InsurTech and Risk Management: Reshaping Risk Scoring and Underwriting

The vibrant combination of insurance services and technical innovation takes a swing at the insurance sector. Let’s look at the current state of the market and how it pushes insurers toward rethinking risk scoring and underwriting procedures.

The State of the Insurance Market

In a global sense, the insurance industry is safe and sound. The sector is growing steadily, showing overall profitability. According to the Global Economic and Insurance Market Outlook 2020/2021 based on the data provided by Bloomberg, Thomson Reuters, and Swiss Re Institute:

- The global non-life insurance market shows steady premium growth and profits (ROE) in 2020/21 and flat combined ratios. Rate trends of commercial lines are firming, but social inflation is putting upward pressure on liability loss costs, especially in the US.

- The global life insurance market shows a premium growth of 3% through 2021 with emerging markets, and China as the key driver .

- Insurers reported healthy profits (ROE) in 2019, partly due to the realized gains from the investment portfolio.

- The investment outlook is challenging with low-interest rates.

Still, getting ahead of the curve by using technologies to offer new products or services and reduce costs is a reasonable move for insurers. InsurTech has a lot to offer.

InsurTech and Its Value

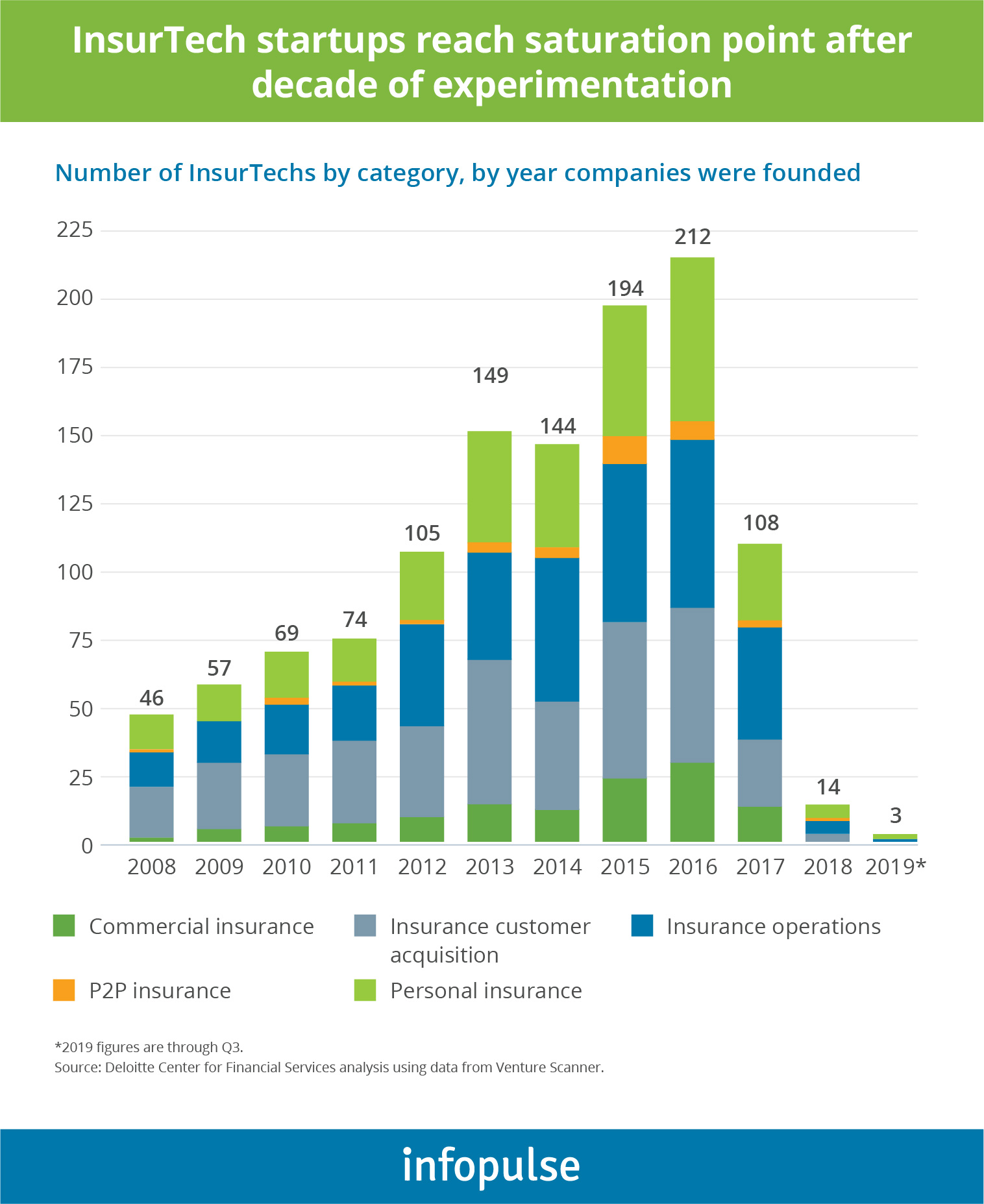

InsurTech is primarily about ambitious startups trying to lead the charge by taking on the already established players. Figures speak for themselves: global investment in InsurTech startups rose through 2019, hitting an all-time high of $3.26 billion.

InsurTech solutions spread throughout the insurance sector and its business processes. From markets, products, and distribution channels to processes and services like underwriting, claims, and risk management, technologies make a difference.

InsurTechs are successful in outpacing traditional companies since they know how to address business and user needs more conveniently and transparently. Don’t be surprised if we witness a more stable increase in this market and more financial infections in its players. On a global scale, the revenue in the field is said to strike $1,119.8 million by 2023.

How InsurTech Improves Risk Management Practices

The category of startups focusing their efforts on risk management is one of the broadest and well-supported ones. The tech efforts in this sphere fortify the pillars of risk scoring and decision making the industry relies on. While the traditional approach to risk assessment is mostly based on past claims, tech offers ways of making better-informed decisions. Real-time data and smart observation help insurers automate risk factor monitoring, giving decision-making a new level of certainty and speed.

Successful InsurTech solutions concentrate on the areas of risk scoring and decision-making including:

- Numerous channels to access applicant data gathered from different facets of theirlives.

- Risk-based pricing approach. Technology helps companies detect risk events or changes to claim rates on time.

- Consistent reinsurance arrangements based on the comprehensive data on risk appetites of the insured organization.

- Advanced risk mitigation options that cover data-based avoidance, transfer, and retention of risk.

- Time-effective underwriting process due to deeper data insights and process automation.

- Better risk-adjusted pricing, which helps insurers lower losses caused by risk events and operate their capital rationally.

Technologies That Reshape Approaches to Underwriting and Risk Scoring

The traditional underwriting and risk scoring models decide on insurance premiums according to the average questions about age, family composition, and occupation. This approach can’t compete with some sophisticated tech solutions. Cloud computing, AI, IoT, and blockchain have already forced positive changes in the sector.

Cloud Computing

Scalability, speed, and flexibility are what makes cloud computing so desirable for the insurance domain. Moreover, cloud computing is the base of the InsurTech infrastructure that allows running big data, predictive analytics, or AI algorithms. Risk assessment criteria, loss events, key risk indicators, and other data placed in a single cloud-based environment help businesses to develop sophisticated risk scoring or rating engines, allowing companies to run complex risk and premium calculations.

Cloud-based risk assessment software contributes to the effectiveness of the entire underwriting process as it helps underwriters:

- Analyze applications and verify them against the existing risk assessment and policy issuing criteria.

- Point out areas of exceptional concern.

- Automatically approve applications that meet all underwriting criteria.

- Suggest new underwriting criteria based on the number of issued and declined policies.

Internet of Things

InsurTech has already made use of such manifestations of IoT as transport sensors, wearables, and geolocation systems. The latter is of particular importance in agriculture. There is even a separate rapidly developing market called agri-insurance that emerged on the edge of AgriTech and InsurTech.

By leveraging IoT, insurers get access to a treasure trove of data to apply, among others, in underwriting or risk scoring. IoT data-driven risk assessment and underwriting is based on real-time, individual, and noticeable data on the risk of loss. This data helps insurers act immediately to mitigate risks or set accurate risk pricing. As soon as insurers identify the risk-causing behavior or actions, they can start monitoring this behavior using IoT sensors. This will help insurers work out algorithms that connect the observed behavior directly to the pricing models.

Big Data and Predictive Analytics

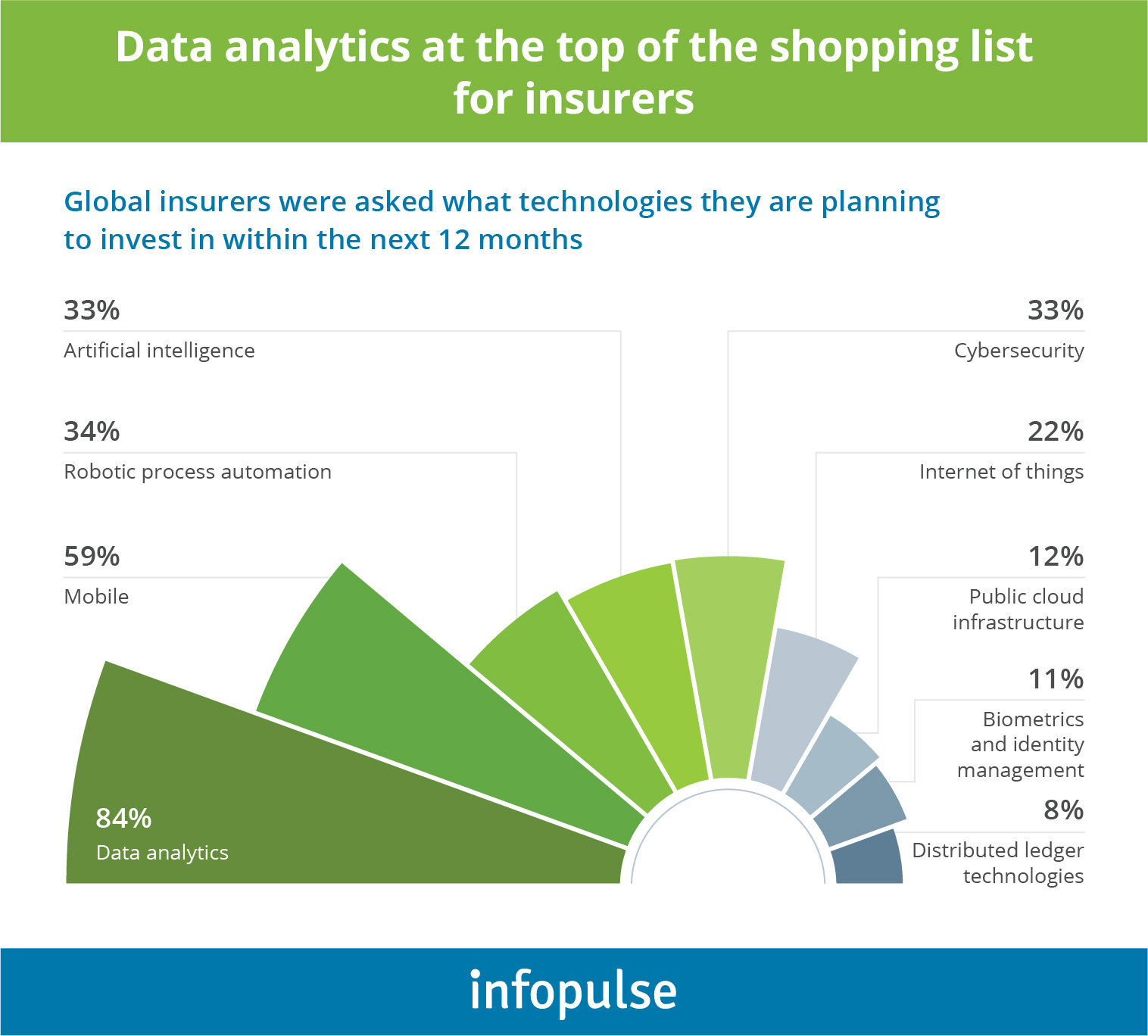

By analyzing structured and unstructured datasets, insurers get accurate insights that arm them with powerful and accurate forecasts of future consumer behavior. No wonder data analytics is at the top of the list for insurers.

Fueled by big data, predictive analytics helps insurers change their approach to policyholders. Instead of calculating risks based on historical data, they can help policyholders reduce their risks in real-time. Take car accidents, insurers can leverage telematics and predictive analytics for risk mitigation by providing timely and specific feedback to reward driver’s safe behavior and warn them of risky actions. Lower risks for drivers mean lower risks for insurers.

RPA and Artificial Intelligence

Robotic process automation and artificial intelligence both have a strong impact on finance banking and insurance. RPA captures manual steps employees take and replicates them. Effective use of RPA allows for a high level of process automation in various insurance procedures and processes.

Using RPA in underwriting can streamline the following processes:

- Gathering data from different sources for further risk assessment associated with any insurance policy.

- Checking if a policy applicant has been previously insured.

- Accessing public databases for evidence of arrests, charges, and convictions that might pose risks to the insurer.

- Populating information based on the insurance history into the insurers’ internal system.

- Searching available databases for claims a customer filed with previous carriers or agents.

- Providing policy applicants with insurance quotes.

- Assisting in contract issuing by auto-populating specified fields.

Sadly, according to Accenture, the majority of executives perceive AI both beneficial and intimidating. At the same time, 77% of insurance executives agree that AI is advancing faster than their organization’s pace of adoption.

In underwriting and risk scoring, AI provides insurers with deeply personalized insights. Calculating risk on an individual basis rather than dealing with data generalized for various groups of people will give better underwriting results. Moreover, AI algorithms are less prone to errors than humans and much faster. AI can even help insurers improve customer experience: thanks to automation and better data insights, customers can count on a shorter time span to receive their coverage decision.

Blockchain

The blockchain in insurance market will grow to $1,393.8 million by 2023. To achieve such a result, market players expect to see InsurTech solutions manifesting in smart contracts and distributed ledgers, featuring a combination of blockchain and IoT, big data, and AI. Blockchain can assist in underwriting and risk scoring mechanisms by:

- Providing transparent and explicit information on the existing or previous insurance policies or claims.

- Establishing industry standards by using the distributed ledger, which will eliminate ambiguity in data format, processes, and standards.

- Streamlining cooperation between insurers and policyholders, providing better user experience for the latter through the shared interface.

- Ensuring a high level of personal data protection due to the advanced approach to cryptography.

- Providing effective mechanisms against fraud and human input errors.

The Bottom Line

When the insurance industry’s aspirations are backed by IoT, the cloud, AI, blockchain, and big data, we can all expect dizzying changes brought by InsurTech. Are you keeping up with the pace of technology?

Infopulse offers R&D, consulting, audit services, as well as IT strategy implementation, and optimization of internal business processes across the insurance sector. Contact us to extend your development capabilities, set up IT processes, or implement a specific technology for your insurance or finance project.

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![Generative AI and Power BI [thumbnail]](/uploads/media/thumbnail-280x222-generative-AI-and-Power-BI-a-powerful.webp)

![AI for Risk Assessment in Insurance [thumbnail]](/uploads/media/aI-enabled-risk-assessment_280x222.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![5G Network Holes [Thumbnail]](/uploads/media/280x222-how-to-detect-and-predict-5g-network-coverage-holes.webp)

![How to Reduce Churn in Telecom [thumbnail]](/uploads/media/thumbnail-280x222-how-to-reduce-churn-in-telecom-6-practical-strategies-for-telco-managers.webp)

![Automated Machine Data Collection for Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-how-to-set-up-automated-machine-data-collection-for-manufacturing.webp)

![Money20/20 Key Points [thumbnail]](/uploads/media/thumbnail-280x222-humanizing-the-fintech-industry-money-20-20-takeaways.webp)