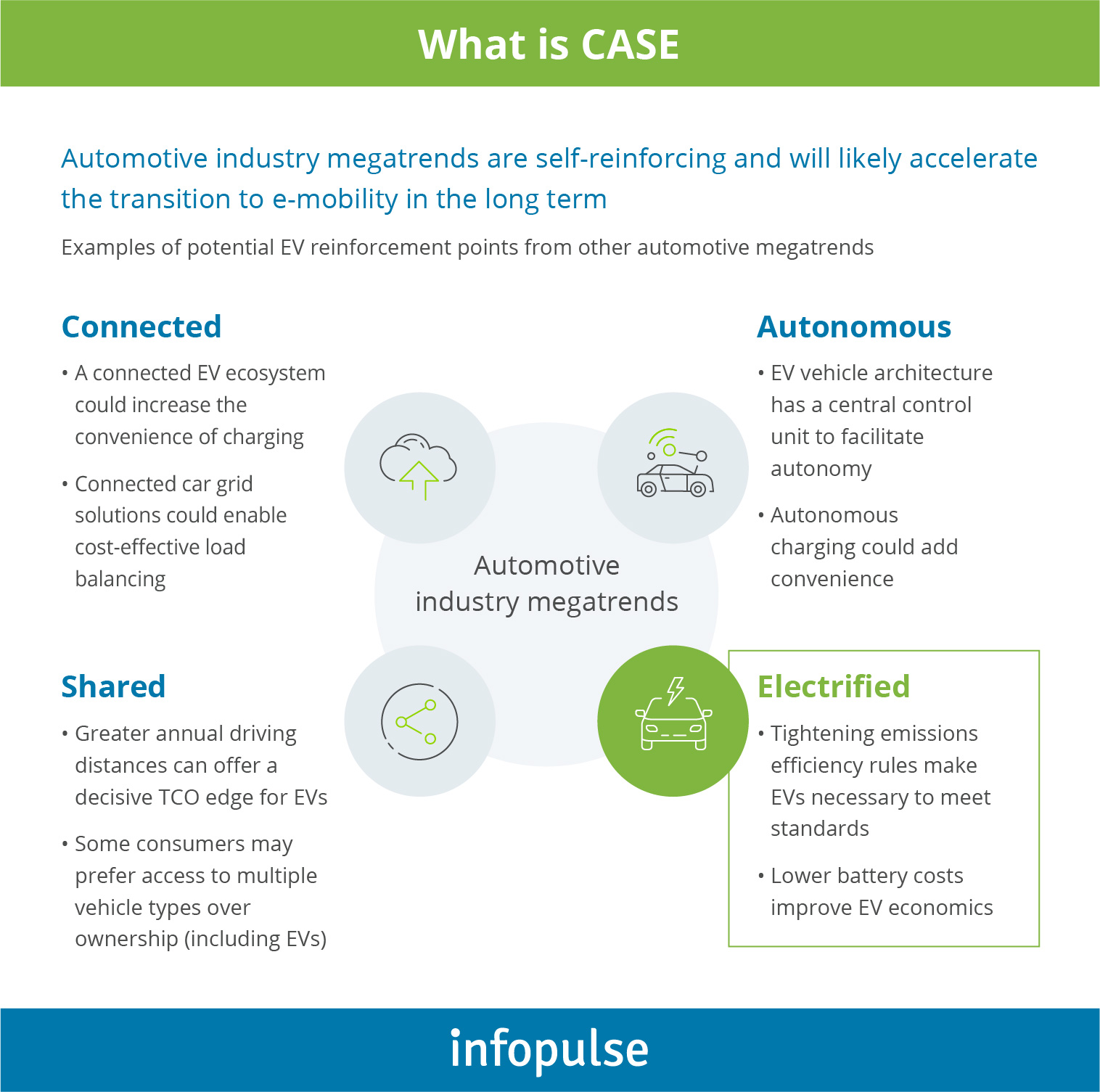

Why Automotive Leaders Cannot Ignore the CASE Megatrend

In this post, we provide an overview of how each of these technologies is directly tied to additional revenues and why investing in them today is integral to remaining competitive and profitable in the next decade.

Connected Cars: New Monetization Opportunities and Business Models

A connected car is a passenger vehicle with an embedded Internet connection, powered by WLAN or 5G (4G) connectivity, with a proprietary Telematics Control Unit (TCU) hardware processing all the data exchanges.

A connected car is a passenger vehicle with an embedded Internet connection, powered by WLAN or 5G (4G) connectivity, with a proprietary Telematics Control Unit (TCU) hardware processing all the data exchanges.

Such connectivity setup enables the in-car support for a broader range of functions and features such as:

- OTA updates – over-the-air software and hardware updates installation.

- V2X communication – the ability to interact with other IoT-equipped road users and infrastructure.

- Advanced navigation including real-time updates for road, weather conditions and AR-powered navigation.

- New-gen infotainment – intelligent personalization, in-car payments and commerce, smart parking and additional value-added services.

- Remote diagnostics and predictive servicing/maintenance.

- Pay-per-use and personalized insurance.

The new segments of connected cars, such as those released by Porsche, Audi, BMW, Volvo, and Mercedes Benz, among others, delight drivers and passengers with a new level of comfort, safety and security; and that directly reflects in OEMs revenues.

According to Adobe “Future of Driving” report 2019:

- Since January 2019, pages providing connected car information on OEM’s websites had 35% more visits versus a 5% increase for non-connected car pages.

- Also, connected car sale pages now contribute 12% more traffic to the manufacturers’ websites than at the beginning of 2019.

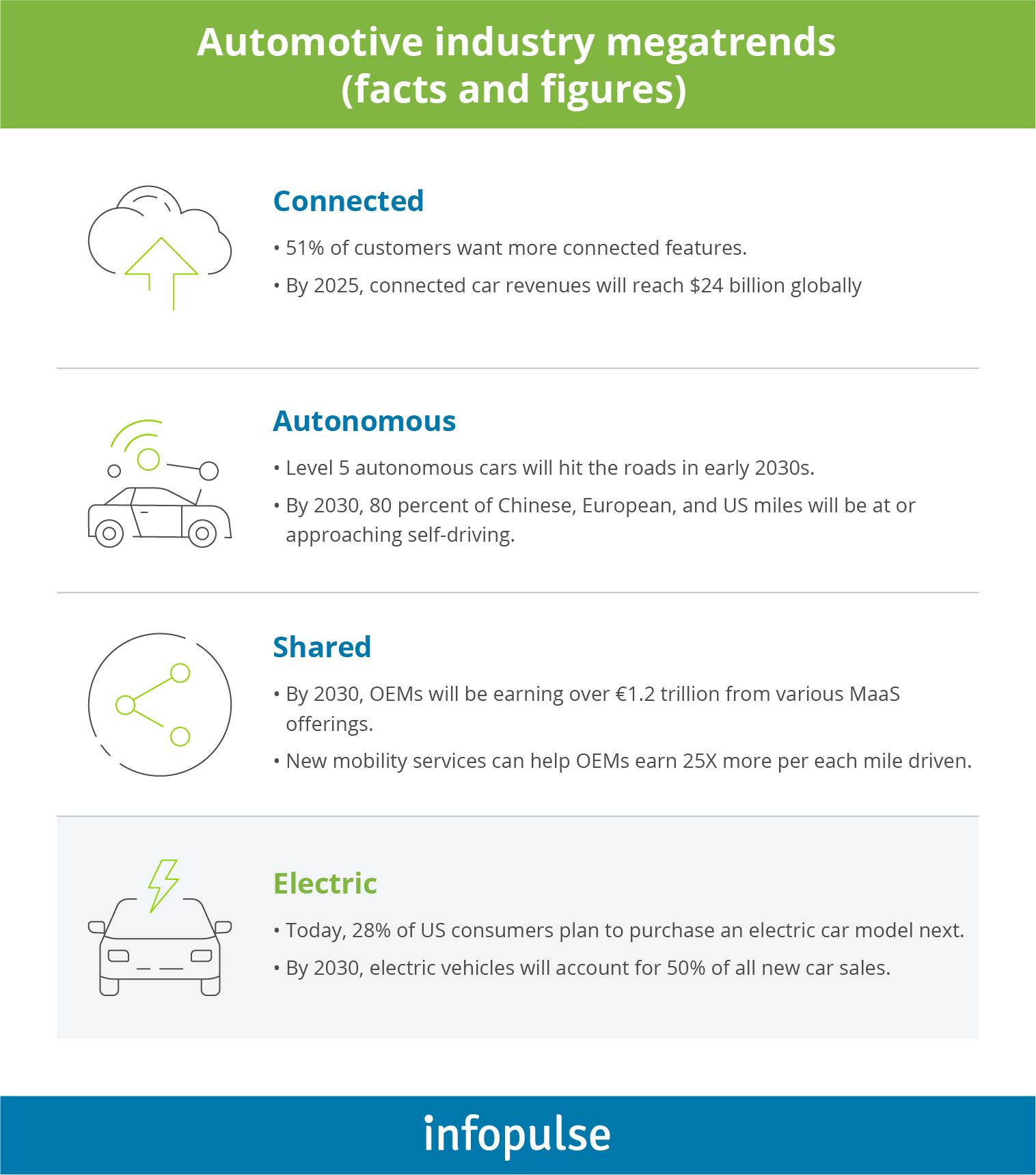

- Lastly, 51% directly said that they want more connected car features in their vehicles to spend less time on the smartphone behind the wheel.

Deloitte 2019 Automotive Consumer survey further elaborates what exactly modern car owners want:

- Real-time traffic and congestion updates; suggested alternative routes;

- Updates to improve road safety and avoid collisions (e.g., regarding severe weather conditions);

- Customized vehicle insurance plan;

- Maintenance updates, vehicle health reporting and maintenance costs forecasts;

- Access to nearby parking including availability, booking, and payments.

Leaders in the connectivity space are already seeing returns on their investment in better connectivity in the form of additional revenues and higher profit margins. Specifically, the OEMs are testing out the following connected car data monetization options:

- Mobile, in-dashboard commerce: GM Marketplace.

- Mobility-as-a-Service (MaaS) offerings: ShareNow by BMW & Damier; Audi on Demand, M by Volvo.

- Usage-based insurance: TIMS by Toyota.

Beyond that, automotives are looking into geo-location advertising, new-gen infotainment and personal health monitoring as additional value-added services for drivers. Ultimately, Counterpoint research estimates that connected car revenues will increase five-fold between 2020 and 2025, reaching $24 billion worldwide. The majority (58%) of profits will come from new connected services.

Some other data can be seen in our infographics below:

Autonomous: From Semi-Autonomous to Level 5 Driverless Experience

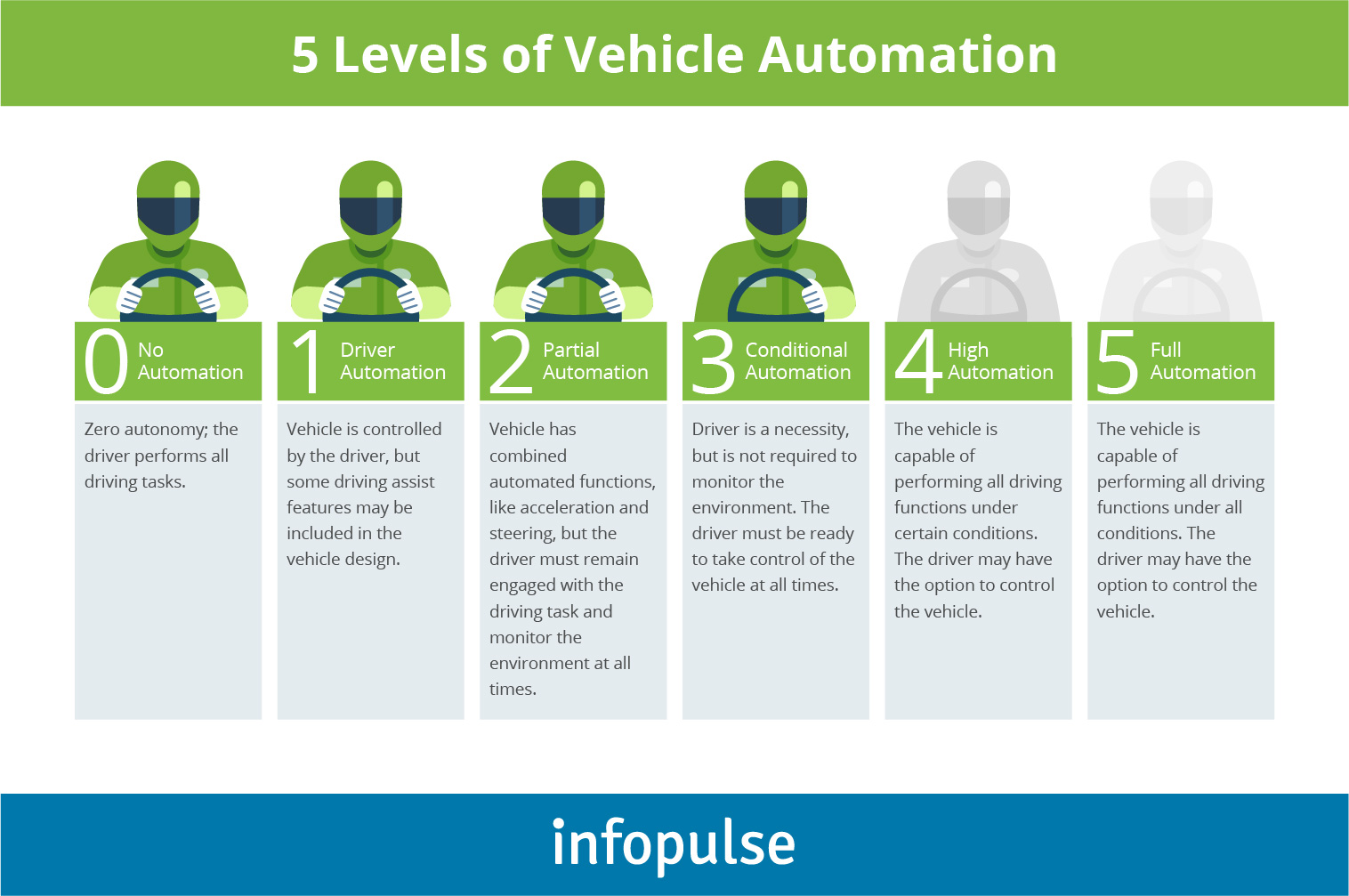

Here’s a brief recap of what is an autonomous vehicle:

An autonomous vehicle (Level 5) is a vehicle that can drive itself to a predefined destination without any direct involvement from the driver. The “autopilot” mode is powered by several in-vehicle software and hardware components such as IoT sensors, adaptive cruise control, steer by wire and brake by wire systems, GPS navigations, radars or LiDARs, computer vision algorithms, and advanced machine learning algorithms (such as neural networks).

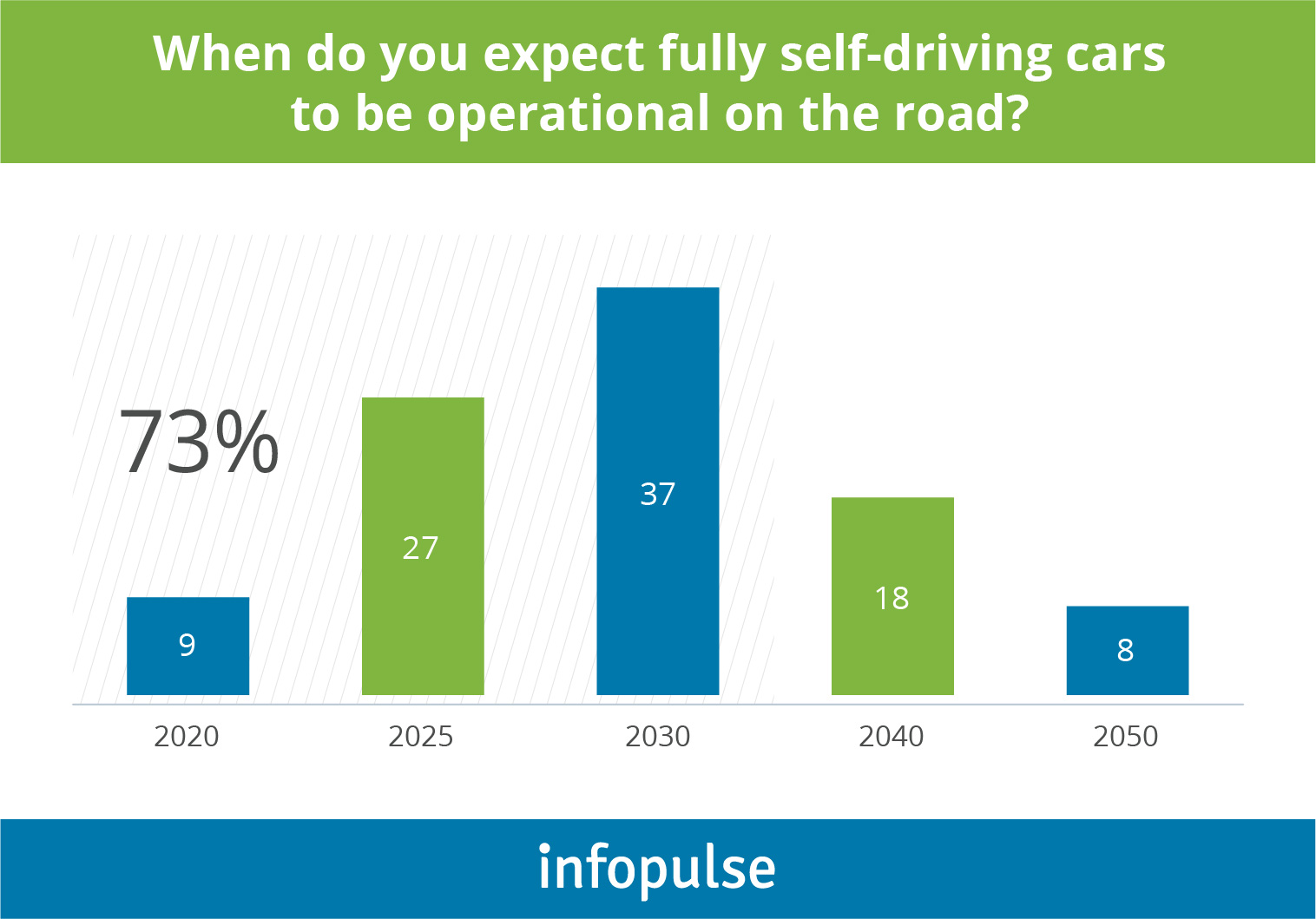

At present, most market-ready self-driving solutions (such as Ford’s Co-Pilot 360, Tesla’s Autopilot, and GM’s Super Cruise) offer Level 2 automation. The mass transition to full autonomy will likely happen in the early 2030s:

Today, consumers already have a fair share of excitement for autonomous vehicle technology, according to the Adobe survey:

- 40% of drivers are looking forward to self-driving cars (Level 5 autonomy) becoming available for purchase.

- 46% said the availability of self-driving functions, such as lane assist/parking assist, affected their buying decision.

OEMs and regulators, however, share a more cautious sentiment regarding the mass-adoption of self-driving cars. KPMG survey indicates that 71% of execs believe that autonomous and non-autonomous vehicles (unless separated on the roads) will create severe safety hazards.

Before self-driving cars hit the road in the 2030s, the driving ecosystem will need to undergo an array of transformations:

- Urban infrastructure will have to be prepared for autonomous vehicles. Urban planners will need to create separate lanes, charging stations and new traffic rules/regulations to accommodate driverless units. The most progressive OEMs are already negotiating deals and trials with authorities, prompting a wider adoption of C-V2X technology as the main standard for connectivity and sensor data exchanges between vehicles and connected objects.

- Define areas of utilization for autonomous vehicles. Both OEM leaders (84%) and consumers (74%), surveyed by KPMG, agree that “autonomous is a question of utilization”. Meaning that self-driving cars won’t be able to take over the entire country immediately, but rather organically coexist with other modes of transportation for both goods and services, fulfilling certain needs.

Toyota, for instance, plans to test this concept in action during the Tokyo Olympic Games 2020. The OEM plans to deploy its Level 4 self-driving electric vehicle fleet to drive people around the Olympic village.

A few years ago, Ford hosted a trial self-driving pizza delivery with Domino’s along with a series of other demos, illustrating how their autonomous vehicles will function. While, Renault is running late-stage trials for its purpose-built electric, autonomous, shared vehicle model – Renault EZ-GO – that is planned to become part of their car-sharing fleet in several years.

In fact, autonomous carsharing and MaaS (mobility-as-a-service) offerings will generate a significant share of revenues during the early stages of autonomous rollout. First of all, the operational costs decrease as you no longer need to pay any driver’s salaries or have people rerouting shared vehicles to the requested parking space and/or back to the garage for maintenance (the car can drive itself).

KPMG estimated that half of the cost of hiring an on-demand private vehicle relates to the driver and their availability. Connected autonomous vehicles provisioning is cheaper to orchestrate and such fleets are less expensive to run (as an OEM) and use (as a customer). The same survey says that autonomous MaaS services can end up being 40% cheaper than private car ownership. With declining car ownership, OEMs, who ignore the MaaS space, become at risk of losing their customer bases to savvier tech players (Uber, Lyft, Alphabet).

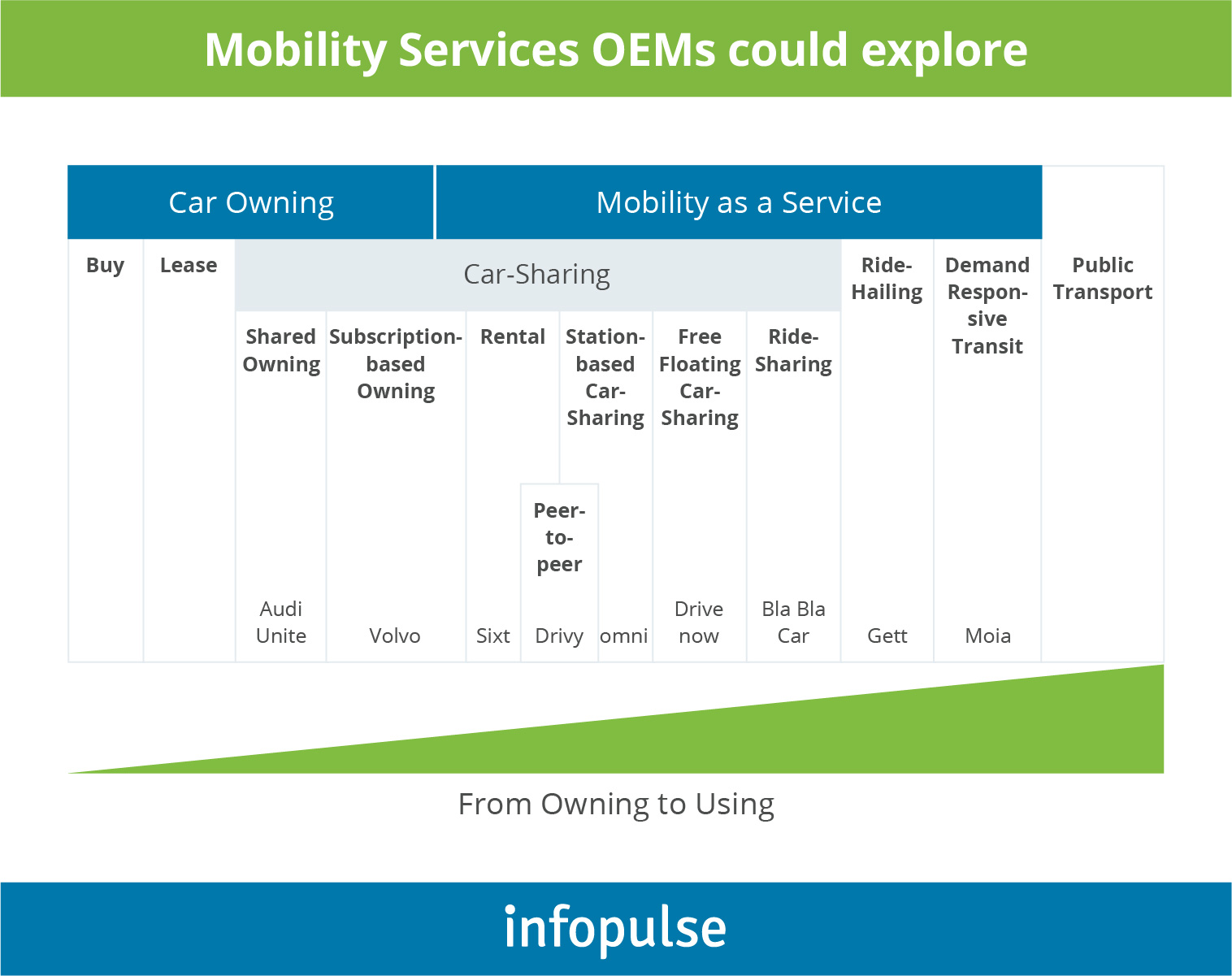

Shared and “Servicetized” Vehicles Will Create New Revenue Streams for OEMs

BCG group predicts that by 2030, as much as 25% of all the miles driven in the US will be in shared electric self-driving vehicles that will come to replace traditional cars starting from the late 2020s.

At present, the shared mobility sector is already cutting into OEMs revenues, as more and more consumers in established markets give preference to “renting” versus “ownership”.

- Germany had 2.46 million registered car sharing users in 2018.

- In France, 90% of the 1+ million users car-sharing market is dominated by peer-to-peer ridesharing providers.

- The US car-sharing market (worth $23 billion in 2019) has 18 stationary car-sharing operators, 7 P2P companies, 8 free-floating services providers, and an array of ride-hailing options.

Beyond that, the US has become a hotbed for CASE innovations. Between 2014 and 2018, the investment levels in CASE tech increased sevenfold, signifying that different players are gearing up their forces to enter the new era of mobility and unlock additional revenues.

Accenture estimates that by 2030, new mobility services will be generating over €1.2 trillion in revenue for OEMs.

Greater connectivity, autonomy, and electrification are key enablers for this brand new era of MaaS and “servicetized” offerings from automakers.

- ShareNow, a joint car-sharing offering launched by BMW and Daimler, already has over 4 million registered users. In the next several years, the OEMs will spend $1.13 billion on additional mobility offerings, spanning over autonomous vehicles, ride-hailing, e-scooters, car-sharing, and electric car charging.

- MOIA, an electric ride-hailing service, operated by Volkswagen in several German cities, has an estimated revenue of $4.7 million annually.

- Renault Mobility offering incorporates several ride-hailing and ride-sharing apps, a car-sharing program and short-term rental options. The OEM already has several electric ZOE’s models in their ride-sharing fleet, running late-stage trials for the EZ-POD concept – a 2-seat, Level 4 e-vehicle designed for first mile/last mile journeys, and for the ZOE Cab – a fully autonomous vehicle developed specifically for car sharing.

With “peak car” just a decade ahead and consumers’ changing attitude to ownerships, smart OEMs are heavily exploring alternative revenue streams – such as free-floating car sharing services, subscription car rental programs, joint multi-modal journey offerings, delivered in partnership with other mobility companies (private and government). When played out right, such diversification can help OEMs make 10X-to-25X more profit per each mile driven to compensate for declining sales.

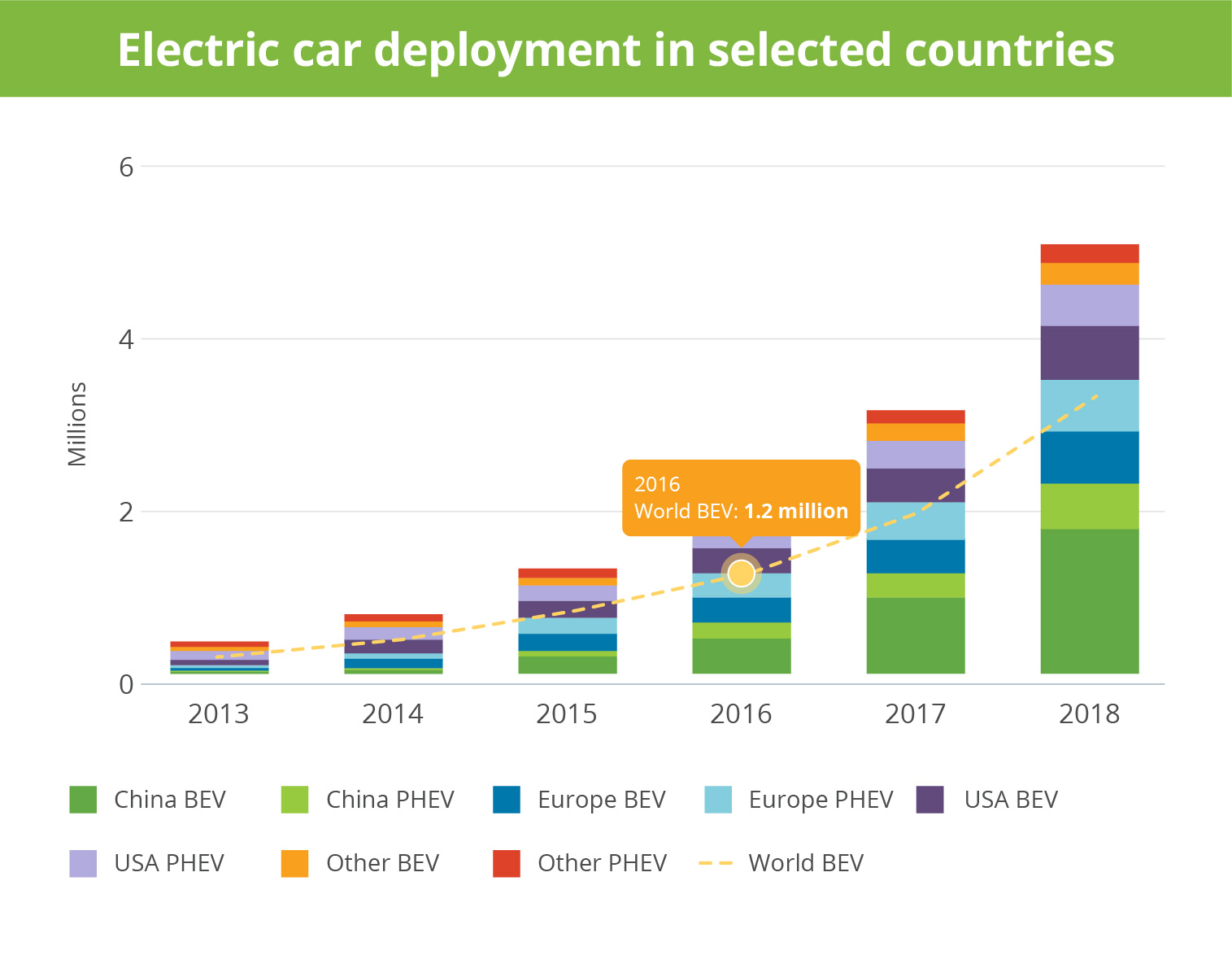

Electrification – Lower Costs, Higher Customer Support

On a global scale, EV battery costs can be reduced to as low as $150-$200 per kilowatt-hour, putting electric vehicles within the same price range as traditional cars. Electric vehicle charging stations are also multiplying in numbers as EV OEMs strike new partnerships deals with other businesses and governments.

Lastly, the so-called “green policies” make e-car ownership even more attractive to consumers. Many countries offer competitive tax credits to owners, along with other perks. In 2019, roughly 50% of consumers in the US said they’d be interested in owning an EV someday, while 28% plan to purchase an electric car model next.

Beyond the direct purchase interest, consumers are also largely favoring electric car-sharing services. In fact, 35% don’t mind paying extra for a ride in an EV. Adding more electric vehicles to a car-sharing/ride-sharing fleet also makes sense for another economic reason: EVs usually have 20-40% lower maintenance costs over 5 years when compared to traditional cars.

Getting on the CASE Trend

Within the next decade, tech investments will determine which OEMs will remain among the market leaders and thrive in the new landscape of shared mobility, multimodal journeys, and autonomous applications.

Become one of those leaders with Infopulse automotive expertise and our help in CASE megatrends adoption. Contact us today to tap into a number of opportunities with an ASPICE v2.5 certified IT provider.

![Power Apps Licensing Guide [thumbnail]](/uploads/media/thumbnail-280x222-power-apps-licensing-guide.webp)

![How to Build Enterprise Software Systems [thumbnail]](/uploads/media/thumbnail-280x222-how-to-build-enterprise-software-systems.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![ServiceNow and Third-Party Integrations [thumbnail]](/uploads/media/thumbnail-280x222-how-to-integrate-service-now-and-third-party-systems.webp)

![Cloud Native vs. Cloud Agnostic [thumbnail]](/uploads/media/thumbnail-280x222-cloud-agnostic-vs-cloud-native-architecture-which-approach-to-choose.webp)

![DevOps Adoption Challenges [thumbnail]](/uploads/media/thumbnail-280x222-7-devops-challenges-for-efficient-adoption.webp)

![White-label Mobile Banking App [Thumbnail]](/uploads/media/thumbnail-280x222-white-label-mobile-banking-application.webp)

![Mortgages Module Flexcube [Thumbnail]](/uploads/media/thumbnail-280x222-Secrets-of-setting-up-a-mortgage-module-in-Oracle-FlexCube.webp)

![Challenges in Fine-Tuning Computer Vision Models [thumbnail]](/uploads/media/thumbnail-280x222-7-common-pitfalls-of-fine-tuning-computer-vision-models.jpg)