How to Approach the Development of a Credit Risk Management Software

How can banks digitize the workflow of credit risk management? Should they purchase software solutions from established vendors or create a loan risk management platform from scratch? In this post, we will review the approaches available today and analyze the tangible results such transformation brings based on our practical experience.

Why Does Legacy Credit Risk Management Software Underperform?

Around 75% of enterprises began the digitization of credit risk management before the COVID-19 pandemic, driven by the following market forces:

- The expectation for new solutions from investors, counterparties, and customers

- New, tighter regulations on risk management

- Competitors’ innovations

- Increased pressure on costs/returns from FinTechs

- Technological disruption of the industry’s traditional business models by new digital attackers.

One of the biggest competitive threats for legacy banks is the increasing population of digital-only banks. The Insider Intelligence reports that in 2021, its penetration among the adult US population was 11.4%, and it is going to expand to almost 20% by 2025.

Putting the market forces aside, legacy approaches for credit risk management imply multiple limitations, including:

- Slow “time to decision” and “time to cash” due to manual and paper-based processes and limited resource coordination between different bank units.

- Regulatory compliance: financial and nonfinancial loan regulations get more substantial and diversified across the countries. Banks are forced by governments to help detecting illegal and unethical financial transactions, money laundering, fraud, and facilitating the taxes collection. Without integrating modern regulatory technologies, legacy banks struggle to comply with newly emerging regulations of such kind.

- High operational costs and low performance: manual data collection and processing, data-based risk analytics, decision-making, and reporting consume much time and talent.

- Incomplete view of risk: limited data sources do not allow for generating accurate risk scores and inability to get the data fast enough to react to market changes. Robust data management with traditional and alternative data sources can significantly improve the risk assessment quality.

- Data management issues: not automated and standardized enough, legacy systems provide different data definitions among different units (like business, IT, and risk units) that lead to data inconsistency, problems with finding the correct data set, identifying the most recent one, etc.

- No single and consistent source of truth due to human factor, inconsistent credit underwriting processes, or disparate risk data sources.

Obviously, it is time to guide loan business toward economic recovery in the post-pandemic period. Most banks today clearly understand the urgency of modernizing legacy software systems. The question is, how to implement the required changes within the available time and budget?

Approaches in Loan Risk Management Automation

Loan businesses face the challenge of choosing an appropriate strategy and tools for upgrading their risk management workflow. Two main available approaches are buying a ready-made product from a third-party vendor and creating a custom solution from scratch. Let us take a deeper look at the pros and cons of each approach.

Buying a vendor solution

To automate risk assessment and management, a bank can integrate a ready-made solution, adapting the standard functionalities according to its specific needs and processes. According to the Global Banking & Finance report, the software market for credit risk management was valued at $962.35 million in 2021, and it will grow at a CAGR of 6.23% by 2028. IBM, Oracle, SAP, SAS, Experian, Misys, Fiserv, Kyriba, Active Risk, and Pegasystems are leading the market.

At its core, such solutions are based on different risk assessment models that capture data from specific sources and process it through a pre-defined risk assessment model. Based on the results of these calculations, the system outputs the credit risk evaluation and decision for each applicant. There are a few key advantages of vendor solutions for credit risk management from the business point of view:

- Lower upfront investment

- The lower total cost of investment (TCO)

- Faster time to market.

Such systems automate the data processing routine and speed up decision-making. Loan specialists do not need to collect data and calculate risks manually. Yet, vendor systems have severe drawbacks and challenges, including:

- Limited data sources

- Non-transparent risk evaluation mechanism

- Challenging integration with the core banking system

- Lack of support and slow processing of maintenance requests

- Costly customization to satisfy the bank’s needs and requirements comparable to creating a custom solution from scratch.

This approach is viable for retail loaning where risk assessment is consistent and standardized. If the bank requires flexibility in providing services to various customer segments or provides specific loan products for different industries, a ready-made vendor solution would most likely lack personalization and customization capabilities to address all these peculiarities.

It can also be a problem if a bank collaborates with B2B customers on a banking-as-a-service model when the software has to be customized to each B2B partner. Such banks should opt for custom solutions.

Custom solution for credit risk management

Alternatively, a bank can design a solution tailored specifically for its business within an in-house IT department or hire a software development service provider. At first glance, it may seem more expensive and longer to implement. Yet, such investment is justified by:

- Complete control having a well-written code and advanced data security

- Better scalability for future growth

- Ease of use and maintenance

- Significant reduction of operational costs and efforts

Custom banking software development has its own drawbacks:

- Longer deployment and integration compared to ready-made solutions

- Higher investment costs

- Problems with finding a software development contractor with relevant expertise.

Taking into account that both approaches have their own pros and cons, it may be hard to decide which one is better for each specific case. Analyzing all the decision-making factors may help define the suitable strategy.

How to Solve Buy vs. Build Dilemma?

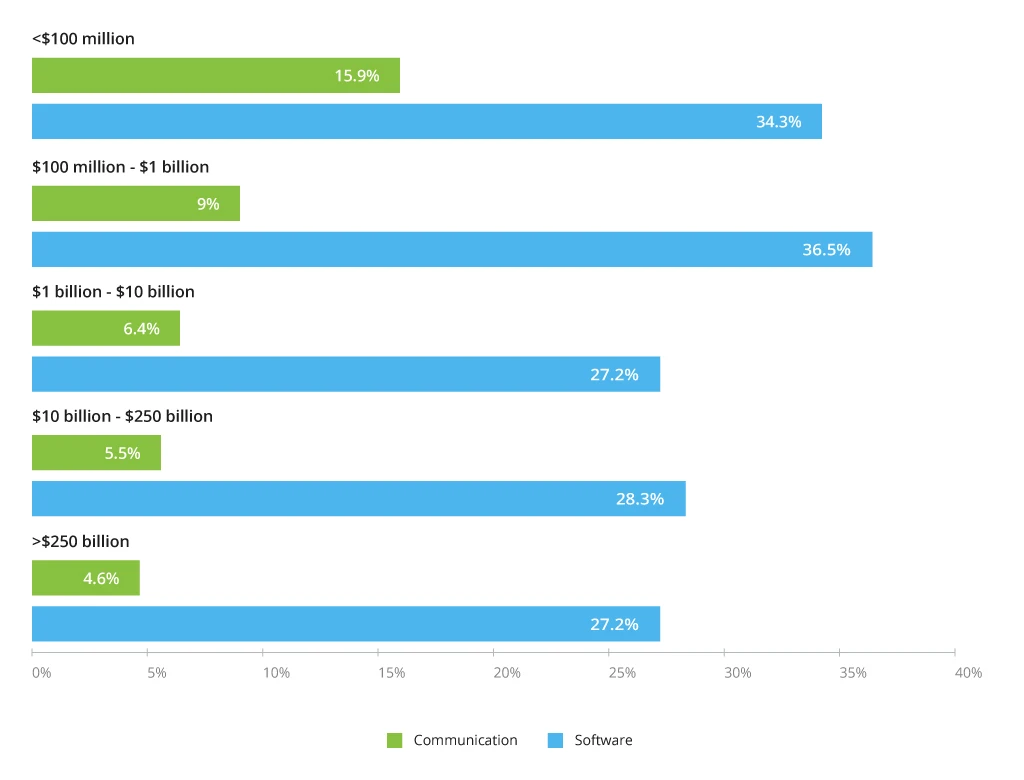

Banks are spending from 27.2% to 36.5% of their IT budget on software, including solutions for loan risk management:

Type of IT Spending as a Share of the Total IT Budget

Every new investment into software solutions requires in-depth analysis, considering potential failure risks. Pre-investment research helps get an overview of available options, match them with the bank’s requirements, and finally, choose the optimum.

Pre-investment research for credit risk management software includes the following steps:

- Outline your requirements to the future solution and the business value it should bring. Build a deep understanding of the challenges you would like to resolve.

- Think over the capital, time, and human resources you can invest in your future loan risk management platform.

- Analyze the available vendor solutions and see if any meet at least 80% of your requirements. How critical are the missing 20%? Is there any way to compensate for that shortage?

- Request proposals for developing the system per your project specs from software development service providers. Analyze the collected proposals in terms of development time and cost, the team’s relevant experience in producing similar solutions, and how they evaluate and communicate your needs.

- Shortlist the potential vendor solutions and custom development proposals, compare them, and make your final decision.

Such analysis on the bank’s side takes time and effort. However, it significantly decreases the risk of choosing the wrong strategy or service provider.

Here is a short ‘build or buy’ assessment framework to help you further. The combination of these criteria may prompt which way to go in your specific situation.

“Build or Buy” Assessment Framework

Criteria

When to build a custom solution?

When to buy a vendor solution?

Must-have features

There is no product on the market that fits at least 80% of your functional and technical requirements.

An out-of-the-box product on the market fits at least 80% of your needs.

Time-to-market

There is no tight time-to-market deadline.

You need a ready-to-use product as soon as possible. Quick time-to-market is your top priority.

Technical skills and knowledge

You have an experienced IT department in-house or ready to hire a software development provider to build and maintain the solution long-term.

There is no internal technical talent to develop a custom solution. Hiring a software development service provider goes beyond the available budget.

Level of innovation

Your company’s digital strategy pushes technological boundaries further than available third-party solutions can tackle them.

Your organization is not planning or has no resources to pioneer innovations and make them a competitive advantage.

Cost analysis

You have a clear picture of all initial, ongoing, and hidden costs of the required solution development, and it fits your resource capabilities.

License models offered by a software vendor, its maintenance and upgrades costs fit your limited budget much better than the custom development project cost.

Analyzing your requirements and available options will help you decide on the right approach. Clarity with the needs, well-defined goals, and a comprehensive overview of available solutions is a solid base for any successful digital transformation initiative.

Our Case: Wholesale Risk Management Solution for Car Financing

Going from theory to practice, here is our hands-on experience in creating a custom wholesale risk management system from scratch.

Santander Consumer Bank AG, one of the top 20 world banks, aimed to modernize its car financing processes for big automobile dealers, insurance companies, SMEs, and other corporate clients in the German market. After previous attempts to adapt ready-made vendor solutions, the company decided to implement a custom system from scratch. The goals included streamlining the decision-making process, reducing manual efforts and operational costs, and optimizing the interaction between all participants in the conciliation process.

After in-depth requirements analysis, the Infopulse team designed a complex wholesale management system based on the microservices architecture and hosted on a private cloud. The credit risk management solution was a part of this system, and it had to be tightly integrated with its other components. One of our challenges was to design a scalable architecture that could be integrated smoothly with existing and upcoming banking systems and stay viable for at least the next 25-30 years.

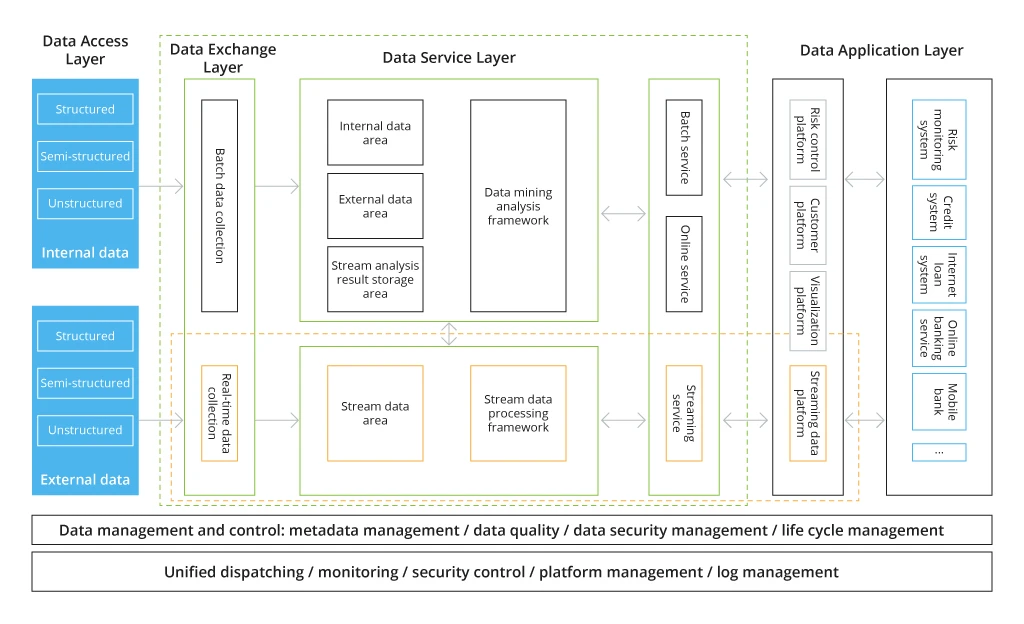

Such a system required a complex, multi-layer infrastructure, like in the sample below.

We literally created a virtual risk analyst’s workplace with an adjustable, user-friendly interface. As a result, the bank got much lower TCO compared to other existing solutions on the market, faster decision-making, and lower human error probability. Please check our detailed case study to find out more about this project.

Conclusion

Risk management in the loan business defines its entire profitability, affecting numerous processes beyond approving customer applications. It is integrated tightly with the rest of the operations in the credit product lifecycle and defines the quality of decisions made towards potential and existing clients and counterparties.

The future risk management solution should cover the functionalities and demands of all bank units involved. The deeper you understand and document your requirements, goals, and desired outcomes, the more chances for success your future solution has. Here are a few more recommendations that will help you receive an effective credit risk management solution that fits the bank’s requirements and budget:

- Clearly define and document the desired features and technical requirements for the future solution.

- Outline the time, budget, and talent resources your organization is ready to invest in.

- Conduct the pre-investment research, studying all available credit risk management software on the market to define if any match your expectations.

- Request proposals for the development of a custom solution from software development service providers.

- Shortlist potentially suitable offers and make the final choice based on the assessment framework listed above.

Whether you choose a ready-made solution or develop a custom system from scratch, tight cooperation between the client’s key experts and the development (or customization) specialists is vital. It helps developers better understand the client’s requirements, while a client is more likely to receive the expected result.

In-depth technical expertise in banking and financial solutions development is another critical success factor when choosing a development service provider for your loan risk assessment solution.

Developing custom software solutions for banking and finance is one of Infopulse’s key areas of specialization. We will help digitize your credit risk assessment routine and improve customer satisfaction through fast and efficient decision-making.

![Credit Risk Management Software Development [banner]](https://www.infopulse.com/uploads/media/how-to-approach-the-development-1920x528.webp)

![Power Apps Licensing Guide [thumbnail]](/uploads/media/thumbnail-280x222-power-apps-licensing-guide.webp)

![Cloud-Native for Banking [thumbnail]](/uploads/media/cloud-native-solutions-for-banking_280x222.webp)

![Generative AI and Power BI [thumbnail]](/uploads/media/thumbnail-280x222-generative-AI-and-Power-BI-a-powerful.webp)

![AI for Risk Assessment in Insurance [thumbnail]](/uploads/media/aI-enabled-risk-assessment_280x222.webp)

![How to Build Enterprise Software Systems [thumbnail]](/uploads/media/thumbnail-280x222-how-to-build-enterprise-software-systems.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![ServiceNow and Third-Party Integrations [thumbnail]](/uploads/media/thumbnail-280x222-how-to-integrate-service-now-and-third-party-systems.webp)

![SAP Service Insight [thumbnail]](/uploads/media/Service Insight-Infopulse-SAP-Vendor-280x222.webp)

![Carbon Management Challenges and Solutions [thumbnail]](/uploads/media/thumbnail-280x222-carbon-management-3-challenges-and-solutions-to-prepare-for-a-sustainable-future.webp)

![White-label Mobile Banking App [Thumbnail]](/uploads/media/thumbnail-280x222-white-label-mobile-banking-application.webp)