The Rise of Digital Payments During the Pandemic

Apart from the challenging economic conditions, financial players are now faced with another business and technological dilemma – the consumers’ mass foray into digital payments and banking.

Major Shifts in Consumer Behaviour: The Course towards Online Payments

Despite the initial slump in spending, the pace of both consumer and business transactions is steadily accelerating in Q3 2020. What has also changed along with the transaction volumes are the ways of how people are interacting with different payment mediums. Cash is moving to the margin, whereas online money transfers, digital wallets, and simple mobile online payments are moving to the mainstream.

Over 45% of consumers, surveyed by Capgemini in April 2020, said that they planned to increase the usage of digital payment methods over the next 6-to-9 months. With this in mind, let’s take a look at how consumer attitudes towards payments have changed in 2020.

Card and Contactless Payments Are on the Rise

Cash has long been a preferred medium of payment for settling small value (under $100) transactions in certain European economies (Germany, the UK) and the developing markets where banking penetration rates remain low. However, the global pandemic has significantly affected the consumer attitude towards notes and coins. A large fraction of consumers (including the older adults) is stepping away from using cash both for hygienic and convenience reasons.

Recent Mastercard data indicates that as much as 50% of the UK society has gone cashless with just 20% of the population still relying on cash. The volume of ATM cash withdrawals in the region has declined for the first time in a decade as well. More than half (57%) of Germans also started using their debit/credit cards more often and up to 50% reduced reliance on cash.

The volume of contactless payments that further minimize interactions with payment terminals has surged during the pandemic as well. Both Mastercard and Visa contactless payment limits have been raised. As a result, Visa reported that the volume of tap-to-pay transactions in everyday consumer spending segments in the US has grown by 100% YoY with some 31 million US shoppers using this payment option in March 2020.

The surge in contactless payment adoption is largely led by retailers. According to an August 2020 study by National Retail Federation, you no longer need to wonder where you can use contactless payments as:

- 67% of retailers now accept some form of no-touch payment at the point of sale;

- 58% accept contactless payments, up from 40% in 2019;

- 56% accept different types of digital wallets, up from 44% in 2019.

And 69% of the surveyed retailers also said that the volume of contactless payments has been continuously increasing since January 2020.

The takeaway: Consumers’ affinity towards touchless payments will only grow stronger, so all payment industry players need to adapt to that trend.

Cash Usage Is on Decline

Consumers newly found affinity towards card and digital currency wallet payments undercuts cash usage. Visa’s “Back to Business” Study indicates that consumers’ reluctance to use cash will only increase even post-pandemic:

- 78% of consumers changed their shopping habits during COVID-19 and now shop online whenever possible, prioritize contactless payments at checkout, and use less cash;

- 62% of respondents have used less cash since the start of the pandemic due to safety concerns;

- 48% will not shop at retailers that only support ‘contact’ payment methods (such that require contact with a cashier or POS terminals);

- 12% has completely stopped using cash.

The concept of a ‘cashless society’ has existed long pre-pandemic, especially in Nordic countries. However, the COVID-19 pandemic has created a situation where both consumers, businesses, and governments are strongly aligned on reducing the reliance on cash.

Certainly, this may leave certain vulnerable demographics at a disadvantage – the underbanked and unbanked consumers who lack access to traditional banking services as FIs have been slow to engage with them. It’s a shame since unbanked consumers can bring an estimated extra $380 billion in revenue to banks. Clearly, we should expect new developments in the financial sector in this regard.

Digital Wallets Surge in Adoption

The pandemic has also prompted more consumers to discover the benefits of digital wallets. Similar to contactless payments, mobile wallet payments require less surface contact, can be made on the go, and at a faster pace. What’s more, the best digital wallets offer seamless integration with online retailers, meaning that the payment experience becomes fully embedded into the consumer retail journey, further increasing the convenience of usage. The future of digital wallets also remains bright as in 2020, 64% of consumers said that they plan to use mobile wallets – up from 46% last year.

While that’s certainly great news for retailers, orchestrating their shift from offline to online commerce, the surge in mobile wallets usage undercuts profits from traditional financial players. Alipay, for instance, recently announced a post-COVID-19 initiative, aimed at launching a wider range of embedding payments for a variety of services, ranging from medical care to food deliveries. Such payment mini programs will bypass the usage of cards and traditional electronic payment networks, leaving payment providers short of some revenue and consumer data.

How Finance Players Can Technologically Prepare for Digital Payments

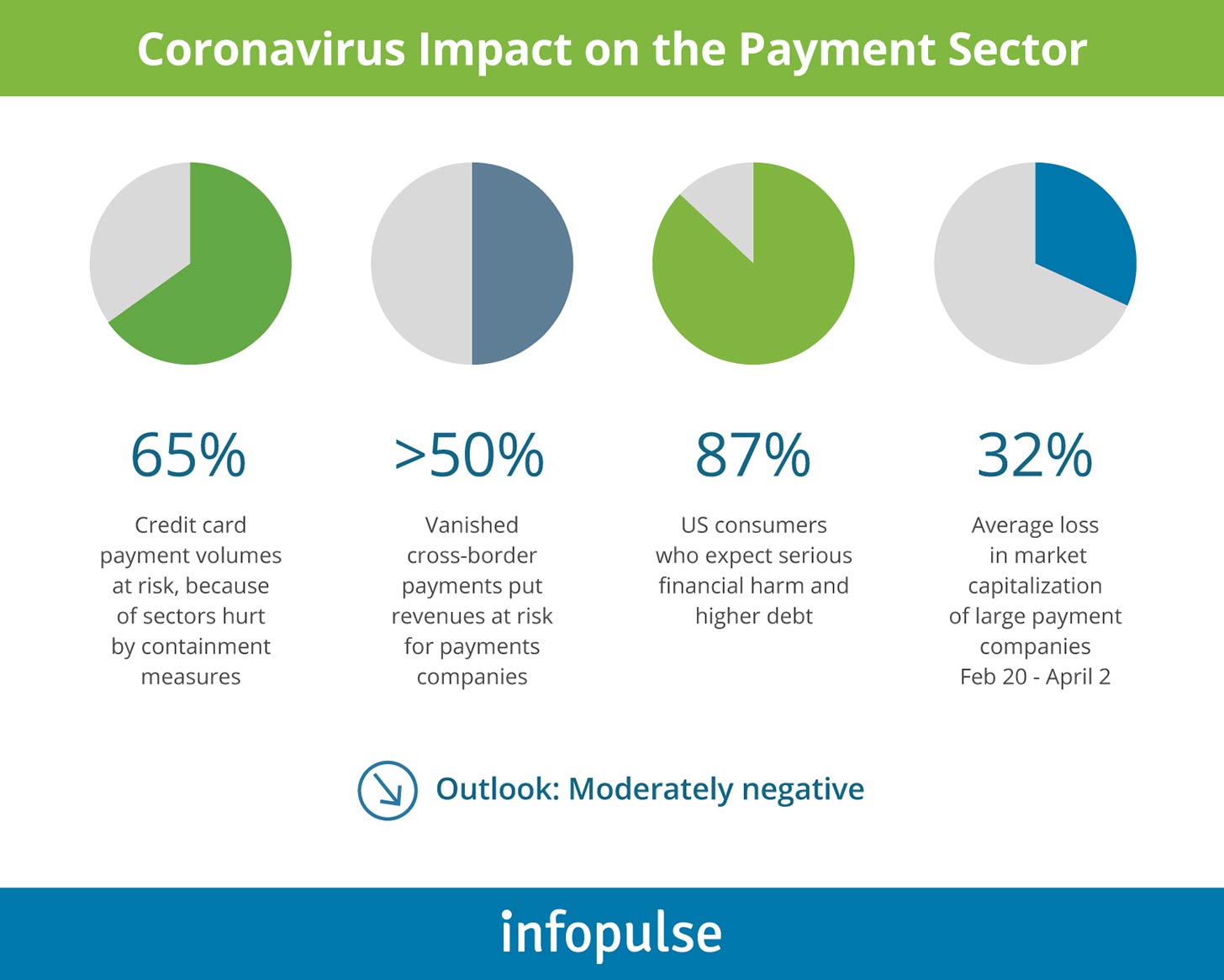

Both banks and payment services providers (PSPs) have experienced compressed revenues due to decreased financial services consumption. As a result, most are actively seeking ways to reduce operational costs to offset the faded revenues and stabilize cash flow. Research suggests that larger financial companies have had to cut on investment in innovation.

Despite the unfavourable climate, right now the ability to act fast on innovative payment technologies can be crucial for all companies. Otherwise, reluctant investors may find themselves cash-rich, but customer-poor within the short-term perspective. A survey conducted in May 2020, suggests that digital banking has become the new normal for most consumers:

- 79% want more all-digital processes from their bank in the short-term;

- 47% look forward to the drive-thru or touchless banking;

- Only 26% would prefer in-person banking with safety measures.

The earlier mentioned Visa study also suggests that as much as 63% of consumers will switch to a store that offers touchless payment methods.

For most financial players now is the high time to capitalize on the newly emerging payment trends post-COVID-19 and accelerate investment in new mobile, contactless, and embedded payment propositions.

Accelerate Development of Mobile Banking Solutions

The market data unanimously shows that remote digital banking and online bank transfers are the new operational normal for most consumers. For those still lagging behind in adoption, we recommend reading our ongoing Mobile Banking Series, where we discuss the core aspects of developing a viable mobile banking application that delights customers and drivers extra profits.

In addition, we showcase the technical nuts and bolts of building a mobile banking app that was subsequently adopted in 10 Scandinavian markets in a detailed case study.

Improve Payment Fraud Detection Mechanisms

As more businesses accept payments online and experiment with alternative payment methods, security risks and payment fraud increase proportionally. Card-not-present (CNP) fraud levels have been on a steady rise over the past few years. Unless no targeted action is taken, retailers can lose $130 billion to CNP fraud and part of that toll will fall on the payment services providers and card issuers.

New digital banking and payment solutions will require improved security and anti-fraud mechanisms. Predictive analytics and machine learning have emerged as two strong contenders for attaining real-time monitoring over anomalies. Such ‘intelligent’ systems can scan over through billions of transactions and identify unusual behaviour faster and at a higher accuracy than the current rule-based systems most banks rely on.

As banking goes remote, you should also focus on strengthening (or developing from the ground) your digital KYC processes since these will be integral to ensure customer data security. Blockchain technology is one of the strong the technological contenders for enabling an efficient, secure, and immutable system for storing and exchanging sensitive customer data and other credentials. In addition, digitizing the KYC process can result in significant operational savings as we showcase in our case study.

Prepare for Embedded Payments and IoT Payments

During the pandemic, non-financial players accelerated their move on the payment providers turf and are now luring in customers with integrated, invisible payment experience, offered as part of their brand. Starbucks and, more recently, 7-Eleven, have a convenient mobile wallet app that lets customers pre-order goods, choose a pick-up location, and pay in one tap. Alipay and WeChat – the two Chinese super apps – are also chipping away profits from traditional PSPs, along with a goldmine of customer data.

On top of that, with the rise of voice payments, driven by smart speaker tech and assistants, FIs will experience further market erosion. While connected commerce may not go mainstream as soon as estimated, the in-car payment market is another area where traditional players are losing to technology companies and FinTechs. Lastly, prepaid store cards (that are replacing cash among underbanked consumers) add further to payment market fragmentation post-pandemic.

All of these newly emerging payment avenues stand for untapped revenue opportunities for financial players. However, to capture those future profits, you need to plan ahead:

- Determine how your core payment technology needs to be adapted to drive interoperability with other players;

- Identify emerging digital customer journeys and new ways to add value to them;

- Extend your partnership network to accommodate new participants that could benefit from embedded payments.

To Conclude

The payment sector may not be in its best beat right now, but it’s soon to bounce back to pre-pandemic spending levels. What has changed is the way consumers interact with different payment mediums – digital wallets, contactless payments, voice, and wearable payments. Technologically preparing for these major shifts in behaviour is crucial to ensuring future stability in operations.

Contact the Infopulse financial development team to learn more about the process of developing secure financial applications and embedded payment experience. A trusted partner to Fortune 500 banks and global retailers, we have cross-domain experience in developing innovative financial solutions that fit into the newly emerging types of digital consumer journeys.

About the Author

Oleksandr Nikolaienko has 20 years of overall IT experience, 15 years of which he dedicated to project management and business analysis. He contributed to the development and delivery of financial software, risk management solutions, internet and mobile banking solutions. He has proven expertise in managing the entire portfolio of projects in FinTech, Logistics, and Telecom. Oleksandr is a highly qualified expert having earned such international certifications as Project Management Professional (PMP)®, Certified ScrumMaster® (CSM), Certified SAFe 4 Agilist® (SA), and ICAgile Certified Professional – Delivery at Scale (ICP-DAS). Connect with Oleksandr Nikolaienko on LinkedIn.

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![Generative AI and Power BI [thumbnail]](/uploads/media/thumbnail-280x222-generative-AI-and-Power-BI-a-powerful.webp)

![AI for Risk Assessment in Insurance [thumbnail]](/uploads/media/aI-enabled-risk-assessment_280x222.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![5G Network Holes [Thumbnail]](/uploads/media/280x222-how-to-detect-and-predict-5g-network-coverage-holes.webp)

![How to Reduce Churn in Telecom [thumbnail]](/uploads/media/thumbnail-280x222-how-to-reduce-churn-in-telecom-6-practical-strategies-for-telco-managers.webp)

![Automated Machine Data Collection for Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-how-to-set-up-automated-machine-data-collection-for-manufacturing.webp)

![Money20/20 Key Points [thumbnail]](/uploads/media/thumbnail-280x222-humanizing-the-fintech-industry-money-20-20-takeaways.webp)