About the Customer:

Allianz Bank Bulgaria is a part of Allianz Group, one of the world's leading insurance and asset management companies that operates in 70+ countries. As a universal commercial bank, the client provides general insurance, retirement provision, mortgage loans, e-banking, leasing, and other financial services to more than 1,3 million individual and corporate customers across the country.

Business Challenge

Oracle FLEXCUBE is a holistic digital platform that is widely used by financial institutions to modernize their core banking systems. At the beginning of cooperation, Infopulse helped Allianz Bank Bulgaria to navigate through the functionality of the system and perform simple modifications of multiple modules.

Consequently, Allianz Bank Bulgaria decided to implement two new Oracle FLEXCUBE modules – Mortgages and Deposit Locker. Having won the client’s trust with successfully provided consulting services, Infopulse was selected as the key IT partner for the upcoming project, which had to tackle the following challenges for the bank:

- Enhance customer experience by streamlining safe deposit and mortgage services

- Boost operational efficiency and employee satisfaction by automating manual front and back-office tasks

- Improve process transparency and break down cross-departmental silos

- Substitute the use of voluminous Microsoft Excel spreadsheets with centralized and efficient data management.

Solution

The Infopulse team elicited the key business and technical requirements, outlined the scope of the work together with Allianz Bank Bulgaria, and proceeded to implement the Mortgages module. This FLEXCUBE module covers the entire mortgage lifecycle, including loan account creation, loan initiation, collections and delinquency management, loan amendments, disbursements, etc. Once an applicant becomes a customer of Allianz Bank Bulgaria, the module creates a loan account that reports to the bank’s general ledger. The installment payments are credited to the dedicated account, and when the amount is fully repaid, FLEXCUBE marks the account as zero-balanced and closes it.

Loan accounts are created under specific templates called “Products”, which can include different property types and contract conditions. Infopulse configured six mortgage products for Allianz Bank Bulgaria, each having different loan plans, tranches, and grace periods. Moreover, Infopulse configured 16 different types of component accounting for mortgage agreements, including:

- Negotiated interest rate

- Late payment penalty/interest rate

- Statutory interest rate on principal payments

- Fees for early payment, maturity period extension, changes in mortgage conditions, etc.

The next project stage involved the implementation of the Oracle FLEXCUBE Deposit Locker module, which is designed to streamline safe deposit services and vault-box management. Our experts configured the module to enable automated customer account creation, deposit box fee and rental payment collection, and rental prolongation.

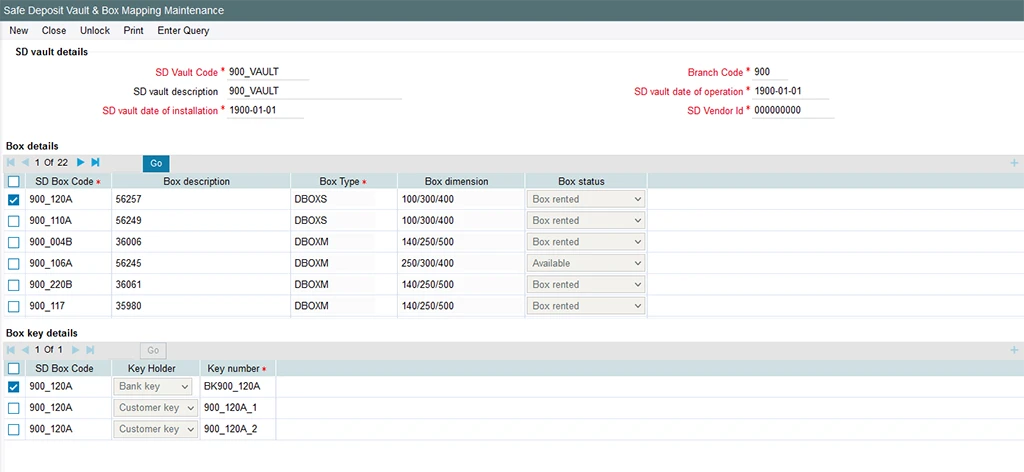

To improve the visibility and management of deposit boxes for the client, Infopulse structured the boxes across the vaults of each bank branch by mapping them in Oracle FLEXCUBE. Now the responsible employees can quickly access each vault and view its installation date, availability, and a range of other parameters.

Safe Deposit Vault & Box Maintenance

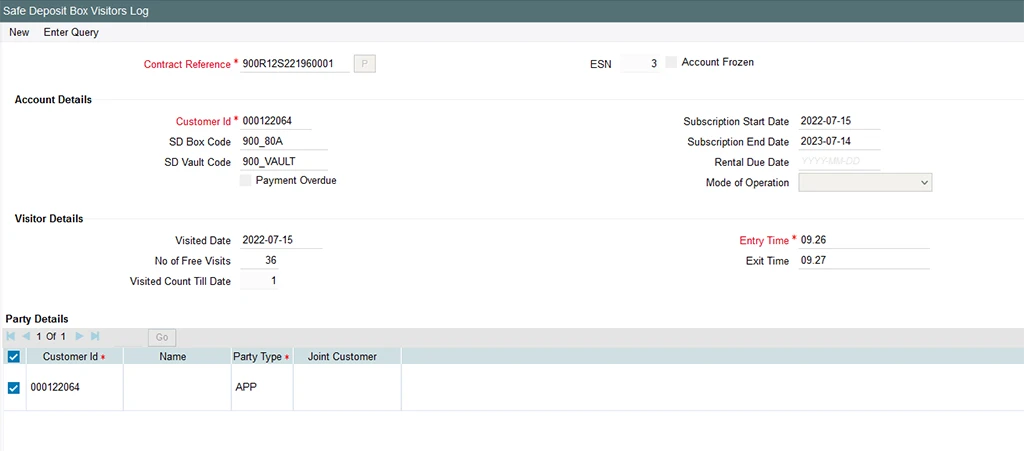

Furthermore, the client wanted to optimize visitor information management, as it was previously stored in large Excel spreadsheets. To ensure accurate and convenient tracking of customers who can visit a specific deposit box, our team has set up a visitor log. As a result, Allianz Bank Bulgaria can easily monitor the visit date, entry and exit time, and visitor details to ensure that only authorized users can access the deposit box.

Safe Deposit Box Visitor Information

After rolling out the new modules, our team developed a script that performed a seamless autonomous migration of the customer data from the existing core banking system into Oracle FLEXCUBE. The migrated data included customer personal info, open accounts, balances, as well as all of the required mortgage contract and deposit box data.

In addition, Allianz Bank Bulgaria requested to create a notification system that would inform customers about the due deposit box rental payments. As Oracle FLEXCUBE is focused on internal reporting and cannot be used to notify customers, Infopulse offered to develop a custom mailing service based on Oracle BI. The mailing service operates in a semi-manual mode. It automatically generates PDF notifications and forms a list of customer e-mails. Bank employees only have to copy the respective e-mail and send the ready-made notification designed in alignment with the corporate brand guidelines.

Technologies

Business Value

By configuring and implementing two brand-new Oracle FLEXCUBE modules, Infopulse helped Allianz Bank Bulgaria provide better customer service and streamline the financial operations of 90+ bank branches across the country.

As a result, the combination of tailor-made FLEXCUBE modules and the Oracle BI has provided the following benefits for our client:

- Higher employee satisfaction, enhanced operational efficiency, and optimized costs due to smart automation of routine back/front-office tasks

- Improved customer experience through more flexible mortgage and safe deposit services that do not require physical presence at the bank office

- Microsoft Excel spreadsheets replaced with centralized FLEXCUBE-based data management that ensures immaculate accuracy and significantly reduces the probability of human errors

- Transparent 360-degree view of deposit boxes, which improves their security and management

- Creation of a notification system that automatically generates notifications for the lease of the deposit box and the approaching expiration date of the deposit box. Automatically generated notifications are sent to clients' email addresses by bank employees.

Currently, Infopulse continues to support and monitor the performance of the implemented FLEXCUBE modules.

As Allianz Bank Bulgaria was satisfied with the project outcomes, the bank plans to continue cooperating with Infopulse on a range of other FLEXCUBE-related projects. One of the upcoming projects involves the implementation of a new module – Relationship Pricing, which is designed to improve customer loyalty by creating and managing personalized product bundling offers, discounts, cashback, and other loyalty awards. Most importantly, Infopulse prepares to conduct a full-scale modernization of the client’s entire core banking system with the help of Oracle FLEXCUBE.

Related Services

Transform your entire banking operations with the Oracle FLEXCUBE platform.

Thank you!

We have received your request and will contact you back soon.