How to Shift from Offline To Online Commerce: a Guide for Retailers

In this post, we offer a streamlined framework for retailers, ready to reinvent their traditional operations and seize the growing opportunities in the e-commerce space.

Ramp Up Your Data Management Capabilities and Supporting IT Iinfrastructure

The shift from offline to online commerce is impossible to execute without a strong cloud infrastructure to support your operations. Despite the overall retail sector slowdown, online commerce growth surged during the lockdown period – the US e-commerce market increased by 49% in April 2020, compared to early March 2020.

To support and further capitalize on the customers’ growing affinity towards online commerce, retailers need to prioritize investment in legacy systems modernization, especially when it comes to data management, analytics, and storage. The key initiatives to focus on right now are as follows:

Enable Cloud Autoscaling for Your Website

Few retailers (especially in the grocery sector) were technically prepared to meet the surged traffic load on the websites. Since January 2020, the retail website traffic has increased by about 5%. However, considering that the retail category already attracts 14 billion monthly visitors from around the globe, a 1,5 billion increase in visits is rather significant.

In fact, few businesses were prepared to cater to that surged demand. Ocado, a popular British supermarket, experienced several websites and mobile app crashes due to huge customer demand as first shelter-in-place orders were issued. Uniqlo Japan is still dealing with regular website outages as consumers line up to purchase new washable masks from the brand. Lagging infrastructure and occasional website crashes cause significant reputational damage. What’s more problematic though is that misconfigured and unoptimized infrastructure, without proper attention, can eventually fail in the most sub-optimal time. As estimated by IDC, ‘big ticket’ infrastructure failures can cost enterprises up to $100,000 per hour (ouch!).

The bottom line: don’t let your digital infrastructure deteriorate due to negligence. To prevent that, practice the following:

- Setup cloud load balancing and traffic balancing for your website

- Enable and configure cloud autoscaling

- Consider cloud-based disaster recovery (DR) for faster failovers

- Migrate to a better-suited e-commerce platform with more robust functionality

Upgrade Your ERP Systems

The best ERP systems today are cloud-based as they offer on-demand access to an array of new features, virtually unlimited data storage, and seamless collaboration capabilities. If your goal is to go from offline to online, you’d have to move your entire supporting operations in the cloud too, especially if you are planning to expand cross-border anytime soon.

Infopulse recently helped one retailer set up new SAP ERP systems in the cloud. As a result, the company majorly improved its remote productivity, especially in terms of financial management, compliance, and document flow.

Real-Time BI and Intelligent Analytics

From product recommendations to payments security, and supply chain management, real-time BI and predictive analytics are revitalizing the retail operations in the new markets. Companies that managed to identify emerging customer trends (and more importantly – distinguish between short-term changes in behavior and long-lasting implications of the pandemic) are now seeing the most significant returns on their analytics investment.

Walmart’s US, for instance, recognized early on that they wouldn’t be able to meet the surged demand for goods alone. Therefore, they took the strategic decision of creating an Amazon-style virtual marketplace and onboarding new sellers. Doing so allowed Walmart to increase the volume of SKUs available online and subsequently boost their e-commerce sales by 74% in Q1 2020.

24×7 Infrastructure Monitoring

With a growing array of infrastructure monitoring tools on the market, it’s somewhat surprising that most retailers still don’t have complete visibility into their digital operations, and worse – cannot identify the onset of potential trouble.

To ensure further business continuity (and prevent costly downtime) prioritize investment in 24/7 infrastructure monitoring, covering servers, networks, applications, and databases hosted both on the cloud and locally. Moreover, revisit your Service Desk practices as these may require a ‘refresh’ if most employees of your company recently switched to remote work.

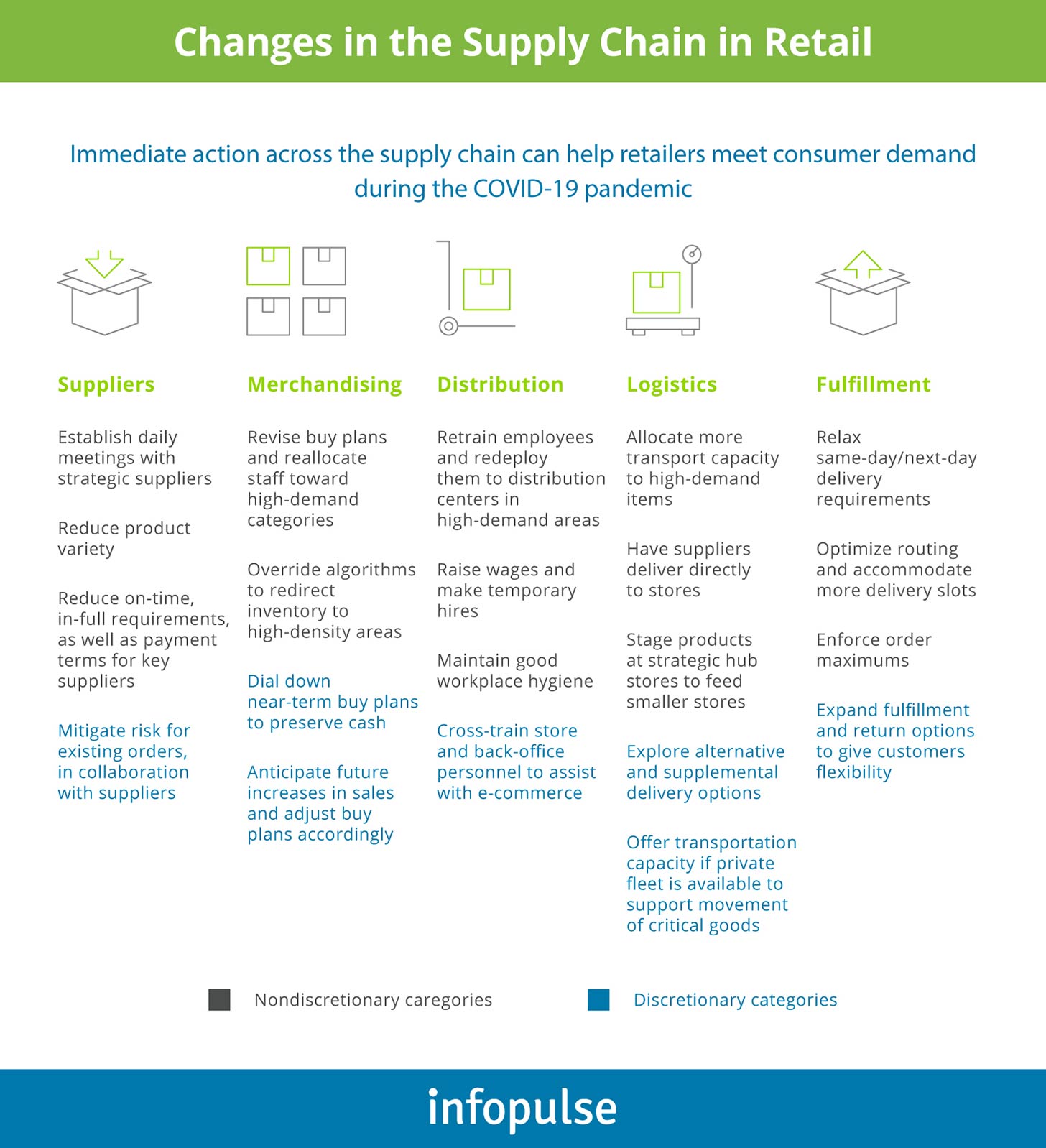

Re-Assess Your Approach to Logistics and Distribution

Saying that most supply chains were hit hard during COVID-19 is a bit of an understatement. 163 of the Fortune 1000 had Tier 1 suppliers in the Wuhan area, and 938 had one or more Tier 2 suppliers in this same impacted region. Even those retailers who had no direct links to China experienced the bullwhip effect within their supply chain due to unexpected plant closures and goods shortages.

For online commerce, such disruptions in supply were crucial as retailers were forced to limit stock, or, on the contrary, give away deadstock for next-to-nothing, issue refunds for unavailable inventory, and otherwise woo consumers to address their disappointment concerning the extended delivery times or the unavailability of goods.

If you’d like to orchestrate a ‘clean start’ into e-commerce in the second quarter of 2020, consider incorporating the following best practices to your supply chain management:

In addition:

- Prioritize the digitalization of your supply chain to ensure better visibility into all operations and have a real-time rapport with all ecosystem partners.

- Consider implementing AI-driven demand forecasting to avoid holding too much or too little inventory as the demand for various goods remains volatile.

- Re-consider your distribution and delivery models – join forces with other businesses to run joint-deliveries; introduce new in-store pick-up options for digitally purchased goods (curbside pickup, drive-up pickup, and same-day deliveries).

Refine Your Digital Customer Experience (CX)

The previously reluctant online shoppers got ‘sold’ on e-commerce during the lockdown period much due to the reduced spending in other categories such as childcare, travel, transportation, and so on. According to WWD, 56% of customers purchased groceries and healthcare items online for the first time this year. Another consumer survey found that 64% of US shoppers are prioritizing name-brands over generics right now, specifically when it comes to packaged foods, frozen food, and drinks.

McKinsey’s latest consumer survey data indicates a strong intent to shop more online across various categories in the following countries: US, India, South Korea, and Japan, with Europe and Latin America showing slightly less affinity. Notably, in the US higher-income Millennial and Gen Z consumers are pushing the trend further.

In China, consumers also opt for an array of online commerce solutions – websites, super apps, and even live streams – despite mass re-openings. Analysts predict that Chinese online retail spending will further increase by 16% to around $2 trillion by the end of 2020.

The early industry prognosis indicates that a good fraction of offline transactions can permanently migrate to online. What’s even more important is that most consumers will expect the same (if not better) online shopping experience as they had in-store. Brands are taking different steps to deliver just that:

Social commerce streams: Asian consumers have developed a strong affinity to ‘group commerce’ and shopping live streams during the pandemic. This tendency remained strong post-reopenings. JD.com – one of China’s largest e-commerce platforms – hosted regular celebrity-led online stream campaigns for both local and foreign brands, present on the platform. One Canadian luxury retailer decided to jump on the trend and managed to generate over $1.4 million in sales during the 9-hour live stream. Taobao, another popular B2C e-commerce platform in China, also allows shop owners to host regular live streams, and so does WeChat.

The western world may want to take this cue as live streaming can effectively replace (and scale) the in-store experience consumers used to have with a sales assistant.

Chatbots: Product questions are inevitable. Resolving them on the spot is key to selling more online. That’s why e-commerce was among the first industries to mass-adopt chatbots, especially for product after-service. As the conversational AI technology gets more mature, chatbots are now sent to deal with more advanced chores:

- Pitch personalized product upsells/cross-sells to customers

- Curate recommended products’, based on the customers’ past shopping history

- Assist with product selection and product search

Last year, Juniper Research predicted that such sales-focused chatbots can drive an extra $112 billion in retail sales by 2023.

Beyond doing the ‘shop talk’, AI-powered chatbots have also become trusted assistants to customer service departments, augmenting agents’ abilities to lead personalized conversations with multiple customers at a time. Gartner indicates that by 2025, companies using AI-powered virtual assistants will improve their operational efficiency by 25%.

VR and AR: Retailers already made a cautious foray into AR/VR technologies in the late 2010s. IKEA brought an AR house decor app to the market. Decathlon launched an in-store VR app for assembling a tent.

However, few use cases moved from the industry margin to the mainstream. The global pandemic may revitalize the retailers interested in creating fully immense shopping experiences for consumers. As consumer spending on VR/AR gear is expected to increase to $7 billion by the end of 2020, retailers will have an easier time in distributing their apps and engage shoppers from the comfort of their home. Nike pioneered a computer-vision based virtual try-on app for shoe pre-pandemic. Nike Fit captures 13 data points regarding the person’s foot and suggests how different Nike shoe styles will fit. Customer data is saved for further reference during offline and online shopping.

To Conclude

The road to full recovery will be a long and challenging one for the retail industry as consumers’ discretionary spending dipped. However, one thing is certain: digital channels will keep playing an increased operational role. Even post-store reopenings, the majority of consumers still favor online shopping over brick and mortar locations. To thrive, you’ll need to place great emphasis on the online realm and adapt your infrastructure accordingly.

Online commerce software, cloud storage options, or advanced analytics implementation, Infopulse team would be delighted to further advise retailers on the right course of action! Contact the author of this post and our ecommerce solutions expert today!

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![How to Build Enterprise Software Systems [thumbnail]](/uploads/media/thumbnail-280x222-how-to-build-enterprise-software-systems.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![5G Network Holes [Thumbnail]](/uploads/media/280x222-how-to-detect-and-predict-5g-network-coverage-holes.webp)

![How to Reduce Churn in Telecom [thumbnail]](/uploads/media/thumbnail-280x222-how-to-reduce-churn-in-telecom-6-practical-strategies-for-telco-managers.webp)

![White-label Mobile Banking App [Thumbnail]](/uploads/media/thumbnail-280x222-white-label-mobile-banking-application.webp)

![Money20/20 Key Points [thumbnail]](/uploads/media/thumbnail-280x222-humanizing-the-fintech-industry-money-20-20-takeaways.webp)

![Deepfake Detection [Thumbnail]](/uploads/media/thumbnail-280x222-what-is-deepfake-detection-in-banking-and-its-role-in-anti-money-laundering.webp)