Whys and Hows of API Strategy for Banking

What Is API Strategy?

Not a new concept in corporate IT, API is an application programming interface. Initially, it was used for internal purposes to reduce the operational overhead and simplify the data exchange between inner services.

Lately, the role of APIs has been significantly expanded, allowing enterprises to implement new business models by extending the product and service lines with offerings from other vendors and providing their own products and services through outside partners.

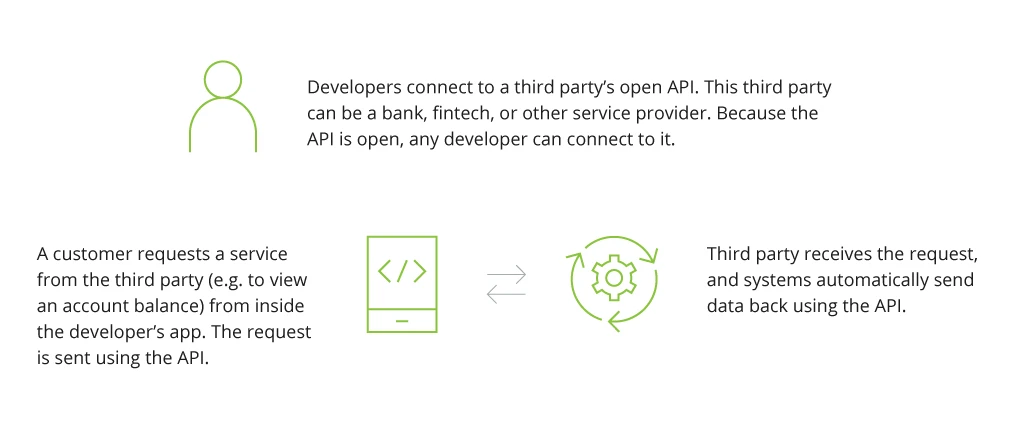

How Open API Works

Currently, APIs are widely used across all industries, and, namely, FCMG, to issue commands to third-party service providers. For example, in 2019, Banco Bilbao Vizcaya Argentaria launched its API-based Bank-as-a-Service platform. It allows third parties to offer financial products without the need to provide the complete banking services package. Recently, HSBC introduced the ‘Buy Now Pay Later’ B2B API, which helps e-commerce companies extend payment terms to their buyers and quickly process credit applications. Besides, HSBC actively develops multiple market-facing APIs. The company launched its API Developer Portal to let customers access and integrate the bank’s API solutions, use a secure testing environment, and receive the latest product documentation.

4 Pillars of a Banking API Strategy

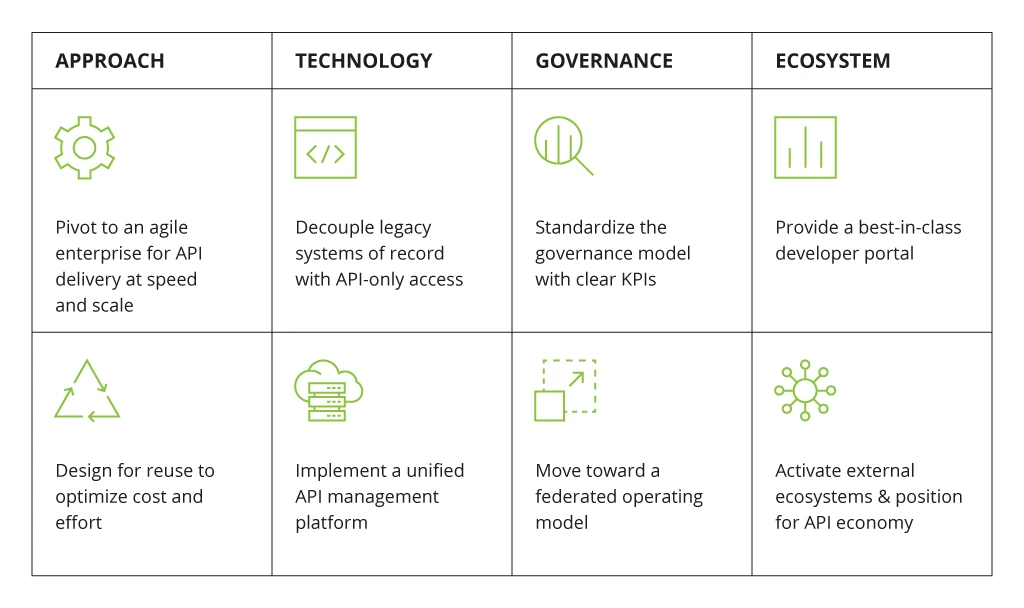

The transition to an API-led model starts with an organization-wide strategy. According to Accenture, the efficient API strategy for banks is based on four pillars:

1. Approach: transforming to an API-driven architecture requires a severe change in how IT teams conceptualize, build, and deliver financial products and services. Such transformation touches every part of the financial organization on all levels. Business stakeholders should consider APIs as a tool for building new value propositions. Thus, they need to create proper infrastructure for building APIs and integrating them with the existing services and data. Fragmented API implementation without a complex organization-wide strategy leads to the duplication of effort, increased expenses, and reduced benefits from an API-led architecture.

2. Technology: Banks should consider moving from legacy core architecture and monolithic apps to a microservice-based architecture (MSA). Within MSA, each app is a set of microservices that are developed, maintained, and updated autonomously. Microservices use APIs to communicate with one another and with external apps. Another technology aspect is using modern API management platforms to access, distribute, and control APIs. They also provide advanced functionalities for analyzing APIs performance, managing security, preventing DDOS attacks, etc. Additionally, all internal and external APIs should be well-documented and cataloged for good discoverability. It supports the culture of reuse and prevents the creation of redundant APIs working for the same purpose.

3. Governance: Quick and scalable API delivery becomes possible with a multi-tiered governance structure that includes a central team, business unit design teams, and delivery teams. Central teams are responsible for creating and managing architecture and design standards, acting as a quality gate for all APIs developed across the organization. Business unit design teams manage unit-specific developments and operational activities, ensure following the guidelines and frameworks established by the central team, and engage with the delivery team to produce a final API product. Delivery teams work on APIs’ technical implementation, maintenance, and updates.

4. Ecosystem management: To reap all the benefits from the API business strategy, the organization should think over proper API ecosystem management that includes engagement with other technology providers, the developers’ community, and monetization channels.

Before starting the implementation of the bank API strategy, you should consider the following recommendations for effective API adoption:

Banking API Strategy Implementation Steps

Benefits of the Banking API Strategy

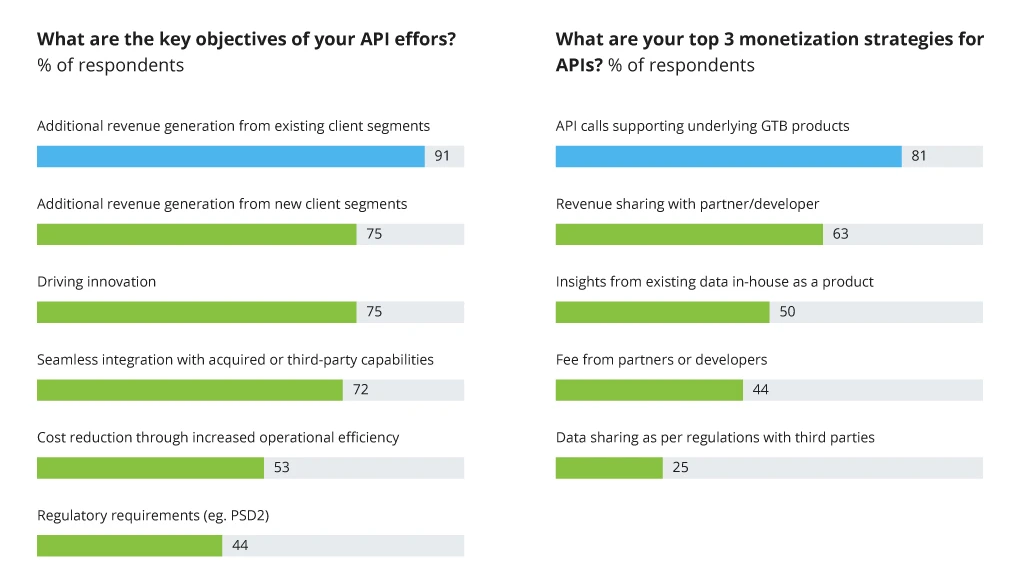

APIs have become a much broader instrument for banks than just a tech tool for software development. They are a critical strategic asset for income growth, customer experience improvements, and driving innovation. McKinsey survey shows that more than 90% of financial institutions use or plan to use APIs to generate additional revenue among the existing customers:

Top Objectives and Monetization Strategies of API Adoption

An increase in revenue is one of the main goals that can be achieved in multiple ways. Adopting an API strategy can significantly improve how banks operate and serve their customers, leading to stable revenue growth. Here is how banks benefit from the API-led approach:

- Compliance: regulatory initiatives like Payment Services Directive 2 (PSD2) and Open Banking are aimed at making banks ‘open’ to external market entities to drive innovation, generate higher value for customers, and become more secure. Implementing APIs helps comply with the latest regulations and makes it easier to adapt the bank system to any new regulatory changes. It increases profitability by avoiding unnecessary fees and fines and improving the bank's trustworthiness and customer loyalty.

- Improved digital agility: the API-based microservices approach allows making changes to specific app processes and features independently. It leads to quicker application development and faster update rollouts. If any issue arises, it can be fixed quicker, as only a small piece gets affected instead of the entire app. In addition, this approach provides higher performance stability and reduces downtime for end-users. Lastly, the API-based microservices architecture can be scaled horizontally. You gain the ability to scale up and down whenever you need, saving your money and time. This way, the organization can respond to market changes with appropriate technical solutions quicker.

- Increased customer satisfaction: the banks’ API strategy brings a broader selection of financial service integrations. As a result, customers become more satisfied and are less likely to seek alternatives, as they can cover all their needs within one financial service provider.

- Wider customer base: besides providing their users' data, banks get access to user data from other financial companies. Thus, they get an opportunity to promote their services to new audiences and extend their customer base.

- Potential for partnership: third-party financial service providers gain access to customer data in exchange for additional functionalities and dedicated support. Using APIs, the bank can expose its services to affiliates and partners to improve operational efficiency and enhance customer experience.

- Premium API products: APIs allow the creation of new revenue-generating products relatively easily. For example, Nordea, one of the largest banks in Europe, provides premium banking APIs for corporate clients to ease foreign exchange operations, enable instant reporting, etc. Singapore-based multinational DBS Bank offers its corporate customers to integrate a wide range of real-time banking services to their own platforms via DBS RAPID API solution.

- Higher competitiveness: Challenger banks, neobanks, and fintech firms provide financial services using technologies that challenge traditional banks. The API business strategy helps financial institutions adapt to this reality quicker and get new competitive advantages to conquer the market.

These benefits open new revenue streams and help generate more revenue from the existing channels. It opens vast opportunities for partnerships with other financial enterprises lowering the degree of competition. The banks can extend their product portfolios with innovative services from fintechs with no need for in-house development. The flexibility and diversity of API-driven approaches help integrate the newest technologies in a suitable way for each enterprise.

Types of API Strategies for Banks

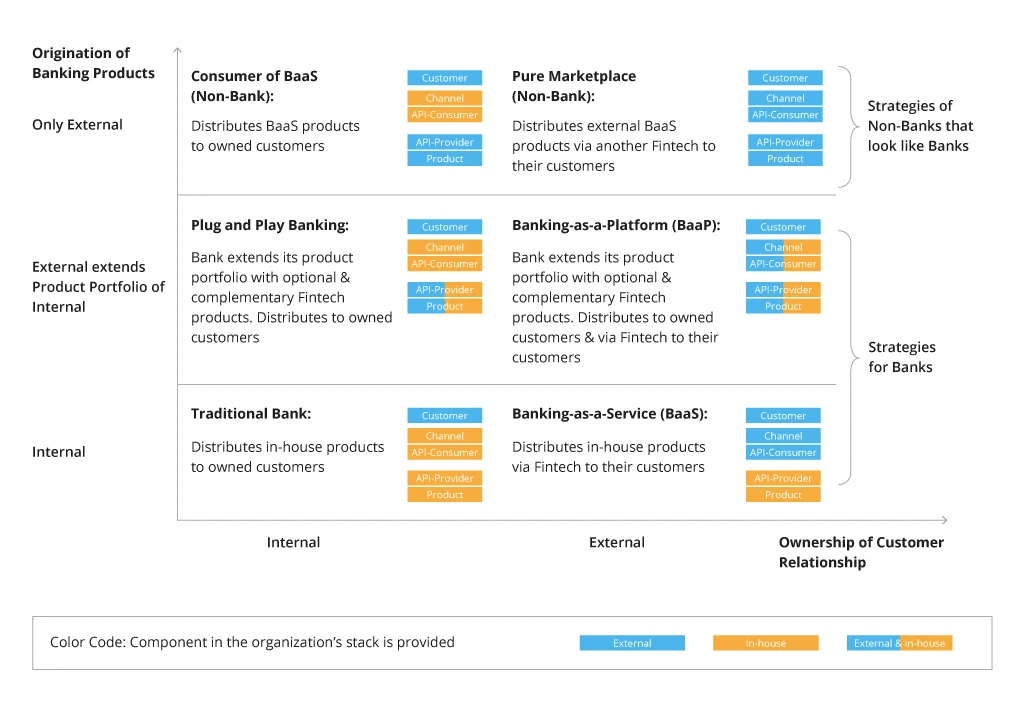

There is a bundle of API strategies banks can adopt depending on their business goals, available resources, and the desired level of control over the banking stack. The traditional three-tiered banking stack consists of:

- Product: loans, payments, accounts, and other items provided to customers.

- Channel: the mechanisms that deliver banking products to customers such as websites or mobile applications together with the marketing activity to support the promotion and distribution.

- Customer: the end-user of banking services and products.

Traditional banks produce and distribute their services on their own, which means they have complete oversight of their products and channels. Owning a channel gives banks the ability to cross-sell products from their portfolio and have complete control over the ways customers access them. Yet, such an approach often seems disadvantageous to customers. They wish for a wider choice of services, more modern mobile applications, and better personalization.

Inserting an API layer into the banking stack helps achieve these customer demands. Banks can add a channel from the outside or put a third-party product into their own portfolio. It helps extend their business capabilities, improve the customer experience, and expand to new markets. All these reconfiguring options are available through different bank API strategies. The main types are shown in the scheme below.

Strategies in an Open Banking Environment

Traditional Banks

Banks can implement APIs yet stay on the traditional track owning all segments of the digital value chain. They create internal APIs to deliver their products through their own channels, which helps them optimize specific processes, reduce costs, and deal with regulatory restrictions. Yet, with this scenario, the banks risk losing customers who may prefer more innovative and diversified offers from digital banks, neobanks, and big fintechs. If traditional banks invest enough to innovate in order to satisfy the increased customer demands, there is still a risk of skyrocketing expenses and the inability to fulfill all the digital customer needs.

Banking-as-a-Service (BaaS)

In the Banking-as-a-Service API strategy, banks supply fintechs with their financial services. Fintechs use the bank’s APIs to create innovative customer-facing applications and deliver them through their own channels. Within this model, fintechs act as bank customers, and, from the end-user’s perspective, the bank itself is almost invisible. While banks can significantly extend their reach through the BaaS model, the product cannibalization risk makes it unsuitable for the markets where customer relationships matter.

Plug-and-Play Banking

Banks can use APIs to extend their product line with complementary fintech products. They still control the customer interface and distribution channels yet get access to digital solutions from third parties. It helps stay competitive against digital and neobanks and satisfy customer expectations at minimum cost, as you do not need to develop all products in-house.

Banking-as-a-Platform (BaaP)

Banking-as-a-Platform API strategy is a mix of BaaS and plug-and-play banking. In addition to plug-and-play banking capabilities, it allows third-party institutions to be the channel for customers. On the one side, the bank still reaches its regular clients. On the other side, it reaches the customers of third parties, integrated with the bank’s API, which helps to grow the customer base.

For example, Infopulse created a custom-made risk management system that allowed our client to provide BaaP services to a banking group in Germany, expanding its market share and customer reach.

Marketplace Banking

Within the marketplace model, the financial institution (bank or fintech) acts as a broker of third-party banking products. It does not produce any services in-house but resells the products of others. To make it work, the organization needs to put much effort into standardizing its APIs, unifying multiple APIs in one environment, and providing various supporting services for vendors, including due diligence.

Consumer of BaaS

This model is for a non-bank that offers banking functionality to its customers. For example, a music streaming service or any other non-financial services provider can be a consumer of BaaS by offering banking functionalities to its customers. Here, banks act as product and API providers for non-banks to extend their audience with indirect customers.

When choosing an API strategy model to go with, banks should assess the viability of each option in terms of their business objectives and values. Customer relationships, security, and trust factors should also be assessed.

Banks often consider different API strategies for different product lines. For instance, they can stay traditional with the services they are strong with and deploy the BaaP approach for the products they would like to add to their portfolio.

Key Takeaways

Deployment of a bank API strategy unlocks new business opportunities and revenue streams. It helps meet the latest quality and compliance standards as well as brings customers maximum value to keep up with the competition in the market.

To reap all the benefits from producing API-based banking services and make them cost-effective, a company needs an organization-wide strategy. The latter suggests an API-driven approach, appropriate technologies, governance, and ecosystem management. Traditional banks must build a bridge between modern technologies and their business core to let innovations serve their strategic goals.

Adoption of an API-driven approach in an organized and disciplined manner helps minimize effort and stress for the organization, laying a cornerstone for thriving in the long run. The diversity of API-based models allows banks of any scale and legacy complexity to choose their own digital transformation path and compete with other market players.

![API Strategy for Banking [banner]](https://www.infopulse.com/uploads/media/whys-and-hows-of-api-strategy-for-banking-1920x528.webp)

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![How to Build Enterprise Software Systems [thumbnail]](/uploads/media/thumbnail-280x222-how-to-build-enterprise-software-systems.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![5G Network Holes [Thumbnail]](/uploads/media/280x222-how-to-detect-and-predict-5g-network-coverage-holes.webp)

![How to Reduce Churn in Telecom [thumbnail]](/uploads/media/thumbnail-280x222-how-to-reduce-churn-in-telecom-6-practical-strategies-for-telco-managers.webp)

![White-label Mobile Banking App [Thumbnail]](/uploads/media/thumbnail-280x222-white-label-mobile-banking-application.webp)

![Money20/20 Key Points [thumbnail]](/uploads/media/thumbnail-280x222-humanizing-the-fintech-industry-money-20-20-takeaways.webp)

![Deepfake Detection [Thumbnail]](/uploads/media/thumbnail-280x222-what-is-deepfake-detection-in-banking-and-its-role-in-anti-money-laundering.webp)