uncommon core banking functions had to be detached and moved to external systems.

- Infopulse also needed to create a convenient functional interface for a decision-making platform and underwriter solution and integrate all applications with banking and external systems.

- In this project, the Infopulse team needed to collaborate closely with multiple departments of Santander as well as with the external suppliers of banking solutions, which required a properly aligned communication management process from the Infopulse team.

- Infopulse experts had to work within the development environments of Santander’s headquarters, which made the whole process more complicated, e.g., when they needed to gain access to data and enterprise resources.

Solution

Infopulse, together with the Santander team, produced a complex wholesale management system for the risk management department of Santander. Developed in a private cloud, the solution was designed from the ground up, built on microservices architecture, integrated with an extensive number of existing banking systems, and geared with scalability and flexibility for the forthcoming integrations and growth.

Using a multifaceted approach, Infopulse achieved and implemented the following:

- Conducted a comprehensive update of legacy core banking systems with modern technologies. Since all decision-making functions had to be migrated from the legacy core banking to new external systems, part of the core banking functions was rewritten and extensively modified.

- Described the algorithms for automated decision-making, working closely with Santander’s Director of Risk Management.

- Integrated the new functional system with the legacy core banking system, external state registries, other banking systems, and a custom CRM for partner management that was developed as a temporary solution for the transition. Another more efficient CRM solution is already in the works.

- Migrated data from multiple legacy systems.

- Created a proprietary domain-specific scripting meta-language for automotive wholesale risk management. The scripted expression engine is very flexible and allows risk experts to create and set a multitude of parameters by utilizing specific programmed instructions with relevant ease. Thus, Santander risk experts are able to filter the results for carrying out decisions on a case-by-case basis.

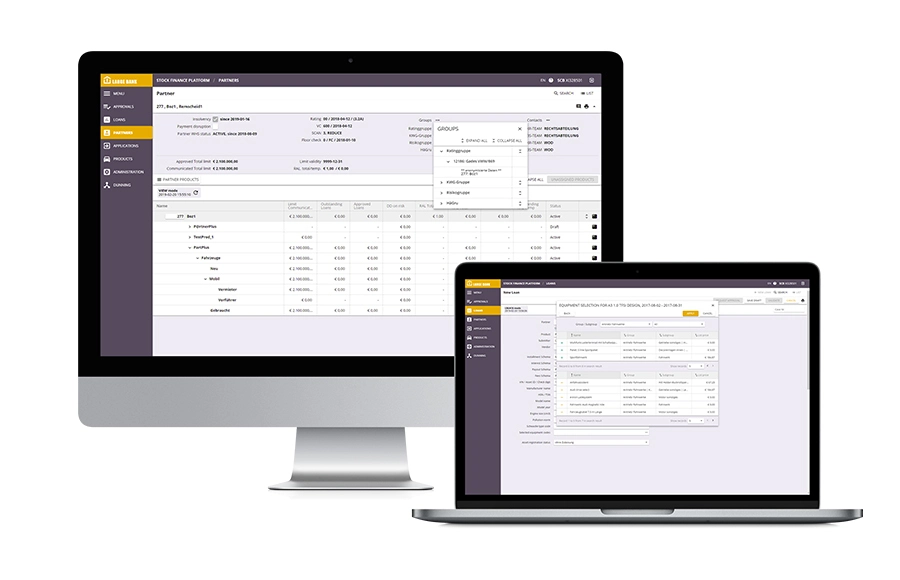

- Designed the modern, user-friendly UX/UI.

- Created an importer interface, which allows automation of the import of request forms and transactions to the credits and requests management system by translating various data formats into a single common system format.

- Integrated debt pre-collection features with reminders about credit periods and front-end for dealers and bank partners.

- Implemented multitenancy so that the solution could be deployed to other banks of Santander Group in any country.

- Implemented Agile/Scrum approaches as well as set up DevOps processes to speed up delivery.

Additional Solutions

Integrated a loan processing scheduler. This

allows configuring the time of processing for different application types

received from different customers. This helps to distribute and decrease the

load when processing massive volumes of loans.

Developed an enhanced automated process with

a separate custom flow for the wholesale loan management of a specific

customer. The fully automated process can create a loan for the customer,

modify/change its type, or terminate it, carrying out actions and decisions

based on a wide range of parameters.

Introduced a brand-new loan front-office system

to improve collaboration with Santander customers.

- Utilizes the latest cutting-edge front-end technologies and software architecture, featuring a modern sleek UI.

- Vastly improves and automates loan submission, management, processing, and tracking for Santander customers.

- Presents all the required data on loans and their status via intuitive user-friendly dashboards.

- Allows managing multiple loans at once.

- Supports multiuser real-time collaboration, vastly accelerating loan processing, saving dealers’ time, and excluding errors.

Facts & Figures

20+ FTE

Team Size

Since 2017

Project duration

Scrum/

DevOps

Methodologies

Faster

decision-making

An hour instead

of a week

Technologies

Business Value

In close collaboration with Santander’s team, Infopulse produced a modern risk management system for automated wholesale and loan application processing, bringing Santander’s business a number of benefits, namely:

- The time required for decision-making processes was reduced from a week to an hour.

- The probability of human errors was significantly lowered.

- Accelerated customer servicing, increasing the number of processed loan applications, improving customer loyalty, and boosting revenue growth.

- Much better time-to-market.

- Vastly reduced costs for licensing, integration, and servicing in comparison to existing software products available on the market.

- Ensured ease of support with improved scalability, minimum risks, and low expenses on maintenance.

- Santander can white-label and resell this solution to other enterprises and partners.

In 2019, the project was deployed successfully. Infopulse continues providing further development and support of the solution for Santander AG. Additionally, Infopulse provides the implementation of this solution for other partners of Santander as Banking as a Service (BaaS), featuring an altered system architecture that is customized in accordance with the local processes and environments.

Related Services

We have a solution to your needs. Just send us a message, and our experts will follow up with you asap.

Thank you!

We have received your request and will contact you back soon.