Top 7 Neobank Features Traditional Banks Need to Adopt

Now, the global market cap of neo banks is projected to reach $47.1 billion in 2021, and its further growth is estimated to be $722.60 billion in 2028. This means an astonishing CAGR of 47.7%. What do these app-based 100% digital banks have that traditional financial institutions can benefit from? How can conventional banks become more agile and learn from challengers to streamline their operations?

Let us first briefly recall what these technology-oriented financial startups are made of.

What Are Neobanks?

Branchless neobanks have low operational costs. They are modern, customer-centric alternatives to traditional financial institutions with their heavy legacy systems. Furthermore, neobanks are called challengers for a reason: they offer a seamless user experience. With all the services in one single app, neobanks challenge the status quo of conventional banking.

From comprehensive analytics to savings and investing, the British Revolut, for instance, has the daring motto of ‘all things money.’ The US-based Chime is another neobank with the largest market cap among its ‘peers.’ It offers checking accounts with no minimum balance, early wage access, and fee-free overdraft option up to $100.

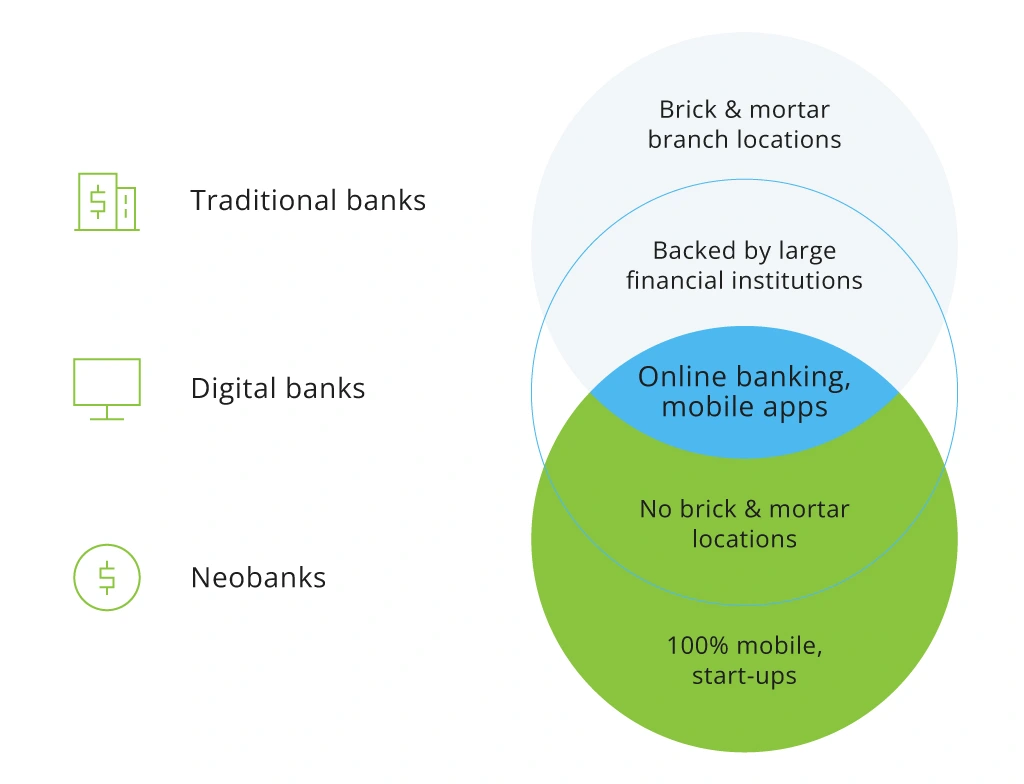

Being all-mobile startups, neobanks appeal to tech-savvy users, who prefer all their money management under one roof. Nielsen compared all player types in the banking sector, showing the difference between incumbents and FinTech startups – the best neobanks that challenge them:

Neobanks vs Digital vs Traditional Banks

At the same time, Finnovate Research and other industry experts defined a few aspects that give a competitive edge to neobanks. Some of them are front-end, while others are more related to the internal workings of a challenger. Quicker credit scoring and enhanced risk management are just a few things conventional banks can benefit from when opting for a technical upgrade.

Further, we elaborate on some other aspects traditional banks can improve on to have a better value proposition.

1. Better Customer Experience

Neobanks adopted an interchange fee model that helps lower customer-facing charges. Beyond that, challengers focus on personal financial management in real-time and use AI-powered credit scoring to streamline their decision-making process.

Today, the global pandemic in the US, for instance, made Americans switch to FinTechs that saw a spike in revenues across different verticals. From payments to lending, FinTech has added 6% since the start of the crisis caused by the pandemic.

Beyond that, neobanks tapped into the millennials’ market, an underserved portion of retail customers, who cannot imagine their lives without mobile banking. The children of baby boomers are likely to experience the largest wealth transfer in history. They will inherit 30 trillion USD, making wealth management the next milestone for neobanks, who can smoothly transform into neobrokers.

2. Convenient Use on the Go

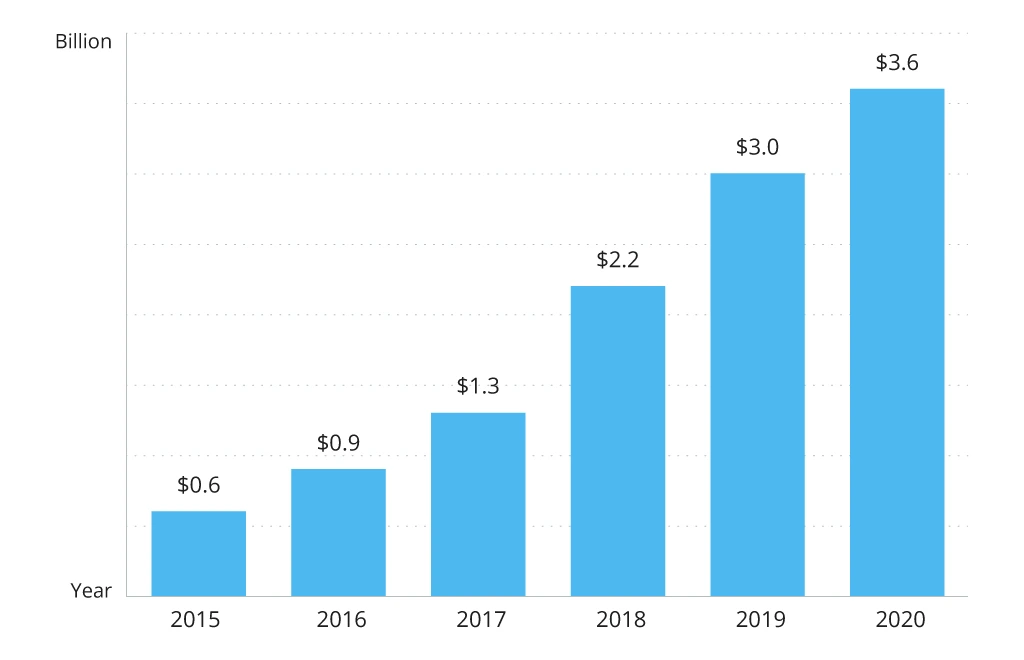

Anywhere, anytime is a new way of busy lives neobanks tap into. Thus, they are all pro the utmost comfort of a customer and offer 24✕7 access to banking. Perhaps unsurprisingly, the sales of neobanks that cut on some of the conventional banking charges and fees have grown exponentially in the last couple of years.

Global Neobanks Revenue

In addition, they consolidate the ties with domestic and global financial players to offer the rebundling of financial services through partnerships and recent innovations. Earlier, neobanks focused on individual products such as FX or lending. Today, however, their focus shifted towards cross-selling, reports Deloitte UK.

Finally, challengers target an underserved segment of users and offer enough flexibility for small and medium-sized businesses, aggregating the necessary core features such as business reporting, accounting, and tax management.

3. Streamlined Processes

Using mid-market exchange rates, neobanks offer quick and seamless international transfers. Unifimoney partnered with Nium to offer its customers secure real-time global payments and transfers at an affordable cost.

Having backed such successful FinTech trailblazers as TransferWise (now Wise) and N26, Valar Ventures decided to support innovation in an emerging market this time. Along with other investors, the VC helped Nigerian mobile-first bank Kuda with HQ in London and Lagos to secure 25 million USD. Kuda is on a mission to offer modern money management to the global African community.

With in-app customer onboarding, users can open an account within a few clicks with no paperwork or fees. The global network of ATMs is another feather in the cap of challengers. Neobank customers can withdraw cash globally hassle-free.

4. Open Technical Infrastructure

Open instead of outsourced tech stack enables neobanks to create ‘plug and play’ cutting edge instruments.

Xinja, for instance, uses Kong Enterprise to enhance its digital platform and comply with industry standards while being able to quickly launch new products and services from any screen in real-time and offer the edge its clients require.

With microservices architecture at their core, neobanks avoid the pitfalls of heavy, slow-moving monolithic ecosystems of traditional banks that have difficulties integrating new capabilities. Thus, most of the time, they end up unprepared for future challenges.

5. Data-powered Operations & Customer-centric Design

Conventional banks still have their data stored both online and on paper records. Thus, unlike neobanks, they cannot offer easy real-time data monitoring and reconciliation. Accenture’s Global Banking Consumer Study notes that in 2018, 52% of consumers appreciated the budget suggestions based on their monthly expenses; in 2020, 9% more people valued such a piece of advice.

By contrast, challengers use data to shape their business model, paying 3rd party affiliation fees.

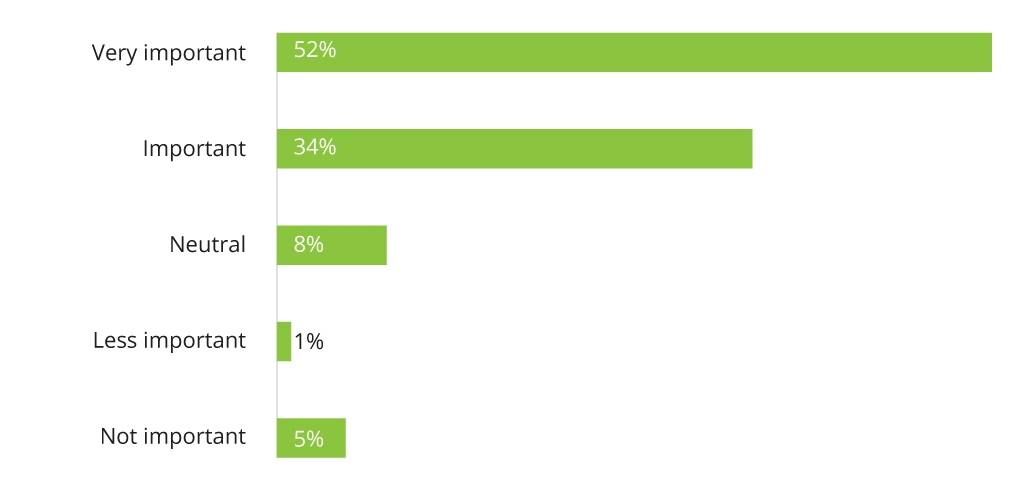

Evaluating the need for built-in data analytics, Tableau, for example, surveyed FinTech players and found out that the integration of business intelligence tools in a tech platform is essential for more than 50% of respondents.

The Need for Comprehensive Data Analytics in Fintech

While conventional banking revolves around their product portfolio, neobanks put clients’ needs and expectations at the center stage with user-centric insights defining their business model.

6. Shifting from Branches to API Layer

Designing Banking-as-a-platform (BaaP), neobanks adopt open APIs to propose not only a seamless user journey but also explore additional opportunities to grow their sales pipeline and acquire more customers. In the UK alone, ‘open banking’ helped earn 700 million USD in 2018. Business Insider anticipates the potential of white-label banking to reach new heights by 2024 and amount to 2 billion USD.

For example, the Australian neobank Up is developing its next-gen publicly available API, promising customers a more creative approach to their funds’ control and automation. Having launched its test version of the API, Up offered users programmatic access to account balances and transaction data through a token, which permitted them to connect their financial data with the apps they make.

7. Sustainable Operations

As per a fossil fuel finance study, some large banks support fossil fuel businesses indirectly, contributing to climate change and other pressing ecological issues. Air and water pollution, among other environmental problems, are a great concern of many environmentally-conscious customers.

Thus, many people go for smaller banks that have ethical operational practices in place. For example, the neobank Aspiration, a green financial services provider, calls for changing the world and reforesting through rounding up the transaction to the next whole dollar and transferring the extra to a special ‘Plant Your Change’ account.

The neobanks help users fight climate change and reduce their environmental footprint. Socially conscious spending is what most of the brick-and-mortar financial institutions are yet to think of transforming their offerings.

To conclude

Traditional financial institutions still mostly believe in off-the-shelf customer experience with many products being one-size-fits-all offerings. To concentrate on custom-tailored solutions, brick-and-mortar financial institutions will need to look up to neobanks, who disrupt the industry and offer 40% more functionality through their smartphone apps than traditional banks.

Challenger banks set the pace for incumbents that are yet to upgrade their operations in line with modern consumers’ expectations.

Neobanks embrace innovation and create their user-centric offerings not only for the digital-first generation. On top of that, neobanks attract those looking for the agility they cannot find in traditional banking products and some ‘extras’ such as sustainable spending practices, for instance.

Reach out to the Infopulse team – find out how we can help you leverage innovative technologies to meet shifting consumer expectations, enhance regulatory compliance, and harness the power of process automation and data-driven analytics.

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![Generative AI and Power BI [thumbnail]](/uploads/media/thumbnail-280x222-generative-AI-and-Power-BI-a-powerful.webp)

![AI for Risk Assessment in Insurance [thumbnail]](/uploads/media/aI-enabled-risk-assessment_280x222.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![5G Network Holes [Thumbnail]](/uploads/media/280x222-how-to-detect-and-predict-5g-network-coverage-holes.webp)

![How to Reduce Churn in Telecom [thumbnail]](/uploads/media/thumbnail-280x222-how-to-reduce-churn-in-telecom-6-practical-strategies-for-telco-managers.webp)

![Automated Machine Data Collection for Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-how-to-set-up-automated-machine-data-collection-for-manufacturing.webp)

![Money20/20 Key Points [thumbnail]](/uploads/media/thumbnail-280x222-humanizing-the-fintech-industry-money-20-20-takeaways.webp)