4 Reasons to Introduce Your Customers to the BNPL Model

The BNPL concept initially allowed consumers to purchase products immediately and then pay for them over time in regular installments. Now, BNPL services are beginning to set their sights on creating their payment gateways and partnering with retailers. Over the last couple of years, fintech has already seen $8 to $10 billion in revenues diverted away from banks within the retail ecosystem.

The meteoric rise in popularity of BNPL in recent years has spawned the birth of a new fintech vertical. As a result, banks and other financial institutions have an excellent opportunity to capitalize on this expanding trend in innovative financial services. Likewise, with an increasing number of people choosing this alternative, it is vital to assess the primary benefits of adopting such solutions for your business.

What is Buy Now, Pay Later and How Does it Work?

BNPL refers to short-term financing that enables customers to make purchases while spreading the entire payment over several months. In comparison to traditional deferred payments, fixed interest-free payments offered by BNPL give customers complete ownership of the product. BNPL is distinct from typical credit models in that it places a premium on increasing sales through quick approvals, rather than on the customer's ability to repay loans.

How does BNPL work? The procedure is as follows: the BNPL provider pays the merchant in full on the buyer's behalf. This enables clients to pay for things over time without paying interest charges via finance arrangements.

BNPL is usually offered alongside credit cards and other payment methods. When making a one-time purchase, customers select a BNPL provider in the payment form and are taken to the BNPL provider's site or app to create an account or log in. After customers accept the repayment conditions, they finalize the purchase. Businesses are paid in full once the transaction is completed. With no hidden fees or interest charges, customers pay their monthly installments straight to the BNPL service provider.

What Does BNPL Adoption Mean for Business?

BNPL is already a major force in the retail world, and its growth is only expected to accelerate in the next few years. By 2026, the BNPL market is predicted to be worth $995 billion, an increase of more than three times from its size in 2021.

For businesses, the appeal of BNPL is clear. It allows customers to spread the cost of a purchase over time, making expensive items more affordable. It also encourages customers to spend more, since they are not immediately faced with the full cost of their purchase. For businesses that cater to a tight budget or sell higher-priced items, BNPL can be a game-changer.

How BNPL Benefits Merchants

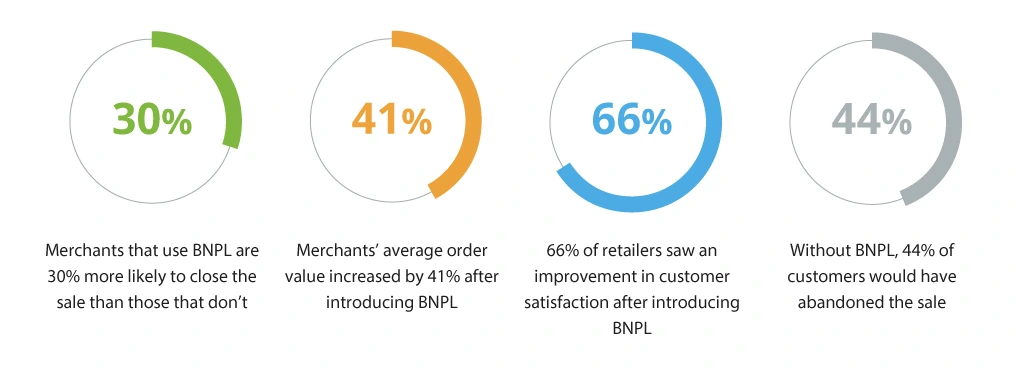

Businesses must also recognize the significance of BNPL in creating a more open, user-driven environment for the financial services industry. The BNPL business model has multiple advantages for businesses, including the ability to attract new customers who tend to spend more with BNPL because they can avoid credit card interest and pay in installments.

With more and more consumers using BNPL, businesses that do not offer this option to their customers may find themselves at a competitive disadvantage.

Below you may find four reasons why you should offer the BNPL model to your audience.

Reasons to Consider the BNPL Model as an Option

1. Generating Additional Revenue Streams

With BNPL, banks can leverage their existing knowledge in consumer credit and credit lines to create new products that are perfectly suited for the fast-growing world of eCommerce.

Due to the BNPL introduction, banks can also gain access to generating new revenue streams by partnering with merchants. Retailers typically shoulder the costs of digital finance options, while consumers benefit from free installment. As a result, businesses can enhance checkout completion rates, while their customers acquire an attractive payment option, and the banks gain a new source of revenue.

Banks attempting to capitalize on the opportunity presented by BNPL are currently employing a variety of strategies. Some offer customized models with certain companies; for instance, TD Bank offers BNPL to NordicTrack, a workout equipment manufacturer. Other banks are developing models that allow them to act in the background behind BNPL offerings — Westpac has a BaaS agreement with Afterpay. Banks also use other players to create differentiated offerings — for example, Royal Bank of Canada has partnered with Bread, a digital payments company, to create its PayPlan offering.

2. Cutting Customer Acquisition Costs (CAC)

Traditional methods of attracting new customers are excessively expensive for today's businesses. To put it another way, BNPL isn't just about getting money; it's a way to acquire customers. The institution's BNPL offers can be discovered by Internet users who may not be using bank services for now but will subsequently be converted into customers.

BNPL, according to Credi2 CEO and Co-Founder Daniel Strieder, allows financial institutions to cut client acquisition costs while also reaching a younger demographic. Despite the high cost of digital marketing (SEO, social media, etc.), he claims that BNPL is a low-cost channel that should not be disregarded.

Even the most successful financial companies can benefit from growing their client base and target vertical market. PayPal and Paidy are working together in the hopes of dominating the Japanese eCommerce market. For a total of $2.7 billion, PayPal purchased Paidy — the most successful BNPL service in Japan, having built a substantial two-sided platform that brings together customers and business owners.

3. Gaining Customer Loyalty Ahead of the Curve

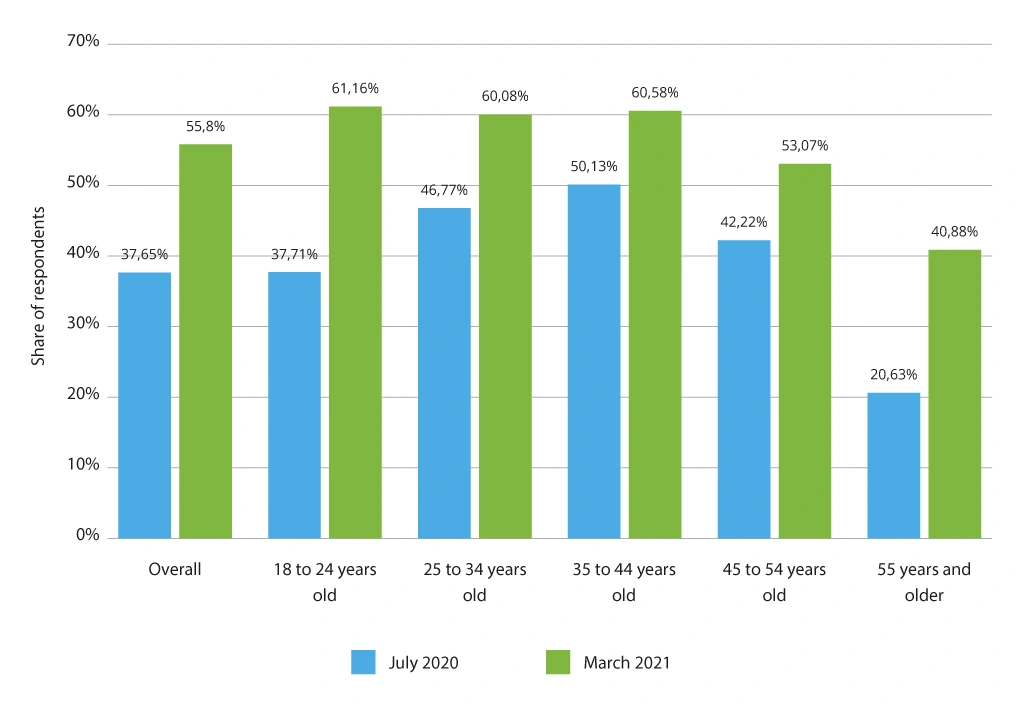

The number of people using BNPL continues to rise at a rapid clip across all demographics as paying in installments is gradually becoming their preferred way of payment. In the US only, about 56% of adults used a BNPL service in 2021, compared to 38% in the previous year. This means the BNPL model is appealing to customers and gaining their loyalty.

BNPL Usage in the US by Age

BNPL can significantly increase customer loyalty and personalization: for instance, banks can proactively develop offers and manage real-time personalization of in-store and online shopping experiences. When there are many offers to pick from throughout the checkout process, customers will select the one that is most suited to their own needs and preferences. Banks will be compelled to provide customers with information that is both contextual and relevant at the time of purchase.

When customers use BNPL to finance their purchases, they are more likely to return to the same merchant in the future. This creates a virtuous circle, in which the customer is attracted to the merchant because of the BNPL offer, and the merchant is loyal to the BNPL provider because of the increased sales. Ultimately, this results in a virtual marketplace forming around the BNPL provider, giving customers more choice and merchants more loyalty.

4. Staying Relevant in Digital Banking

As previously stated, BNPL has seen a lot of growth in the last few years. Still, it’s not too late for financial institutions, fintech companies, and banking technology providers to join the BNPL march.

Banks can swiftly supply portfolio financing programs to BNPL fintech in exchange for funding for short-term microloans. For instance, Mastercard has already announced intentions to expand BNPL services in the United States, the United Kingdom, and Australia, while Visa revealed plans to expand BNPL services in the United States, Canada, and Malaysia. The payment networks' offerings should facilitate the rollout of branded BNPL services by member banks.

BNPL services like Afterpay and Zip Co are becoming increasingly popular, especially among younger shoppers. One of the appealing aspects of these services is that customers don't need to pass a credit check in order to use them. This can be a great option for people who don't have a strong credit history or who might not be able to qualify for a traditional credit card.

Banks should harness their balance sheets and existing client networks to enter the market and compete with fintech which is already providing BNPL solutions. With an established client base, incumbents will be able to cross-sell their products and gain economies of scale more quickly. Additionally, banks can invest in their own BNPL product via a low-cost insured deposit, owing to their substantial balance sheets. This can also contribute to the enhancement of digital customer engagement in banking.

Best Buy Now, Pay Later Apps & Services

When it comes to BNPL apps and services, there are a few that stand out from the rest. Today’s top Buy Now, Pay Later apps are simple to use, and their fees and interest rates are modest so customers can utilize the credit for everyday expenditures. They offer great features and benefits that make them the best choice for anyone looking to manage their finances better.

For instance, Affirm lets customers finance purchases of up to $17,500 with different payment plans. Three, six, or 12 monthly installments are available. Depending on the purchase amount and payment plan, users may pay interest. However, Affirm has no late, prepayment, or yearly fees. Using an Affirm loan to make a purchase can affect users’ credit scores, so it is important to make timely payments to strengthen the credit.

Afterpay is a good option for those who can make payments on time, require a short-term loan with no interest, and don't want their credit score affected. The company offers one product: six-week financing with four biweekly installments — customers pay 25% down and the rest over six weeks. The bad news is that late payments at Afterpay can cost up to 25% of the transaction. If users miss a payment, they can't take out a new loan until they pay.

Another BNPL app, Sezzle, offers short-term loans with no interest, no credit bureau reporting, and flexible payback dates. Six-week loans are available for purchases up to $2,500 with a 25% down payment and bi-weekly payments. Sezzle allows customers to reschedule payments up to two weeks later. The first order rescheduling is free, but each additional one is charged.

Splitit is considered the best no-credit-check BNPL app. Customers can use their Visa, Mastercard, Discover, and Union Pay credit cards to make interest-free payments over time with Splitit. The app does not charge users any interest or fees, even those for late payments. However, Splitit customers must have a credit card with available credit to use this app.

Swedish fintech giant Klarna offers numerous flexible payment options: consumers can choose to make four interest-free payments every two weeks; they can also purchase the item immediately and pay for it in full within 30 days. No interest will be charged. It is also available to finance purchases over six to 36 months, so the app is a good choice for large purchases. Klarna's soft credit checks won't affect users’ credit, but if they finance their purchase over a longer period, they will pay interest.

The BNPL solution Uplift connects with over 200 of the world's biggest airlines, cruise lines, resorts, and other key travel businesses to offer BNPL payment options. Each loan has a different credit limit and is considered individually. Uplift charges up to 36% APR and uses basic interest but some travel partners offer 0% APR loans. Regarding disadvantages, some Uplift loans may have a 2% origination fee. However, the service has no prepayment or late fees.

Conclusion

A demand for more transparent and seamless payment experiences is driving the current race in the Buy Now, Pay Later business model and a significant portion of the fintech industry. Maintaining a user-centric approach to product development and design is now more important than ever but keeping up with current trends is essential as well.

Overall, there is no doubt that BNPL is here to stay, as it is the fastest-growing segment of finance, allowing consumers to pay in equal amounts over a certain period. Consumers embrace BNPL because of its ease of use, predictability of payments, and ability to help them plan their finances.

Infopulse experts would be happy to assist you in introducing progressive banking solutions to your customers as part of your digital transformation efforts. Get in touch with us to utilize our expertise in developing and implementing BNPL solutions.

![Reasons to Adopt the BNPL Model [banner]](https://www.infopulse.com/uploads/media/4-reasons-to-introduce-your-customer-to-the-BNPL-model-1920x528.webp)

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![How to Build Enterprise Software Systems [thumbnail]](/uploads/media/thumbnail-280x222-how-to-build-enterprise-software-systems.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![5G Network Holes [Thumbnail]](/uploads/media/280x222-how-to-detect-and-predict-5g-network-coverage-holes.webp)

![How to Reduce Churn in Telecom [thumbnail]](/uploads/media/thumbnail-280x222-how-to-reduce-churn-in-telecom-6-practical-strategies-for-telco-managers.webp)

![White-label Mobile Banking App [Thumbnail]](/uploads/media/thumbnail-280x222-white-label-mobile-banking-application.webp)

![Money20/20 Key Points [thumbnail]](/uploads/media/thumbnail-280x222-humanizing-the-fintech-industry-money-20-20-takeaways.webp)

![Deepfake Detection [Thumbnail]](/uploads/media/thumbnail-280x222-what-is-deepfake-detection-in-banking-and-its-role-in-anti-money-laundering.webp)