A Complete Checklist for Enhancing Digital Customer Engagement in Banking

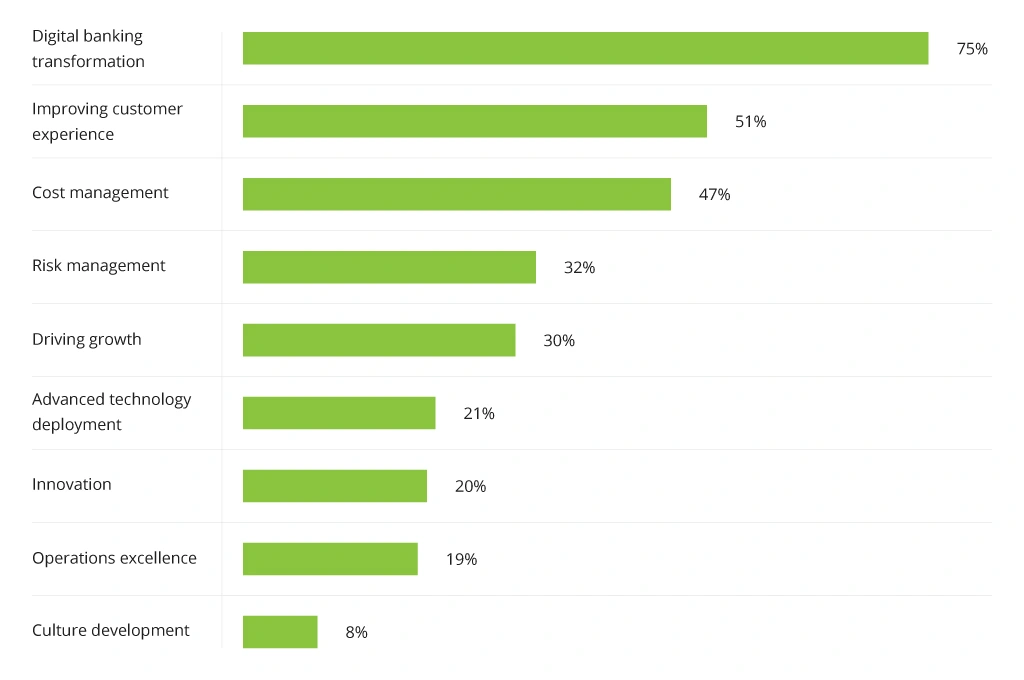

Top Banking Priorities Through 2021

To help you navigate the expanding landscape of tech innovation, we have compiled this comprehensive checklist of how to reinvent your service portfolio, establish digital presence, and improve customer engagement even for tech-savvy users.

6 Steps to Enhance Digital Customer Engagement in Banking

1. Exhaust the Possibilities of Customer Data Analytics

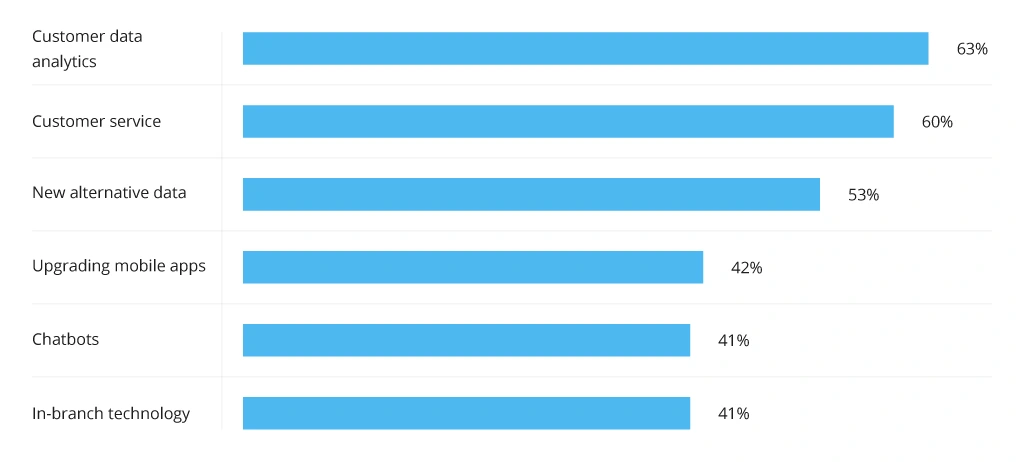

The better you understand your users, the more appealing you can make your services. Using business intelligence solutions for customer data analytics is a well-adopted practice, which you can apply to nourish your customer engagement strategy. In fact, 63% of banks plan to leverage customer data analytics to improve banking experience for their users.

Enhancements Banks Plan to Make to Boost Customer Experience

Employing state-of-the art analytics solutions opens new possibilities for such a data-rich industry as banking. With the help of data-powered operations, banks would be able to uncover customer-centric insights, tailor their service offers to the customers’ expectations, predict business-essential trends, leverage the risks, and improve the business processes efficiency.

For example, HSBC has been using AI to create better opportunities for personalized shopping. Its AI-powered system analyzes and predicts how the customers will use the bonus points on their credit cards based on their shopping patterns. Then, the bank sends email letters with personalized offers. This email marketing idea has led to a 40% open rate increase.

Case in point. Infopulse has developed an AI-powered web-based system to streamline the process of approving loan applications. We paid special attention to automatic and real-time data capturing and system integration with the bank's solutions.

2. Switch to Hyper-Personalized Services

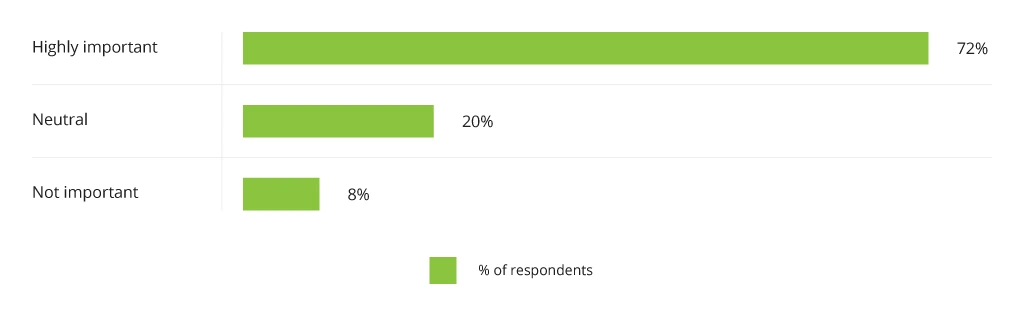

A Capco’s research report states that 72% of customers expect to receive personalized banking experience, including financial advice based on their income level, spending habits, and saving goals. Having your customer data properly structured and analyzed, as discussed in the previous section, allows you to create hyper-personalized banking services and engage the customers more effectively.

Importance of a Personalized Banking Experience for US Customers

According to Deloitte, hyper-personalization can be defined as using real-time data to generate insights by using behavioral science and data science to deliver services, products and pricing that are context-specific and relevant to customers’ manifest and latent needs (i.e., those needs which, due to a lack of information or availability of a product or service, cannot be satisfied). While personalization is already used to analyze data arrays after a specific action of the user (for example, visiting a loan’s section on a banking website), hyper-personalization is powered by a more extensive set of data, including location, shopping habits, transaction history, and more.

Equipped with all the information, AI solutions develop comprehensive digital customer profiles that can be later used to offer individualized services that cater to the users’ changing needs. Even more, hyper-personalized services come with a proactive approach, anticipating the customers’ needs and delivering the right product at the right time. For instance, if a customer browses car loans via their mobile app, it would be wise to come up with a tailored loan offer via a channel the customer prefers – by sending a push notification.

Case in point. Hyper-personalization also helps build deeper connections with the customers, developing consistent and customer-centric branding. A Spanish neobank, Mitto is a brilliant example of such an approach. Its target audience of mainly young people is characterized by an eco-friendly lifestyle, so the bank helps the customers get discounts on products and services from sustainable brands. Moreover, it emphasizes its environmental awareness by showing how much CO2 every transaction generates, which creates a unique dynamic between the bank and its customers.

3. Prioritize Omnichannel Customer Experience

The increasing number of means of communication impacted the way customers want to interact with their service providers – today they expect banks to be where users are. According to McKinsey, 71% of banking clients in Europe prefer interaction across multiple channels, while 25% would like to opt for a fully-digital journey.

That is why delivering omnichannel experience is yet another step in a customer engagement strategy, ensuring the clients enjoy the complete synchronization regardless of the channel they use.

In addition to delivering a seamless online experience across the channels, you may still need to align digital services with an in-branch. While 80% of the US banking customers would rather bank digitally, there are still 20% of those expecting traditional in-branch services. Thus, delivering omnichannel experience both offline and online is another must-follow practice for better customer engagement.

Case in point. For example, the United Bank of Africa created an INETCO Insight® real-time transaction monitoring software to faster consolidate payment data coming from different channels (mobile app and website, ATMs, and POS). This ultimately helped them to proactively identify transaction failures before they impacted customer experience.

4. Add Conversational Banking Features

Conversational banking is one of the most impactful fintech trends. According to the Digital Banking Report, 75% of financial organizations consider using conversational AI technologies. They are designed to enable better engagement with the customers, analyze their in-app behavior, help them resolve issues, automate routine tasks like pre-scheduled payments, and develop personalized offers to cross-sell and upsell.

Conversational chatbots embedded in a mobile banking app are among the top technologies that deliver a better customer experience in 2022. When their features are perfectly tailored to the customers’ expectations, they promise great convenience for the users along with increased customer satisfaction. Banks can also gather smart insights, revealing the stumbling blocks in the customer journey and finding a way to improve an in-app experience.

For instance, resolving the customer’s issue as quickly as possible contributes to trustful relations and loyalty and drives digital banking customer engagement. Customer support chatbots and virtual assistants are cost-effective and convenient tools to deliver timely real-time support and provide self-service features.

By 2028, the AI chatbots market is projected to grow tenfold compared to 2018, and their ability to solve multiple tasks is the main reason for their adoption. When it comes to managing routine and time-consuming tasks, AI automation tools are better at delivering faster service with improved quality, compared to humans. Plus, handling service requests is not the only task they can perform to boost customer engagement.

Cases in point. For example, Eno, an intelligent chatbot developed by Capital One, comes with fraud detection and prevention features. Erica, a chatbot created by Bank of America, is an automated payment solution that processes customers’ payments according to their schedules.

5. Engage in Innovative Partnerships

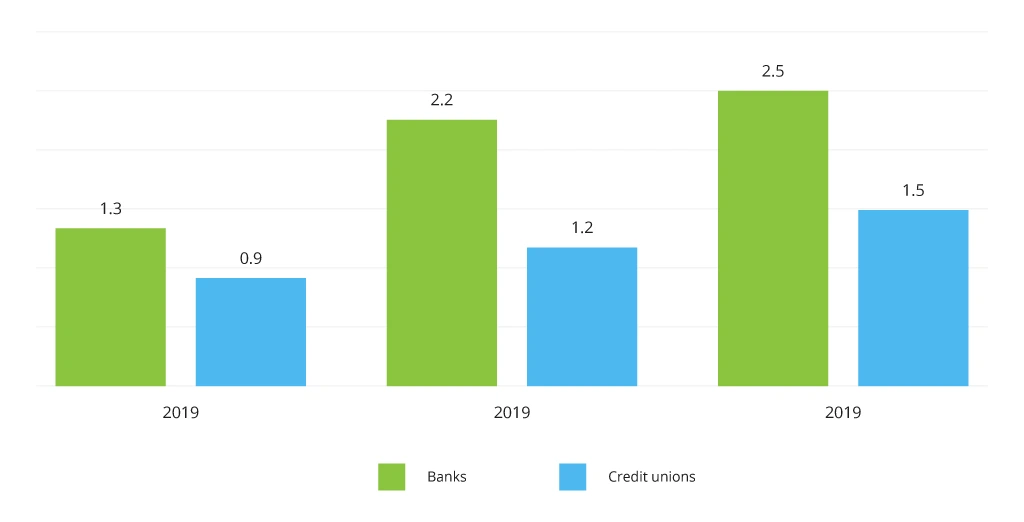

The State of the Union in Bank-Fintech Partnerships reports that banks that partnered with fintechs averaged 2.5 partnerships per institution in 2021. Open finance and open banking development creates opportunities for banks to partner with other financial institutions, retailers, and fintech service providers. Collaborating with these businesses allows financial organizations to share customer data, analyze the data arrays, and as a result, improve customer experience, and personalize the services smartly.

Avarage Number of Fintech Partnerships per Institution

At this point, there are already many examples of how banks partnering with other fintech companies can strengthen their value proposition. Thus, a bank that has adopted an open banking framework can leverage all the data about the customer without being limited to the dataset it already has. In this way, the organization can make winning data-driven decisions, reducing the risks, and improving customer satisfaction, for example, regarding loan approval. On top of that, it creates opportunities for new digital-advanced offerings backed up by the capabilities of a tech-savvy partner.

Case in point. For instance, German bank N26 collaborated with the fintech company Wise. The companies have created an API-powered platform that allows customers to make instant payments with upgraded payment limits for European transactions, plus send money abroad using an N26 customer account only.

6. Bet on Digital Customer-Facing Technologies

Such customer engagement activities in banking as personalized service and conversational banking are already must-follow to keep financial organizations competitive. However, advanced technologies can promise even more customer engagement, reshaping the experience they get.

Self-sovereign identity technology is one more thing to invest in to deliver a better customer experience and build deeper trust and loyalty. To date, this is one of the best ways to improve the customer data security within the omnichannel experience, provide faster onboarding for new customers, and eliminate paperwork for the users applying for banking products and services.

Virtual bank branches can be an example of using virtual reality in fintech. The essence of the idea is that the customers can visit an entirely virtual bank branch, get an immersive experience, and access all the necessary services. According to Accenture, metaverse banking is becoming a new transformational force for the industry, reinventing the customer-brand interaction.

Case in point. Following the emerging trend, the UK bank HSBC developed a representation in The Sandbox virtual environment. The Sandbox partnership with HSBC increases their integration with global financial institutions, while HSBC acquires a platform to “create new experiences”.

Conclusion

Reshaping customer experience and making it more seamless and secure is the best way to stay competitive for modern financial organizations. The Infopulse tech team would be glad to support you on the way to digital transformation, helping with the highest-end banking solutions development for your customers. Contact us now for more insights!

![Digital Customer Engagement in Banking [banner]](https://www.infopulse.com/uploads/media/a-complete-checklist-for-enhancing-digital-customer-engagement-in-banking-1920x528.webp)

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![How to Build Enterprise Software Systems [thumbnail]](/uploads/media/thumbnail-280x222-how-to-build-enterprise-software-systems.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![5G Network Holes [Thumbnail]](/uploads/media/280x222-how-to-detect-and-predict-5g-network-coverage-holes.webp)

![How to Reduce Churn in Telecom [thumbnail]](/uploads/media/thumbnail-280x222-how-to-reduce-churn-in-telecom-6-practical-strategies-for-telco-managers.webp)

![White-label Mobile Banking App [Thumbnail]](/uploads/media/thumbnail-280x222-white-label-mobile-banking-application.webp)

![Money20/20 Key Points [thumbnail]](/uploads/media/thumbnail-280x222-humanizing-the-fintech-industry-money-20-20-takeaways.webp)

![Deepfake Detection [Thumbnail]](/uploads/media/thumbnail-280x222-what-is-deepfake-detection-in-banking-and-its-role-in-anti-money-laundering.webp)