Super Apps Review: Your Ultimate All-in-One Solution

- Banking & Fintech

- Digital Experience

- Innovations

- Digital Transformation

- Software Engineering

- Business Applications

What Is a Super App?

A super app is an all-in-one platform that integrates a wide range of services and functionalities. Within a single app, consumers can use features like texting, payments, transportation, shopping, food delivery, and even government services.

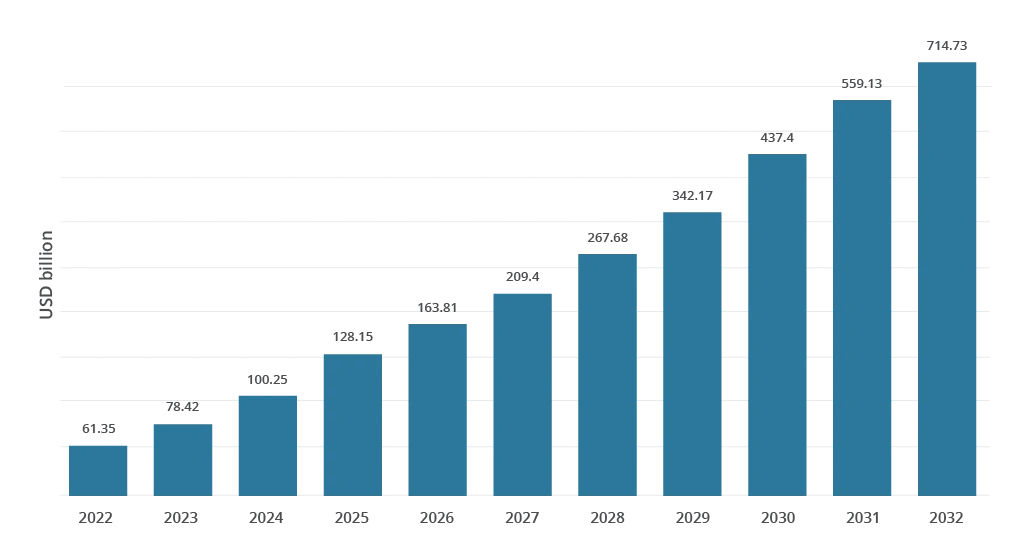

The global super apps market, valued at $61.35 billion in 2022, is anticipated to grow to a massive $714.73 billion by 2032. This expansion is supported by three major trends: increased internet access, the surge in smartphone usage in emerging economies, and the booming sectors of online commerce and digital wallets.

The term "super app" was first coined in 2010 by Mike Lazaridis, founder of BlackBerry. He envisioned it as a closed ecosystem offering a seamless, integrated, and efficient user experience.

Today, super apps are often associated with prominent Chinese examples like WeChat and Alipay. For instance, WeChat, initially a messaging app, has transformed into a platform with 3.7 million of "mini-programs" that allow users to:

- Order a taxi

- Apply for a loan

- Shop at local businesses

- Access government services

- Interact with celebrities.

Incredibly, all these transactions happen within the WeChat ecosystem, making it a true one-stop shop for users. As a result, WeChat annual revenue reached almost $16.4 billion in 2023.

Some experts say that a WeChat scenario will never be possible in the European markets. Indeed, due to the different regulatory environment and market conditions, it’s hard to imagine the exact super app scenarios that we are seeing now in the East. However, it does not mean that local players aren’t pursuing platformization and marketplace routes. The financial sector in particular is strongly gravitating toward the super app approach. The newly emerged digital banks and FinTech players are at full speed ahead into transforming their ecosystem of services into open banking marketplaces.

In Europe, examples like Revolut and N26 also embody super app characteristics. Revolut, a UK-based financial technology company, integrates banking, budgeting, cryptocurrency exchange, and stock trading services into a single app, catering to diverse financial needs seamlessly. Similarly, N26, a German neobank, offers a range of financial services through its app, including banking, budgeting tools, investment options, and international money transfers.

How Super Apps Work

Super apps operate through a combination of in-house technology and third-party integrations. Here’s a detailed look at the key mechanisms that enable their functionality:

- Centralized platform. Super apps provide a single platform for accessing various services. Users can switch between functionalities seamlessly without needing to download separate apps.

- Mini-programs. These are smaller, independent applications built within the super app ecosystem. They offer additional services from third-party providers, expanding the platform's functionality.

- Open APIs. Super apps often utilize open APIs that allow developers to create mini-programs and integrate their services with the platform.

- Unified user account. Users create a single account for the super app, which grants access to all its features and integrated services.

Super App Features: What Can You Offer Your Customers?

Super apps offer a vast array of features, depending on the specific app and region. Here are some common features that demonstrate what super apps are used for:

- Payments. Seamlessly send and receive money, pay bills (utilities, rent), and make in-store purchases using QR codes or NFC. For instance, GrabPay, a popular super app in Southeast Asia, allows users to pay for groceries, phone bills, and even movie tickets.

- Financial services. Manage bank accounts, invest in stocks or mutual funds, or apply for loans directly within the app. Some super apps offer wealth management tools and financial planning assistance. Also, 60% of respondents in Accenture's Payments Survey said they would use a single app to monitor transactions across all payment systems.

- E-commerce. Shop for a variety of products – groceries, clothes, electronics, and more – from a curated selection of vendors or the app's marketplace. JD.com, a Chinese e-commerce giant, also offers features like food delivery and financial services within its super app.

- Ride-hailing. Book taxis, bikes, scooters, or carpooling services for quick and convenient transportation. India's Ola app allows users to arrange rides, order food, and even rent bicycles, all in one place.

- Messaging. Chat with friends, family, colleagues, and even businesses directly within the app. The above-mentioned WeChat allows users to text, make voice and video calls, and connect with businesses for customer service or appointments.

- Food delivery. Order meals from your favorite restaurants or discover new ones with curated options and reviews. Meituan, another Chinese super app, is a major player in food delivery, while offering features like bike-sharing and movie ticketing.

- Travel booking. Book flights, hotels, tours, and activities directly within the app, simplifying trip planning. Many travel super apps, like Qunar in China, offer flight and hotel comparisons alongside visa applications and local activity recommendations.

- Social media. Share updates, photos, and stories, connect with friends, follow businesses or influencers — similar to Facebook or Instagram, but integrated within the super app ecosystem.

- Entertainment. Watch movies and TV shows, listen to music, or play games within the app.

- Government services. Access and pay for government services like taxes, license renewals, or appointments. Singapore's Singpass app allows citizens to access various government e-services with a single login.

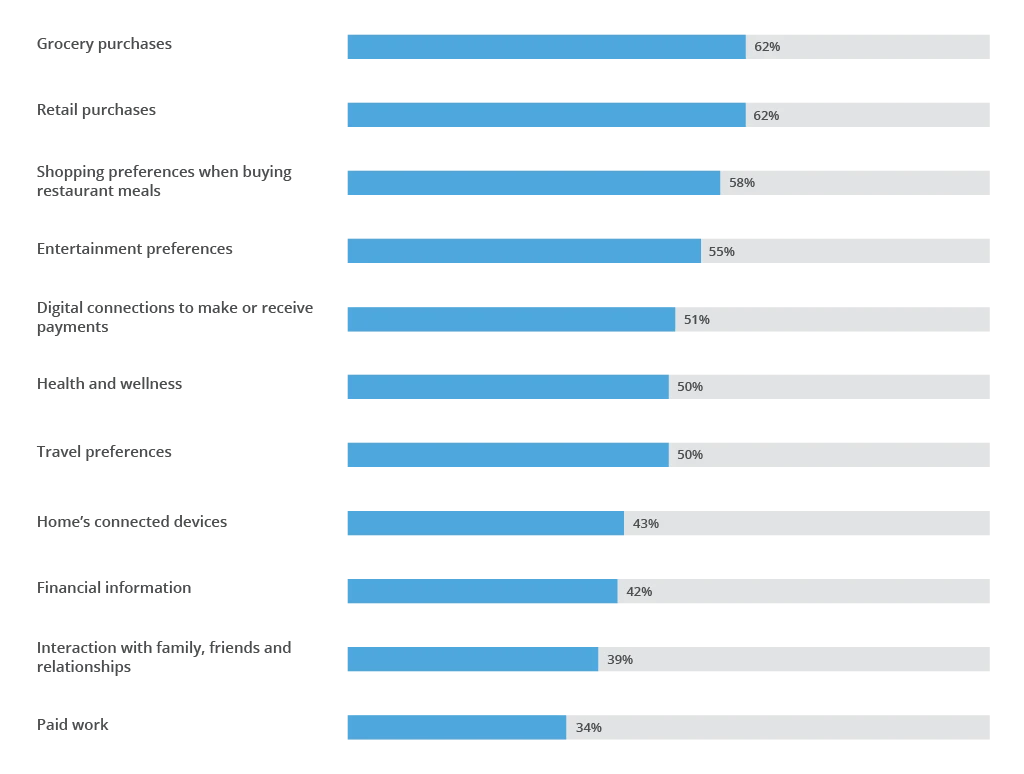

Today, surveys reveal significant worldwide consumer interest in super apps. According to a PayPal recent study, approximately 70% of consumers show interest, with about one-fourth expressing high or extreme enthusiasm for the concept of an all-in-one application. This study also highlights the areas of life where consumers would integrate super apps.

Super Apps and Banking: a Perfect Match

In established markets, banking consumers are demonstrating an increased affinity towards all-encompassing banking solutions due to a high need for products that facilitate the management of their financial ties. Let's go through the reasons why super apps and banking make an ideal combination.

Unified financial management

The demand for unified financial management tools is rising as consumers seek efficiency and simplicity. Accenture's Global Banking Consumer Study found that 32% of consumers often lose track of their financial products, with younger consumers being twice as likely to feel this way. Consequently, more than half of consumers desire an app that provides a single aggregated view of all their financial products, and 60% want a single app to track payments from all providers.

Enhanced security and trust

Super apps often employ advanced security measures, including multi-factor authentication and encryption, to safeguard user data. As consumers become increasingly concerned about data privacy and security, the robust protection offered by super apps can build greater trust and confidence in digital banking solutions. The integration of biometric authentication methods, such as fingerprint and facial recognition, further strengthens security and enhances user experience.

Personalization

Personalization is another big hallmark of super apps. By leveraging vast amounts of user data, these platforms deliver tailored recommendations and services. According to Statista, 53% of consumers express a desire for a super app to simplify and enhance their shopping experience, while 40% seek access to a broader array of products and services.

Lower costs & improved customer retention

Businesses like banks greatly benefit from integrating their services into super apps — in this way, they can access established user bases and infrastructures, which reduces mobile app development and marketing costs. Such an approach allows for quicker, less risky product launches.

Super apps also enhance user retention since they address multiple needs within a single platform, which leads to higher customer loyalty. For example, 41% of users are likely to become more active with their banking if they could do it all within a super app.

However, the convenience of super apps presents challenges. The vast amount of user data they collect — from financial transactions to personal preferences — raises significant privacy concerns. Security anxieties are also running high, with 45% of respondents expressing they are very worried about being hacked on a super app.

Another challenge involves user experience overload. While having everything in one place is convenient, a cluttered interface can be counterproductive. Super apps must focus on intuitive design to ensure a smooth, user-friendly experience. An overly complex interface can undermine the convenience these apps aim to provide.

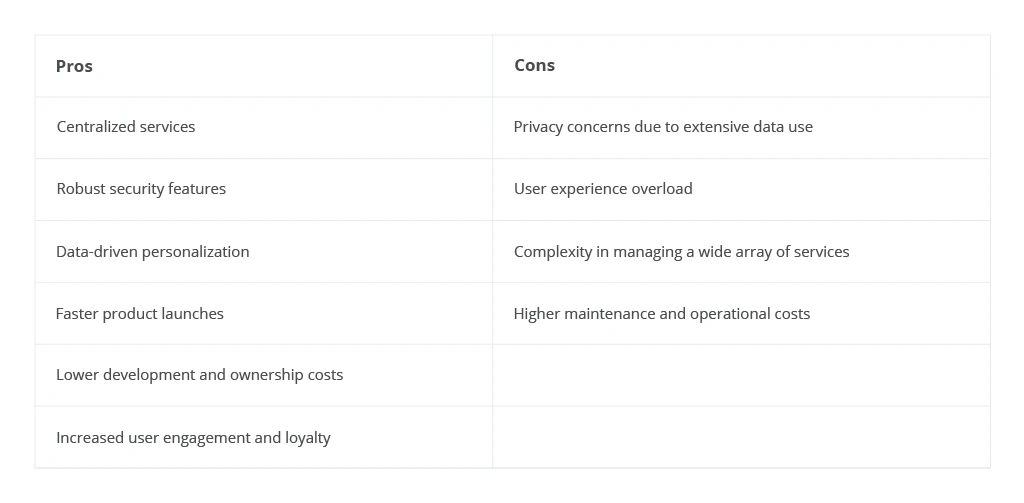

So, what's the verdict of our super app review? Let's evaluate the key advantages and potential drawbacks of super apps.

Conclusions

The trend towards super apps and marketplace approach to scaling will remain strong within the next decade. Consolidating an array of services under one brand reduces the ‘multi-homing’ effect when users try to leverage several financial services at once to secure a better deal. Customers form stronger relationships with a single provider, resulting in higher levels of satisfaction. Service providers, on the other hand, strengthen their market position and prevent external players from siphoning their customers away.

![Super Apps Review [banner]](https://www.infopulse.com/uploads/media/banner-1920x528-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![How to Build Enterprise Software Systems [thumbnail]](/uploads/media/thumbnail-280x222-how-to-build-enterprise-software-systems.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![5G Network Holes [Thumbnail]](/uploads/media/280x222-how-to-detect-and-predict-5g-network-coverage-holes.webp)

![How to Reduce Churn in Telecom [thumbnail]](/uploads/media/thumbnail-280x222-how-to-reduce-churn-in-telecom-6-practical-strategies-for-telco-managers.webp)

![White-label Mobile Banking App [Thumbnail]](/uploads/media/thumbnail-280x222-white-label-mobile-banking-application.webp)

![Money20/20 Key Points [thumbnail]](/uploads/media/thumbnail-280x222-humanizing-the-fintech-industry-money-20-20-takeaways.webp)

![Deepfake Detection [Thumbnail]](/uploads/media/thumbnail-280x222-what-is-deepfake-detection-in-banking-and-its-role-in-anti-money-laundering.webp)

![Employee Experience Platforms [thumbnail]](/uploads/media/280x222-top-3-platforms-for-improving-employee-experience.webp)