About the Customer:

Allianz Bank Bulgaria is a part of Allianz SE, one of the world's leading insurance and asset management companies with more than 122M private and corporate customers in more than 70 countries.

Allianz Bank Bulgaria is a universal commercial bank that provides complete bank services, including general insurance, retirement provision, mortgage loans, e-banking, leasing, and other financial services. Allianz Bank is in the Top of 10 largest banks in Bulgaria.

Executive Summary

Goal: Create a service for 24/7 processing of real-time incoming payments.

Solution: Developed and deployed a custom incoming instant payment service using Oracle FLEXCUBE and API with a retry mechanism.

Benefits: 3X quicker time to market of incoming instant payments solution; Compliance with the new banking regulations of the European Commission.

Services delivered: custom software development, DevOps.

Business Challenge

In 2023, Allianz Bank Bulgaria was among the trailblazer banks looking to deliver a robust incoming instant payment service to their customers in just 3 months. Not only was it a highly demanded service by the bank users, but also an obligation issued by the European Commission for banks and payment service providers in October 2022.

As a reliable partner of Allianz Bank, Infopulse had to come up with a solution fast so that it would go live with the effectiveness that the competitive market expected. The system in question had to be capable of processing real-time inbound payments 24/7, as well as enable payments and information exchange across all the Bulgarian banks in less than 10 seconds.

Solution & Business Value

In close cooperation with Allianz Bank, the Infopulse team developed and deployed a custom incoming instant payment service that allowed to achieve near-immediate request processing. The solution features a unique mapping system based on Microservices that reuses Oracle FLEXCUBE standard services and allows parsing an incoming request in a few seconds.

Main features:

- 24x7 end-to-end processing of incoming instant payments

- A retry mechanism for all the declined cases – reattempting the processing of payments at intervals

- The ability to manually accept or decline payments if the initial validation has failed

- Custom jobs based on Oracle FLEXCUBE to automate the incoming instant payment process

- Information logging with 24/7/365 access to it

- Full logging of the incoming instant payment process, logging of all requests and responses

Benefits for the client:

- 3X faster time to market for the implementation of incoming instant payment solution – the Infopulse team deployed the solution in just one month instead of the expected 3+ months.

- Higher customer satisfaction, ability to engage new customers, and have a stronger market position – Allianz Bank became one of the first banks in Europe to successfully provide incoming instant payment service to their customers.

- Compliance with the new banking regulation of the European Commission for the immediate availability of funds to the recipient and the respective requirements of the Bulgarian National Bank.

- The service allows processing a huge amount of data almost immediately, taking only seconds to respond to the request and process the payment.

- More successful payments are to be expected due to the retry mechanism and manual re-validation option.

- Further digital transformation of core banking processes.

Technical Details

Considering the tight deadlines, Infopulse designed a creative approach to the development of the incoming instant payment solution for Allianz Bank. Our client was already using Oracle FLEXCUBE. However, relying solely on the standard Oracle services would not allow for handling massive amounts of data, complicating the entire incoming instant payment flow.

Besides, processing any payments during the end-of-day operations would be impossible with standard out-of-the-box FLEXCUBE services. Therefore, Infopulse made extra customizations to enable 24/7 incoming instant payments.

In cooperation with Allianz Bank, we developed a Java service using Microservices that would parse files on the fly without using directories and process the incoming request directly through API. The custom service accesses the standard Oracle FLEXCUBE services with all the required data and creates a payment in Oracle FLEXCUBE, providing an instant response to the external systems. This allows completing all the processes of the cycle in just 1 second.

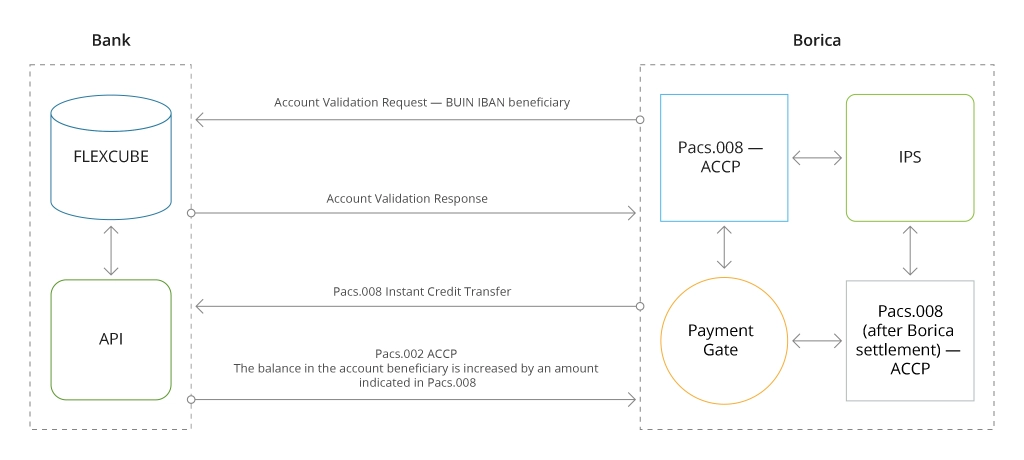

Detailed Process of a Custom Incoming Instant Payment System

- When receiving an incoming message on the API side, the system parses the incoming XML. FLEXCUBE checks the account to which the transfer should arrive.

- If the account is not available, FLEXCUBE returns an instant response.

- If the transfer operation is possible, then, according to mapping, we substitute the parsed parameters into a new service Oracle FLEXCUBE.

- Next, FLEXCUBE creates payments in accordance with the configured accounting model.

- FLEXCUBE returns a multi-tier response that the operation has been performed.

The Flow of Incoming Instant Credit Transfer Process

Technologies

Related Services

We have a solution to your needs. Just send us a message, and our experts will follow up with you asap.

Thank you!

We have received your request and will contact you back soon.