6 Mobile Banking Trends to Revolutionize Your Services

The mobile banking market is rapidly growing towards a projected value of USD 3.19 billion by 2031. Catering to users with an anytime-anywhere convenience and a personalized approach, mobile banking services has created a new segment in the market with extensive opportunities for all players. Below is our take on the current key mobile banking trends that digital-savvy companies should look into.

What Is Mobile Banking?

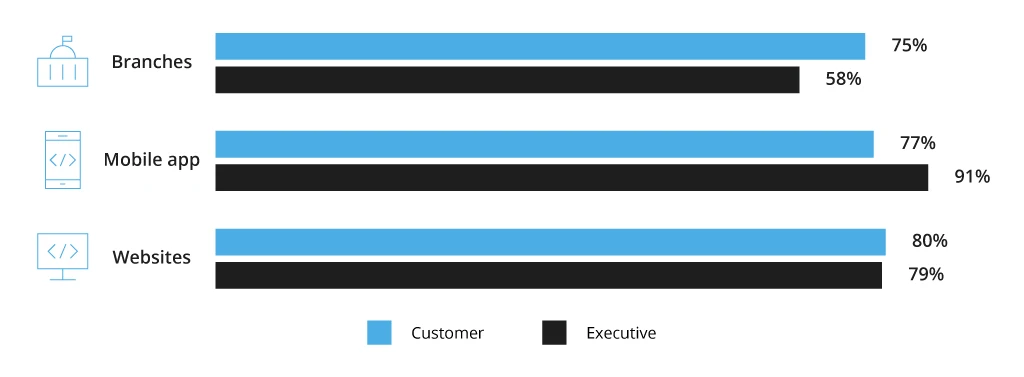

Mobile banking means offering banking services through custom apps to engage users and expand a bank's digital presence. In short, it is the future of how most financial institutions will interact with most of their customers. According to Capgemini’s recent report, 91% of executives and 77% of customers consider mobile apps to be the most important way to engage with banks, followed by websites. At the same time, 38% of consumers say they are ready to switch banks if they find the mobile banking options at a new bank more attractive.

Relying on mobile channels to meet those shifting consumer preferences is just one aspect of the matter. When backed by a strong product strategy, mobile banking applications can also turn into a standalone extension of your brand and deliver unique offerings to the target demographics. For instance, Capital One's mobile app goes beyond banking with features like CreditWise, a free credit monitoring tool, and Eno, a virtual assistant for managing accounts. These additions provide users with valuable financial insights and enhance their experience with the banks.

Whether you are launching a new mobile banking application or improving an existing one, below are several key mobile banking trends to keep an eye on.

How Banks Can Improve Their Mobile Banking Experience: 6 Trends

ABCD-Powered Processes

ABCD – the acronym for artificial intelligence, blockchain, cloud, and data – has already become the new alphabet of the future of finance. Popularized by Chinese financial super apps, this tech combo strengthen all processes, and above all, those related to interaction with the client - personalized recommendations, content and financial advice.

Here's some examples of how it works and how it benefits mobile banking.

Chatbots for Personalized Interactions: Chatbots equipped with AI can engage with customers during the onboarding and identity verification process. They guide users through the necessary steps, answer queries, and provide real-time assistance. Customers can converse with chatbots in a natural language, making the process more user-friendly. A study found that 65% of users prefer using virtual assistants for customer service instead of waiting on the phone. Of those who used virtual assistants, 84% had a positive experience, with 70% mentioning time savings as a major advantage.

AI-Powered Data Extraction: One of the cornerstones of ABCD-powered mobile banking is the seamless and secure extraction of data from various sources. Artificial intelligence plays a pivotal role in this process by automating and optimizing data collection from a multitude of channels, such as transaction records, customer interactions, and external market data.

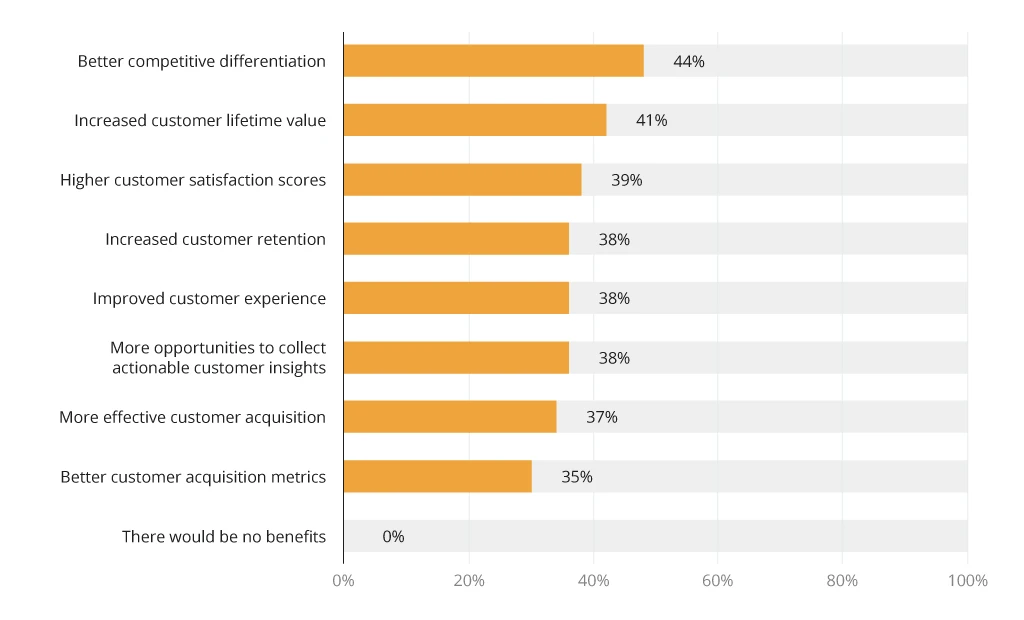

Data-Driven Personalized Recommendations: ABCD processes empower mobile banking apps to analyze vast amounts of user data securely and efficiently. According to Forrester's report, 72% of customers agree that bank product offers are more valuable when they are tailored to their personal needs. By harnessing the capabilities of blockchain and cloud technologies, banks gain valuable insights into customer behaviors, spending patterns, and financial preferences that shape highly personalized product and service recommendations. For instance, the app can suggest custom investment options, savings plans, or credit solutions based on the user's financial history and goals. This, in turn, leads to huge benefits for financial institutions:

Biometrics-Powered Security

Biometrics as a security mechanism remains among the top financial trends year-over-year. There are several good reasons for that:

1. Biometrics authentication is more secure. Its reliance on unique physical or behavioral traits makes it challenging to replicate or pilfer, setting it apart from conventional methods like passwords or PINs, which lack such robust security measures. This is particularly crucial, as 86% of security breaches involve stolen credentials.

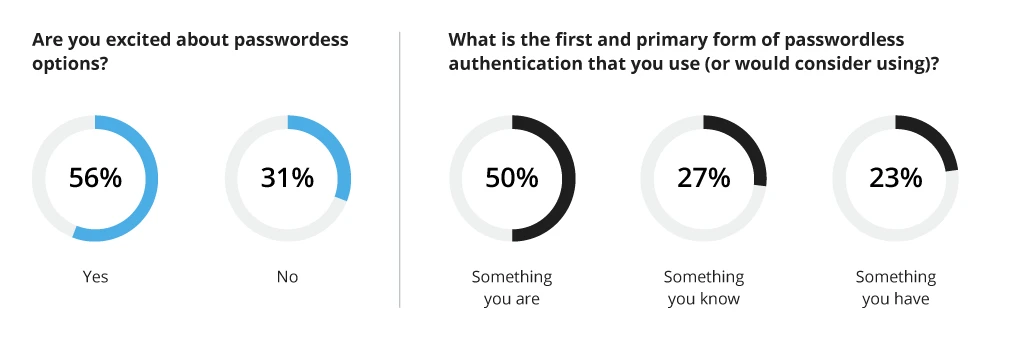

2. Biometrics authentication is also more privacy-centered since all biometrics data remains stored on the user’s devices instead of the data center or cloud server. As per the 2023 World Password Day Survey, more than half of the respondents show enthusiasm for password-free alternatives.

3. Biometrics is user-friendly, especially for mobile banking solutions. Most smartphones already support a seamless collection of biometrics data – fingerprints, voice recognition, face authentication, etc. – making it an attractive choice from a CX perspective. Already, 52% of consumers who use biometrics prefer this authentication method over other options.

Read more about biometric authentication best practices for the financial industry.

Open Banking API Integration

Open banking brings a host of benefits and innovations to customers and financial institutions alike. Here's a closer look at each aspect of this trend.

Enhanced Financial Access: Open banking streamlines mobile app access to financial services, including third-party products. This approach combines account, investment, and insurance administration into a single tool, offering customers greater financial control. Plaid, for example, connects users’ bank accounts to several financial apps, simplifying things like managing money, tracking investments, and making payments all in one spot.

Data Sharing: Open banking ensures secure data sharing via standardized APIs, providing users with better data control and visibility. The survey by McKinsey highlights that around 77% of banking APIs are used internally, with plans for a doubling within five years. Nearly 20% are externally employed for business partner integration, following a similar growth trend.

Regulatory Adherence: Open banking APIs play a central role in meeting regulatory demands. For instance, PSD2 in Europe mandates API exposure for customer data access, encompassing payments, accounts, loans, and more. This model is gaining global traction with similar regulations emerging worldwide.

Ecosystem Expansion: Open banking APIs lay the foundation for dynamic financial ecosystems where various services, spanning banking, payments, and financial planning, interact seamlessly. These ecosystems foster innovation as different financial entities collaborate to provide users with comprehensive and integrated services, enriching the overall financial experience. Over 50% of the S&P Global 100 companies are currently involved in at least one ecosystem and 90% of responders state that their companies intend to extend their involvement in ecosystems.

Voice Commands and Voice Payments

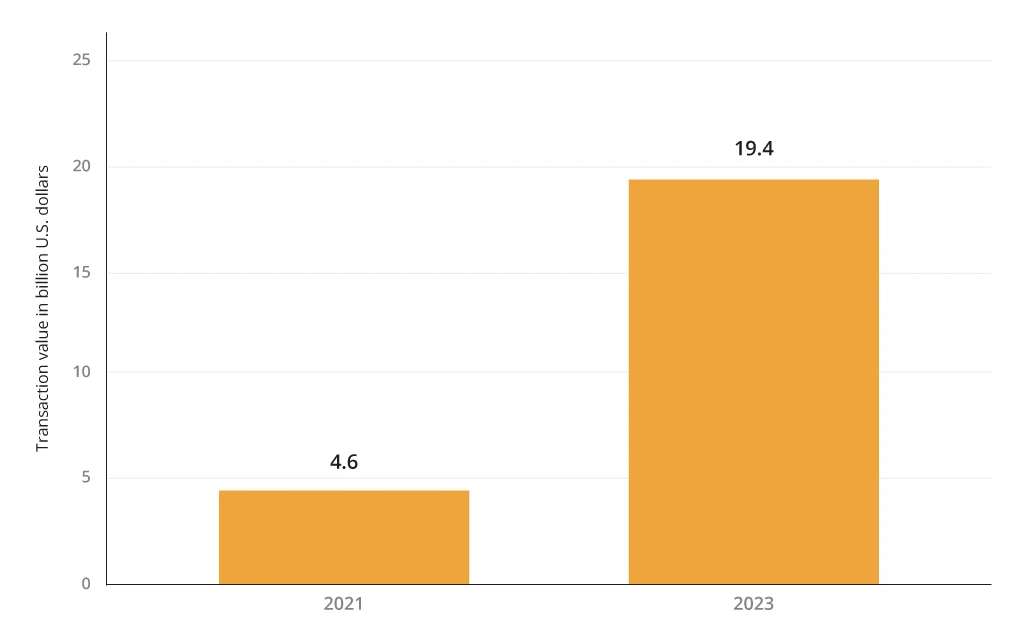

Voice, being a part of conversational banking, is rapidly becoming another venue for commerce. According to a report by Voicebot.ai, 45 million of U.S. adults had used voice commands to make a payment using voice assistants like Amazon Alexa or Google Assistant. Globally, the value of e-commerce purchases done through voice assistants has grown by more than 4 times in just two years.

While payment services providers (PSPs) rush to create new infrastructure for supporting voice-authenticated payments, banks should focus on improving voice support within their mobile banking apps. Here are the examples of banks that have already made voice commands one of the competitive advantages of mobile banking for their customers:

- USAA, a U.S.-based financial institution, has a conversational virtual assistant which is constantly being improved. Customers can use voice commands to perform various banking tasks, including checking account balances, transferring funds, and getting answers to common questions.

- Bank of America has introduced Erica, a virtual financial assistant. Erica can help customers with checking account balances, making payments, and providing financial advice through voice interactions. Over the course of four years since Erica’s introduction, the app has assisted almost 32 million customers in effectively managing their financial affairs. Currently, with Erica, 98% of clients get the answers they need.

Mobile Photo Deposit Functionality

Mobile deposit, also known as remote check deposit, is another feature that the best mobile banking apps offer. It enables users to deposit checks by simply capturing photos of them using their smartphones. Adding this feature to your mobile banking app can give you a major CX advantage over the competition. Moreover, mobile photo deposits can also reduce the load on your staff and save you some operational expenses.

Examples of banks offering mobile photo deposit:

- Chase Bank allows customers to deposit checks using their mobile app by taking photos of the checks.

- Bank of America's digital deposit services shows great results, with 86% of all check deposit transactions now being conducted digitally, demonstrating the convenience and trust customers place in this streamlined process.

Gamification

The global gamification market is set to grow substantially, going from USD 13.26 billion in 2022 to USD 58.71 billion in 2028. This expansion is fueled by the widespread use of smartphones and the recognition of gamification as a tool to facilitate higher user engagement, customer loyalty, and revenue for businesses. For instance, Extraco Banks experienced a 700% increase in client acquisitions through gamification.

Gamification encourages users to develop positive financial habits, such as regular saving or responsible spending. Examples:

- Qapital mobile banking app uses gamification to encourage users to save money. Users set savings goals in the app, and when they reach these goals they earn rewards or are entered into prize drawings. Currently, this feature saves users on average between $1,500 and $4,300 a year.

- Chime uses a "Save When You Get Paid" feature, where a portion of a user's paycheck is automatically transferred to savings when it's deposited. This automated savings feature incorporates gamification elements by rewarding users for saving.

To sum up, gamification is transforming the mobile banking landscape by infusing fun and motivation into financial tasks. As this trend continues to gain momentum, it will likely shape the future of mobile banking, making it more user-friendly and engaging.

To Conclude

It’s certain: mobile banking will remain in mass demand for the decade to come. However, to capture tangible benefits from this channel, banks will need to shift their focus from merely adapting their core services to the new screen sizes to creating mobile-first experiences, driven by native smartphone functionality.

It’s certain: mobile banking will remain in mass demand for the decade to come. However, to capture tangible benefits from this channel, banks will need to shift their focus from merely adapting their core services to the new screen sizes to creating mobile-first experiences, driven by native smartphone functionality.

![Robocall Mitigation Solutions [thumbnail]](/uploads/media/thumbnail-280x222-caller-line-identification-spoofing-and-robocall-4-mitigation-solutions.webp)

![Pros and Cons of CEA [thumbnail]](/uploads/media/thumbnail-280x222-industrial-scale-of-controlled-agriEnvironment.webp)

![BPO in Telecom and BFSI [Thumbnail]](/uploads/media/thumbnail-280x222-ways-business-process-outsourcing-bpo-can-help-telecom-bfsi-and-other-industries-advance.webp)

![Digital Twins and AI in Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-digital-twins-and-ai-in-manufacturing-benefits-and-opportunities.webp)

![Mobile Banking Trends [Thumbnail]](/uploads/media/thumbnail-280x222-mind-your-app-why-reinventing-mobile-banking-really-matters.webp)

![ServiceNow for Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-seven-ways-servicenow-drives-digital-transformation-in-manufacturing.webp)

![AI and RPA Integration for Banking [Thumbnail]](/uploads/media/thumbnail-280x222-ai-and-rpa-integration-for-banking-possibilities-of-intelligent-automation.webp)