In-Car Payment Systems: Use Cases and Business Benefits

The market for connected vehicles is expanding at a rapid pace. And as 5G is making its way to the status of “commodity technology”, even more customers will opt for a “smart” driving experience. Savvy manufacturers are already pivoting with advanced infotainment systems offering a vast selection of safety, driving assistance and app integration features. In-car payments are among the newer HMI trends in automotive. Albeit, this trend has a high chance of becoming the most prominent and profitable one within the next several years.

Why Automakers Rush to Implement In-Car Payment Systems

In-car payment technology is nothing new per se. Payment functionality can be enabled with the help of either:

- long-range radio frequency identification (RFID) tags that can send payment data over the air.

- Embedded BLE hardware modules that can transmit data at a higher range than NFC protocols used by most mobile payment apps.

Development of such in-car payment system can be relatively fast with the right development team on board, and the implementation tradeoffs can be massive. The Digital Drive Report 2019, published by PYMNTS, estimates that commuters are already spending $212 billion a year conducting commerce in their cars. What’s more important though is that 66% of commuters, who are currently using their smartphones for purchases, state they would shop more frequently if in-car purchasing integrations and payments were available.

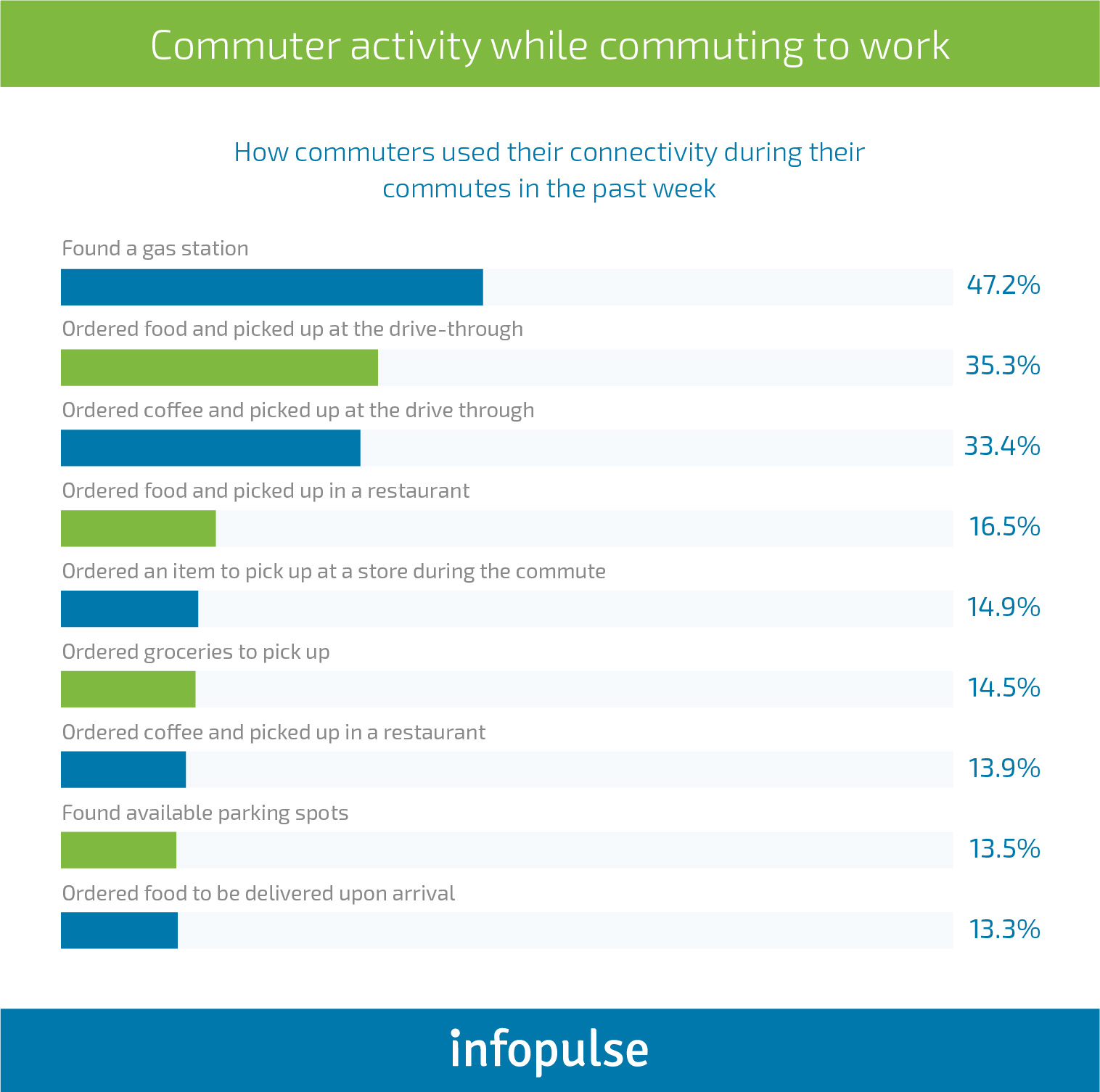

Taking a closer look at the common activities performed during commute suggests that OEMs have plenty of room for seamlessly “inserting themselves” into the drivers’ shopping experience:

Today, 99 million connected commuters in the US are spending approximately $62.3 billion on gas, $16.7 billion on coffee, $43.9 billion on groceries, $47.2 billion on food and $5.8 billion on parking, yet most OEMs are still missing out on getting a share of these revenues.

While many of the above activities can be performed via voice commands on your smartphone, others cannot. For example, ordering food or drink with a smartphone while driving still means it must be paid for upon pick-up. If items are ordered for delivery, there are manual payment processes that must be completed on that phone – not the safest activity while driving.

The idea of having a payment app embedded in a dashboard and not dependent on a phone or a charge is certainly appealing, especially when a payment method is already connected to the system and can be easily voice- or tap-activated.

All in all, it is now estimated that the in-car payment integration has a revenue potential of $230 billion.

The Most Common In-car Payment Use Cases and Their Business Value

In-car payment systems are definitely upon us. Some proactive OEM’s and auto manufacturers are already taking action to gain a competitive edge. Honda recently collaborated with Visa and developed a prototype for an in-vehicle payment app. New GM vehicles are also coming equipped with payment technology and even an in-dash goods and services marketplace. Last year the company expanded its in-car fuel payment services to the majority of pump stations in the US. Hyundai is partnering with Xevo to develop a connected car experience with a payment component that will give drivers the ability to pay for gas, parking and other goods/services.

Clearly, the race for a more comprehensive in-car payment is on and OEM’s and auto manufacturers best take heed. Below are several viable consumer solutions worth exploring in this regard.

1. Pay-at-the-Pump

Jaguar, GM, Hyundai are just some among several automotives which have successfully negotiated partnership deals with the gas stations to offer better auto payment experience at the fuel pumps. And as more stations are getting upgraded with connectivity, the pay-at-the-pump experience can change even more drastically.

For example, drivers will receive a notification when fuel is running low. Geofencing will then notify them of connected pumps in close proximity. The person can then compare prices and make a selection. While the gas will not be pumped for them, there will be no insertion of a debit or credit card (which has traditionally been a security issue). Rather, the customer will make a payment through the dashboard and be on his way.

From a technological perspective, here’s how such setup can function:

- The driver fills the car.

- The driver’s IVI system then communicates with the pump over a secure wireless connection that provides authentication.

- Once the driver finishes, the car automatically transfers money to the gas station, via the internet, RFID tag or Bluetooth connection.

All of this will require application development software such as those used in the existing mobile platforms. The pump already includes both hardware and software for payment terminals, and an embedded operating system. Software modifications for in-car payment technology should not be a huge challenge.

2. Voice Shopping

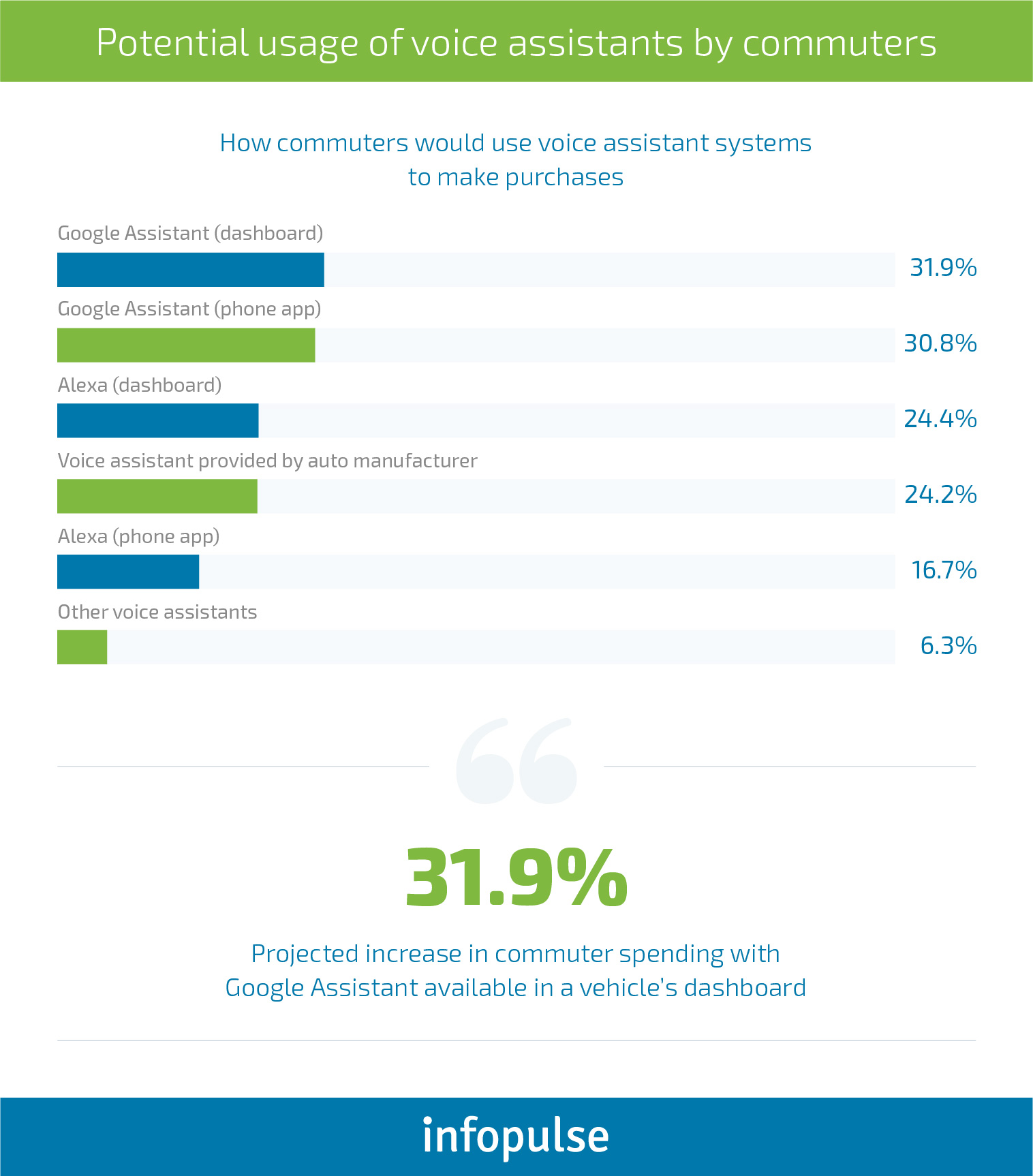

Commuters are already calling in on the voice assistants regularly. Moreover, they are actually ready to use them more frequently:

Integrating these apps into any auto dashboard would certainly be an opportunity for more profits to be made. But it’s not the only way OEMs can bank on voice commerce. Instead of sharing profits with 3rd parties, automakers can effectively retain them by offering proprietary voice assistants embedded in the dashboard.

3. Smart Parking

One of the biggest motivators for commuters to push for high-speed rail systems in their communities is the issue of parking. But Americans also love their cars and the independence they give. Most urban areas, of course, have fee-based parking lots, but whether for work or events, parking is always an issue. Connected cars and payment features will ease these issues for drivers. IoT-powered parking lots can “broadcast” open spaces as well as pricing via over-the-air transmission. Drivers can easily navigate to an open spot and pay automatically – no tickets, no cash or cards, and no parking lot attendants.

The following video illustrates how an in-vehicle payment technology will function in this case:

Infopulse also created Smart Parking solutions leveraging IoT and Computer Vision. Discover how they work in this detailed success story.

4. Toll Roads

Paying for toll roads has always been a hassle. But this process can be largely improved as well. Authentication documents and payment methods can be embedded in a vehicle’s license plate and/or a windshield label. When entering the paid road, those can be automatically read through long-range radio frequency identification. The toll will be automatically deducted from the account a driver has connected to the car.

5. Car Rental Experience

Hertz is already experimenting with a connected car innovation for its business customers, in collaboration with Nokia and Concur and using SAP vehicles network software solution for fueling and parking. The initiative, when fully designed, will allow customers to reserve their rentals and pay for parking and fuel online, as well as track and submit their expense claims.

6. Automated Repair Payments

All late model cars are equipped with technology that notifies drivers when oil should be changed or flash a “check engine light” when repair/maintenance is needed. Taking a step further, smart cars will be able to analyze a specific issue and allow drivers to check prices of repair costs before selecting a service venue. Add to that automated payments, and the driver has an even more streamlined experience.

And consider this: once autonomous vehicles become a reality, the car can automatically take itself in when repairs or maintenance are needed, make a payment and return to the owner.

7. Drive-Thru’s Made Simpler

We use drive-thru convenience for food, dry cleaning, prescription pick-ups and more. If a smart car orders in advance, it alerts the dry cleaner or pharmacy of its arrival and upon receiving the order amount, makes payment before the arrival. What’s more, OEMs can set up partnership deals with different vendors and have an additional revenue stream for referring customers to them.

8. Government and Legal Compliance

The process of registering a car, getting new plate stickers, paying personal property taxes can be really frustrating for drivers. While some States now allow owners to pay registration online, it must be done via computers or mobile devices. The same goes for paying car taxes online. All of such hassles can be resolved by in-car payment technology.

Imagine being alerted in advance when car registration renewal and taxes are due and to automatically have those payments deducted from an account. All of a sudden, vehicle registration is fully automated without any owner initiative. Drivers can seamlessly check vehicle registration status online and pay all the dues from their in-car wallet.

How In-Vehicle Payment Systems Can Be Implemented

A small percentage (16.7%) of consumers already have their smartphones integrated with some of their car dashboard systems, allowing them to use voice to make calls and find places to go. As OEMs think about automotive FinTech, they have to consider that the larger majority still wish to use their smartphones to make payments.

This will present a challenge – moving drivers/consumers to abandon their phones completely may take some time. But OEM’s have three options:

- Provide total in-car connectivity

- Offer smartphone-based connectivity

- Develop some hybrid form of the previous two

For instance, Visa connected car experience will look the following way:

No matter which route you settle on, there will be three essential elements that you’ll need to develop for a comprehensive payment experience:

- A newer generation of infotainment systems. While most modern cars are equipped with IVI systems, including an OS, newer systems will have to accommodate porting lots of current mobile apps that consumers are using. This will be a challenge.

- Transforming a car into a payment device. This can be accomplished using long-range RFID tags, Bluetooth hardware, and third-party APIs, which allow porting of existing apps to a car’s IVI system.

- An in-car digital wallet. Users want to have a variety of payment options (more than just a MasterCard or Visa connection), which automakers will have to enable.

These points certainly present challenges, but collaborative efforts of OEMs, car manufacturers and software developers are already meeting them.

One major issue, of course, will be data privacy and security.

How Data Privacy and Security Can be Achieved for In-Car Payments

Any connected solution comes with lots of data protection issues, as major breaches have been reported. In fact, 48% of U.S. companies using IoT technology have suffered from those. Sophisticated authentication technology (e.g., biometrics and 2-factor authentication) will be critical and any developers/providers of in-vehicle payment software/technology cannot stand aside.

Tokenization of sensitive data is one of the options worth exploring. Customers’ connected payment methods can be codified into unique tokens, stored in a cloud-based vault solution. In this case, the in-car systems will not handle clear payment data. Thus, the chances of fraud and breach are reduced.

Blockchain is another strong contender for enabling secure data storage and exchanges. The technology has proven to be extremely successful in handling IoT data exchanges in different industries (energy sector, manufacturing). Using blockchain for data exchanges also eliminates cross-technology compatibility issues.

In-built intrusion and detection systems, powered by machine learning and Big Data, are another way of improving cybersecurity in connected vehicles. Such systems can examine activities in different onboard systems (navigation, payment module, marketplace, etc.) and detect any abnormal behaviors and usage patterns that could indicate a breach. Intrusion systems can be designed to block and prevent attacks or just alert a driver of a potential issue, allowing them to analyze the problem in a timely manner and take an appropriate action.

Conclusions

Clearly, there is no turning back. The merger of the FinTech and automotive sectors is upon us. More and more sophisticated IVI systems are placed into new gen cars as OEMs rush to meet the consumers’ demand for better connectivity and convenience. In-vehicle payment systems are the next logical step as they enable better CX for drivers, as well as create an additional value stream for manufacturers.

Infopulse is poised to help the automotive sector merge FinTech into its connected car solutions. If you are interested in exploring in-car payment options, schedule a discovery call with one of our automotive specialists.

![Power Apps Licensing Guide [thumbnail]](/uploads/media/thumbnail-280x222-power-apps-licensing-guide.webp)

![How to Build Enterprise Software Systems [thumbnail]](/uploads/media/thumbnail-280x222-how-to-build-enterprise-software-systems.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![ServiceNow and Third-Party Integrations [thumbnail]](/uploads/media/thumbnail-280x222-how-to-integrate-service-now-and-third-party-systems.webp)

![Cloud Native vs. Cloud Agnostic [thumbnail]](/uploads/media/thumbnail-280x222-cloud-agnostic-vs-cloud-native-architecture-which-approach-to-choose.webp)

![DevOps Adoption Challenges [thumbnail]](/uploads/media/thumbnail-280x222-7-devops-challenges-for-efficient-adoption.webp)

![White-label Mobile Banking App [Thumbnail]](/uploads/media/thumbnail-280x222-white-label-mobile-banking-application.webp)

![Mortgages Module Flexcube [Thumbnail]](/uploads/media/thumbnail-280x222-Secrets-of-setting-up-a-mortgage-module-in-Oracle-FlexCube.webp)

![Challenges in Fine-Tuning Computer Vision Models [thumbnail]](/uploads/media/thumbnail-280x222-7-common-pitfalls-of-fine-tuning-computer-vision-models.jpg)