How to Automate Mortgage Services with Oracle FLEXCUBE?

In this article, you will discover how to automate mortgage processing with the Mortgages Module of Oracle FLEXCUBE. You will also learn what benefits such automation brings and what business opportunities it opens up for financial institutions.

Why Automate Mortgage Processing with Oracle Flexcube?

The mortgage lending process is considered one of the most complex credit processes banks offer clients. Long-term liabilities for considerable amounts of money require accurate and balanced decision-making, with a thorough analysis of customers and collaterals. The process is quite resource- and time-consuming, divided into the following stages:

- Application analysis and customer verification

- Customer risk and credit rating (scoring)

- Credit decisioning

- Contract and fund disbursement

All these stages involve multiple data entry and other manual processes, aggregating information from numerous internal and external sources for appropriate decision-making. On the other hand, modern core banking systems like Oracle FLEXCUBE allow automating this routine, streamlining operations for bank employees and accelerating decision-making, thus enhancing accuracy. The Mortgages Module of Oracle FLEXCUBE allows to have all required data in one place, assess customer payability and credit risks, calculate mortgage rates, property amortization, and schedule payments. As a result, such solutions accelerate all the stages of mortgage processing on the bank’s side.

From the customer’s point of view, the most important factor is ‘time-to-money’ or how long it takes to get approved for a loan and receive money to buy property. For many customers, the shortest possible time to grant a loan is decisive in choosing a specific offer.

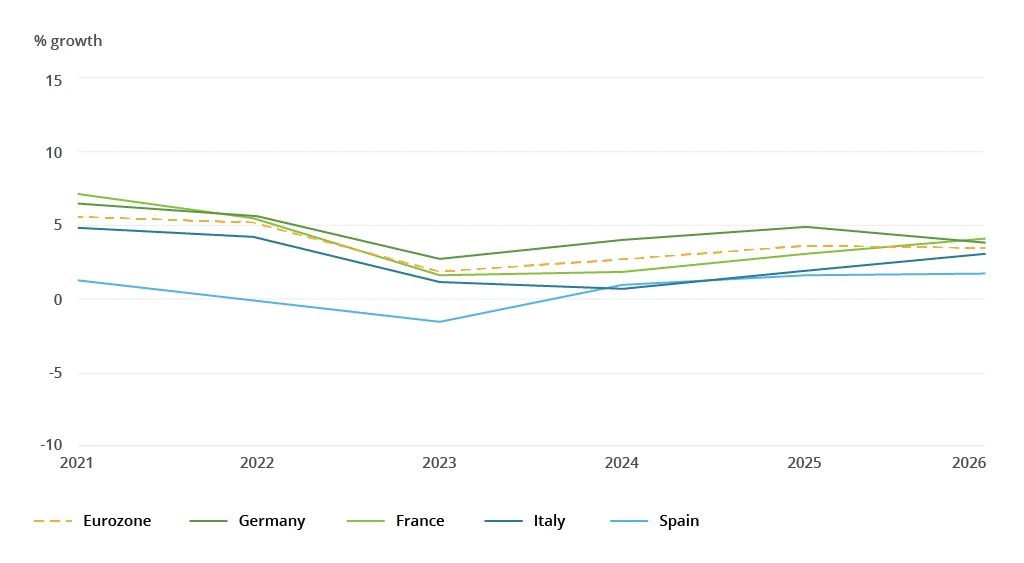

Mortgages are now one of the leading banking products on the Eurozone market, accounting for almost half of the total lending services:

Taking into account the forecasted growth, modernizing mortgage processing is more than reasonable, making it more effective for both banks and customers. Acceleration through automation is beneficial for all parties involved. For the time being, Oracle FLEXCUBE’s Mortgages Module is one of the leading solutions on the global market to modernize and streamline mortgage loan origination and all other related processes.

Mortgages Module: Key Benefits and Features

Oracle FLEXCUBE’s Mortgages module is specifically designed to automate and simplify the management of an end-to-end mortgage lending process, from mortgage loan origination to servicing and closure. It brings banks:

- Efficiency in loan origination: The Mortgage Module utilizes sophisticated decision-making algorithms to evaluate customers’ eligibility for mortgage loans. It automates decision-making, minimizing manual intervention and reducing human error.

- Seamless integration: The Mortgages Module easily integrates with existing banking systems, ensuring smooth data flow between different modules and bank’s departments.

- Automated loan servicing: Seamless payment processing, escrow management, and customer communication.

- Regulatory compliance: It ensures the mortgage lending operations are compliant with local and international regulations, reducing legal risks and protecting the bank’s reputation.

- Document Management: Provides a centralized repository for storing and managing all mortgage-related documentation. Banks can easily access and retrieve customer documents, ensuring compliance with regulatory requirements and enhancing customer service.

- Collateral Management: Comprehensive collateral management capabilities allow banks to effectively track and manage mortgage collateral throughout its lifecycle. It helps assess and monitor property valuations, insurance coverage, and related documentation.

- Risk management: The module features tools for assessing and managing the risks associated with mortgage lending (credit risk, market risk, operational risks) to make informed lending decisions and mitigate potential losses.

- Data analytics & reporting: The module provides built-in analytics and reporting tools to collect insights about the bank’s mortgage portfolio.

- Product Configuration: The ability to configure and customize mortgage products based on their specific requirements, from interest rates and loan terms to repayment options and collateral types.

- Cost-efficient operations: Automation and acceleration of different mortgage operations help reduce operational costs.

- Cross-selling opportunities: The Mortgages Module integrates with existing banking systems, helping banks leverage customer data and identify cross-selling opportunities. For example, if a customer applies for a mortgage, the system can suggest other relevant products like home insurance, investment options, or credit cards.

- Higher security: In-built security features protect sensitive customer data and comply with data protection regulations. It is crucial in the context of the upcoming PSD3 release.

These features enable banks to offer a wide range of mortgage products efficiently, strengthen competitiveness on the market, streamline complex mortgage lending processes, and ensure compliance with regional regulations.

Business Opportunities Brought up by Mortgages Module

Implementing the Mortgages Module of Oracle FLEXCUBE drives significant business value for banks, primarily by enhancing the efficiency and customer experience associated with satisfying mortgage lending. Here are some of the most essential opportunities you may get from its implementation:

- Cost reduction: Savings from reduced paperwork, manual effort, and improved accuracy of mortgage services. The Mortgages Module also allows managing a growing portfolio of services without the need to increase staff and resources proportionally.

- Expanded mortgage services: The module helps to quickly set up new offerings and propose personalized terms for specific customer categories.

- Revenue generation: The ability to introduce new mortgage products quickly in response to market demands helps generate additional revenue streams.

- Increasing customer base: Fast and customer-friendly mortgage services attract more customers, expanding the bank’s market share.

- Better risk analysis: Enhanced risk assessment tools available in the Mortgages Module brings a more accurate evaluation of applicants’ creditworthiness, lowering the risks of defaults.

- Improved operational efficiency: Automation of mortgage loan operations decreases processing time, increasing the number of mortgages a bank can handle within available resources. It also minimizes human errors in data entry and calculations, enhancing accuracy.

- Higher employee and customer satisfaction: Automation decreases human workloads and provides a more convenient employee experience, while customers benefit from faster loan processing and better personalization.

- Better competitiveness: The ability to release new mortgage offerings and react to market changes faster enhances the bank’s competitiveness in the mortgage market.

- Partnership opportunities: Oracle FLEXCUBE can also be integrated seamlessly with third-party systems used by mortgage brokers and real estate agents. With this level of connectivity, banks become more attractive partners for brokers and agencies looking for efficient mortgage lenders.

Such opportunities fully align with banks’ goals for digital transformation, customer-centric service, and agility in a dynamic market. By implementing up-to-date loan origination solutions, banks gain a competitive edge.

Setup Roadmap

Setting up the Mortgages Module for Oracle FLEXCUBE involves several key steps that can vary slightly based on the unique requirements of your financial institution. The general setup roadmap includes the following stages:

1) Initial planning and analysis

- Identify business requirements

- Analyze regulatory compliance terms

- Analyze integration needs

2) System installation

- Hardware and software setup to get the infrastructure ready for Oracle FLEXCUBE integration

- Oracle FLEXCUBE installation (database, app server, network settings, and Oracle FLEXCUBE system itself, including the Mortgages Module)

3) Configuration

- Configure Mortgage products

- Define workflows for mortgage processing

- Setup user roles and security by defining permissions to all staff roles involved in the mortgage operations. Also, setup security to protect customer data

4) Integration

- Integrate the Mortgages Module with other banking systems (CRM, accounting, document management, reporting).

- Integrate the Mortgages Module with third-party services (if needed): systems for credit checks, valuations, compliance reporting, etc.

5) Quality Assurance

- Unit testing

- Integration testing

- User Acceptance Testing (UAT)

6) Training

- Staff training: training sessions for bank personnel to manage daily operations, troubleshooting, and security practices

- Maintenance & support plan for ongoing expert assistance with the Mortgages Module

7) Deployment

- Data migration: needed if migrating mortgage data from legacy systems

- Go-live: deploy the Mortgages Module to the production environment

8) Post-implementation monitoring and reporting:

- Monitor & optimize

- Fulfill compliance reporting

A case in point: Infopulse applied such an approach to set up the Mortgages Module within the Oracle FLEXCUBE implementation for Allianz Bank Bulgaria. Our client aimed to streamline mortgage services to enhance customer experience and boost operational efficiency. Having Oracle FLEXCUBE on board, the company decided to implement the Mortgages module to automate the entire mortgage lifecycle. Infopulse configured six mortgage products with different loan plans, tranches, and grace periods. Additionally, our team configured 16 different component accounting types to manage the related financial operations within the bank’s mortgage services. Learn more about the technical solution delivered and its value for business in the full case study.

Best Practices for Successful Implementation

Based on our practice, configuring the Mortgages Module demands careful planning and execution. These are the best practices that help succeed in such implementations:

- Effective project management: Set up clear objectives, timelines, and plan resource allocation before the development to ensure the project is completed within the agreed time & budget and meet the client’s expectations.

- Deep understanding of the mortgage market in the country of implementation: Consider the country of operation, customer preferences, and competitive landscape, as they may affect the configuration of Oracle FLEXCUBE software. It is important to ensure the solution’s effectiveness and relevance in the local context.

- Strong knowledge of accounting and regulatory requirements: Align the module setup with local and international regulations to avoid legal penalties and ensure reporting accuracy.

- Building an effective reporting system for all the departments of the bank involved: Implement the appropriate tools for monitoring the performance of the mortgage portfolio, risk management, and informed decision-making.

- Data migration strategy to plan, test, and execute data migration: Establish accurate data transfer from all the required sources, without interruptions or data integrity risks.

- Comprehensive testing and QA: Identify and rectify issues before the system goes live. Apply unit testing, system testing, user acceptance testing (UAT), and regression testing to ensure the module is functional, user-friendly, and free of critical issues.

It is essential to follow the guidelines that Oracle provides throughout the setup process. Engaging certified partners who specialize in FLEXCUBE implementations ensures a smooth setup with all the requirements addressed.

Conclusion

The Mortgages Module of Oracle FLEXCUBE is a powerful automation solution that brings operational efficiency, opens up new avenues for market leadership, and enhances customer satisfaction. Yet, it involves certain challenges related to the complexity of mortgage automation setup and correct integrations with other bank’s systems.

Infopulse is a certified expert in Oracle Financial Services Core Banking with hands-on experience in setting up and customizing the Mortgage Module of FLEXCUBE software. We can also help automate the mortgage processing and improve operational efficiency.

![Mortgages Module Flexcube [MB]](https://www.infopulse.com/uploads/media/banner-1920x528-Secrets-of-setting-up-a-mortgage-module-in-Oracle-FlexCube.webp)

![Data Analytics Use Cases in Banking [thumbnail]](/uploads/media/thumbnail-280x222-data-platform-for-banking.webp)

![Mobile Banking Trends [Thumbnail]](/uploads/media/thumbnail-280x222-mind-your-app-why-reinventing-mobile-banking-really-matters.webp)

![Banking Software Development [Thumbnail]](/uploads/media/thumbnail-280x222-software-development-out-of-the-box-vs-custom-vs-low-code-solutions.webp)

![Overview of Connected Banking and its Benefits [thumbnail]](/uploads/media/what-is-connected-banking-its-promises-and-benefits-280x222.webp)

![Low-code for Banking [thumbnail]](/uploads/media/thumbnail-280x222-low-code-benefits-use-cases-banking.webp)

![API Strategy for Banking [thumbnail]](/uploads/media/whys-and-hows-of-api-strategy-for-banking-280x222.webp)