Combining Data Analytics and AI in Finance: Benefits and Use Cases

Across the board, financial leaders have a penchant for artificial intelligence (AI). Over 90% of financial services companies are either assessing or already using AI in production, according to the State of AI in Financial Services Report from NVIDIA. In this post, you will learn exactly how leading banks use AI to gain extra operating speeds and insights for improving their profitability.

What Does AI Bring to Financial Services?

Analytics underpins the entire financial sector, with the earliest systems emerging in the 1970s-1980s, like SPSS Statistics or Oracle’s first Financial Services Profitability Management (FSPM) system. Such systems provided banks with the capability to run cost estimation and profitability modeling using pre-programmed rules.

Many institutions still rely on rule-based or logistic-regression models to determine credit scoring, underwrite insurance policies, or manage liquidity risks. However, traditional data analytics models have inherent limitations:

- Only support structured data sources (e.g., financial statements and transactional data), which hinders the institutions’ ability to use alternative big data sources.

- Limited predictive capabilities. Such models rely on pre-codified parameters. When the actual market conditions change, their accuracy decreases dramatically. Rule-based models also have limited forecasting potential, exposing financial institutions to unforeseen risks.

- High rates of false positives. Every case that slightly deviates from the pre-programmed parameters will be treated as an anomaly due to the system’s failure to process it properly.

Advanced data analytics techniques like machine learning and deep learning emerged to address the above shortcomings. Unlike rule-based models, ML systems can process both structured and unstructured data, identify new patterns and correlations rather than just follow the pre-programmed command, and automatically execute complex analytical workflows (e.g., underwriting for insurance policies) with the same or even higher degree of accuracy as humans.

Advantages of AI for Financial Analytics

- Multi-dimensional analysis. AI models can identify new correlations in datasets that are indicative of new market trends or shifts in operations.

- Faster time-to-insights. Analytics can be performed on real-time data in a matter of seconds, enabling faster decision-making.

- Predictive and prescriptive insights. Traditional models provide diagnostic and descriptive analytics. AI models can use historical and real-time data for advanced predictive forecasting and ‘what-if’ scenario modeling.

- Higher scalability. AI models are easier and faster to re-train to support new use cases and/or changes in operating conditions than rule-based models.

Advanced Data Analytics Use Cases in Finance

A Grant Thornton survey also reveals that financial companies plan to use AI to enhance customer experience and engagement (61%), improve decision-making (54%), and automate routine tasks and processes (51%) this year.

Let’s take a look at how financial leaders achieve these objectives with advanced data analytics and AI.

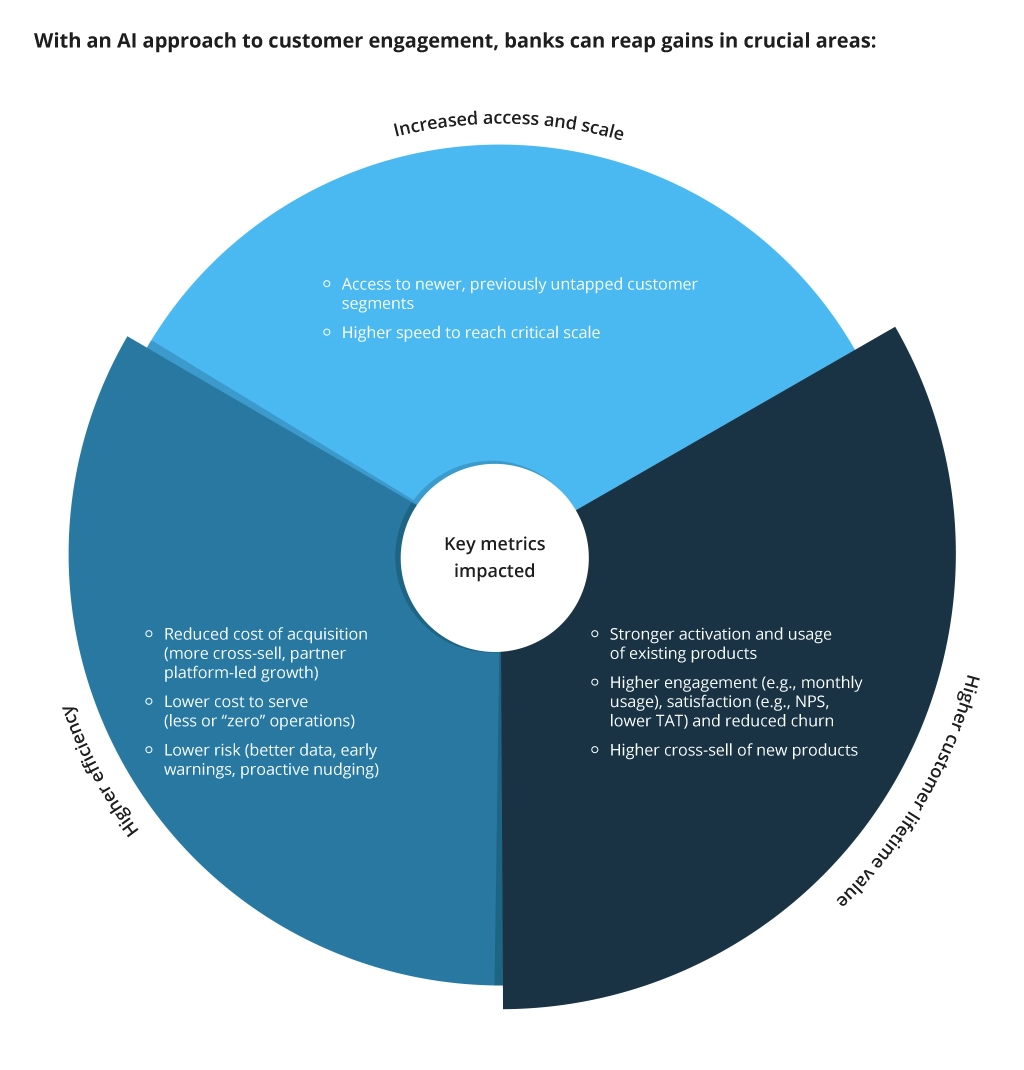

Customer Intelligence

Better analytics translates to better customer experience and higher customer loyalty. By using machine learning models, banks can offer more personalized guidance to customers. AI can predict future financial needs based on transaction records, spending patterns, and the financial aspirations of each customer and recommend the optimal solution for them. This level of personalization can help build stronger customer relationships, increase loyalty, and drive profitability.

Morgan Stanley WealthDesk allows advisors to model different real-world client scenarios to delight them with personalized investment strategies. Apart from running historical analysis, the platform can also predict the customers’ needs based on recent life events. For example, a system may suggest the best time to set up a college fund if a customer recently had a child.

Capital One has been using neural nets and gradient-boosted models for several years to streamline customer service charts, run sentiment analysis, and detect fraud. The bank is now looking to ‘upgrade’ to a large language model (LLM) to enhance its customer service function further. Prem Natarajan, the bank’s head of enterprise data and AI, mentioned that CX is a particularly rich use case for gen AI in finance because of the richness of interactions banks have with customers. Advanced analytics solutions can help leaders capture, consolidate, and operationalize a wider range of signals in customer data and translate these into actionable decision intelligence: better marketing campaigns, new product up-sell/cross-sell offers or entirely new service lines.

Risk Management

Financial institutions need to maintain the balance between available assets and liabilities to ensure optimal liquidity levels. Failure to do so leads to inevitable collapses, as was the case with Silicon Valley Bank, Credit Suisse, and Signature Bank. Risky investments and poor credit decisions are often behind such turmoil.

AI can help address the shortcomings of traditional statistical and rule-based models, which often fail to account for:

- Micro- and macro-economic market conditions affecting specific sectors or customer segments.

- Large capital outflows from customers due to temporary market turbulence and subsequent liquidity shortages.

ML models can process a wider range of data inputs (structured and unstructured), providing financial institutions with warning signals across their credit product portfolio. Such systems can also help better evaluate latent systemic risks and recalibrate governance practices accordingly, enabling banks to increase their loan volume without being exposed to higher client default risks.

Moody’s EDFX system, named the “Best Predictive Analytics Platform” in 2023, allows users to augment time-tested credit models for 450 million businesses with real-time market insights to model different stress performance scenarios. Users can also model different predictive scenarios using trade payment behavior, firmographics, and economic climate data to determine the company’s resilience under different conditions.

In retail banking, better risk management analytics can lead to faster, fairer, and more equitable credit decisions. Infopulse recently helped Santander Consumer Bank AG launch a new wholesale risk management system for corporate lending. With the new systems, lending decisions now take an hour instead of a week, leading to higher customer satisfaction and consistent revenue growth without extra risk exposure.

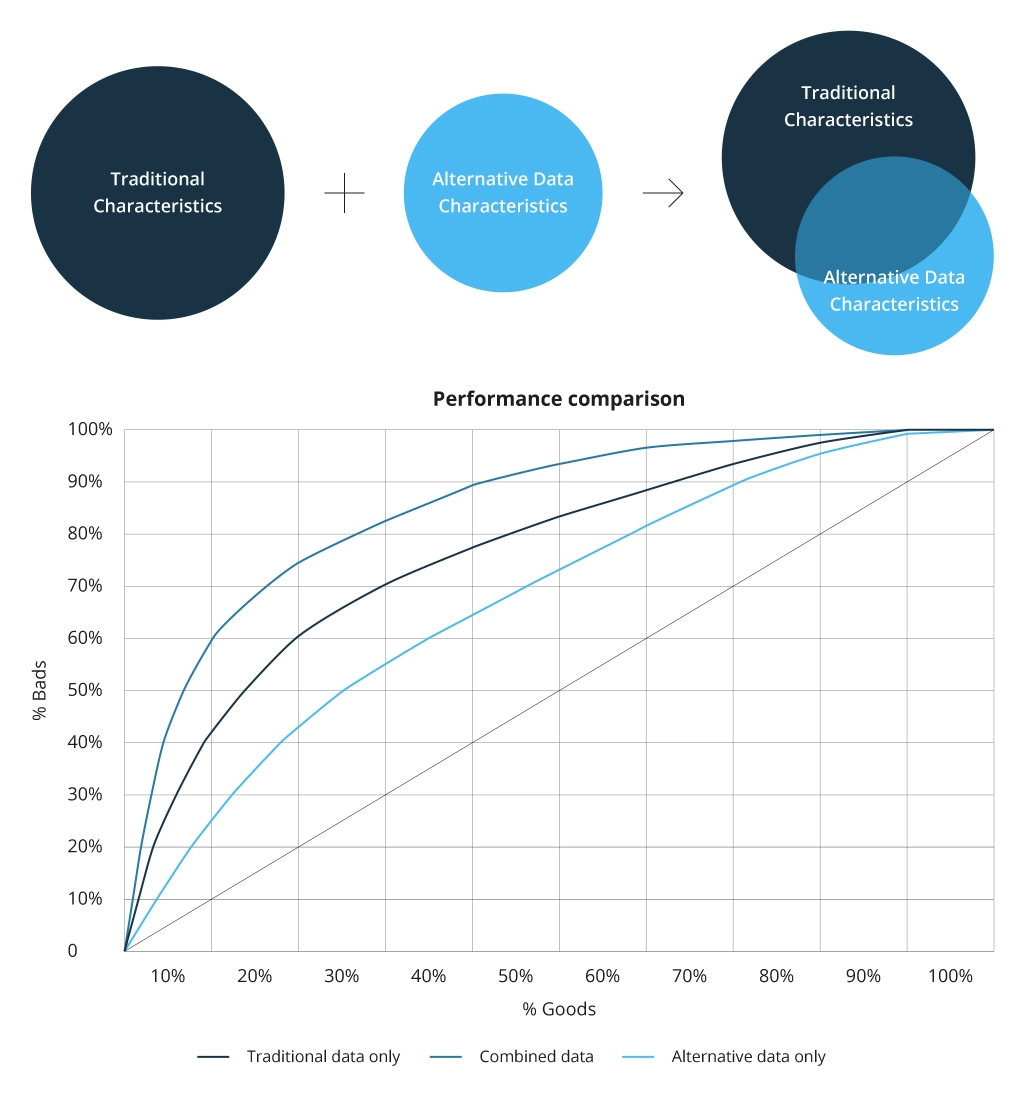

Credit Scoring and Loan Underwriting

Traditional loan origination systems rely on a limited number of variables (10-20 on average) to assess the applicant’s creditworthiness. ML and DL algorithms can bring greater data variety and fidelity to credit assessments, leading to improved accuracy, inclusion, and profitability.

By combining traditional credit data with alternative data (e.g., rental payments, utility, employment history, etc.), retail banks can obtain multidimensional insights about borrowers and safely extend credit to more people.

Fifth Third Bank developed a custom credit card loan origination model powered by traditional and alternative data (like deposit history). The new system is expected to increase credit approval rates by 10%, leading to higher profitability.

Intelligent automation can also dramatically improve the speed of loan origination, allowing banks to delight customers with near-instant approvals. Using AI, the British mortgage provider MPowered reduced the average time for completing a mortgage application from 1-2 hours to 8-10 minutes. The company now works on fully automating formal mortgage offer generation by also streamlining property valuation processes.

Wealth Management

Nine out of ten financial advisors believe AI can help organically grow their book of business by more than 20% in the next several years. The rapid growth of robo-advisory financial products has already proved that retail investors feel comfortable with fully automated experiences. Moreover, half are comfortable acting on financial advice obtained via generative AI systems. Popular personal finance management apps like Cleo and NerdWallet rely on proprietary AI models to provide users with hyper-personalized money management tips.

That said, AI won’t fully replace human advisors but rather scale the degree of precision and personalization they can offer in terms of portfolio creation and ongoing management. Morningstar created a custom generative AI assistant for its financial advisors to help with investment research and analytics. Nicknamed Mo, the tool can easily resurface necessary data from the company’s in-depth pool of equity and managed investment research, editorial, and ratings.

Morgan Stanley plans to roll out a GPT-powered assistant that will create client meeting summaries, draft follow-up suggested portfolio steps, and help advisors deliver better advice in areas like taxes, retirement savings, and inheritances.

Fraud Prevention

Fraud prevention is another area where machine learning algorithms can add substantial value. Benchmarks have shown that machine learning methods like probabilistic neural network (PNN), genetic algorithms, Naïve Bayes classifier, and support vector machine (SVM) can detect financial fraud with 95% to 98% accuracy rates.

In contrast, traditional rule-based fraud detection systems can generate false positive rates of 30-70% for online payment transactions. Analysts must then manually review and investigate false positives, leading to extra operating costs. In one case, 7% of fraud losses were due to fraud, and 19% — due to false positives.

Digital challenger bank Revolut developed an ultra-efficient fraud detection system powered by machine learning. The system instantly detects 96% of the fraudulent transactions. With other security features in place, Revolut loses just $1c out of $100 processed to fraud, far less than the industry average. In 2024, the Revolut team presented an ‘upgrade’ to its model. The system can now detect if the customer is being scammed and asked to send money to a fraudulent entity. During the pilot tests, the bank saw a 30% reduction in fraud losses from card scams involving investment opportunities.

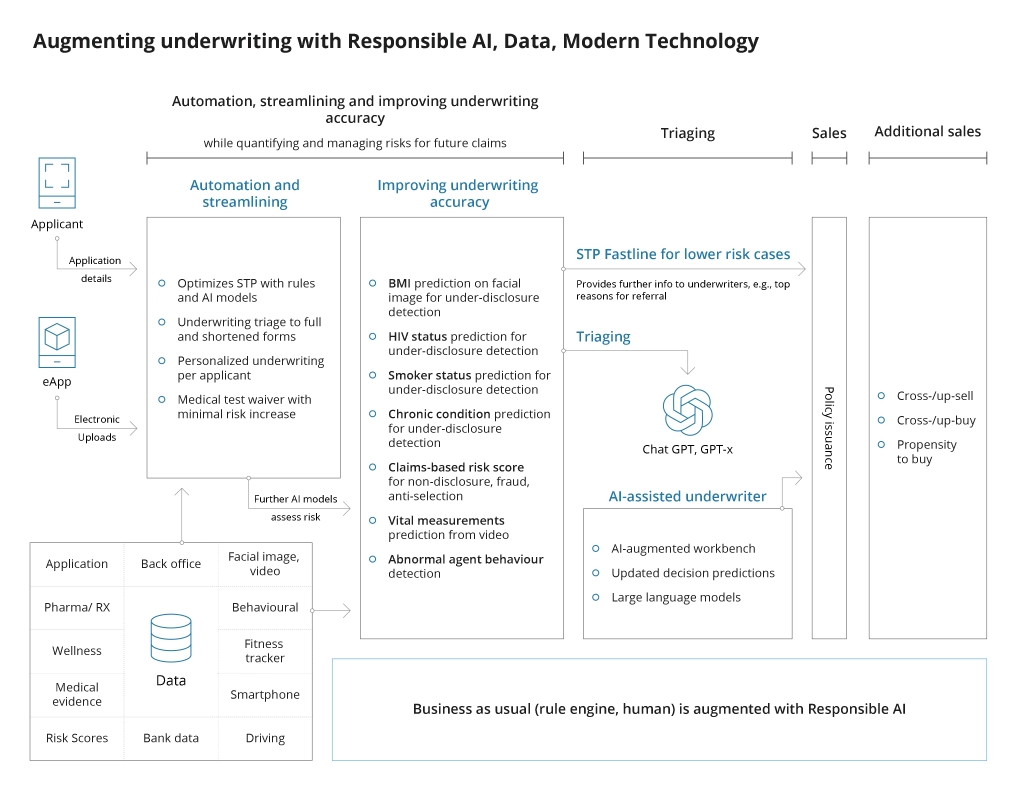

Advanced Claims Management

Similar to lending, machine learning can bring greater efficacy to policy underwriting and claims management. At the underwriting stage, algorithms can help insurers collect data from a wider range of sources to evaluate the insured asset holistically. Instead of relying on cumbersome, manual data collection methods, insurers can automatically cross-check and validate submitted evidence and auto-approve low-risk applicants in real time, increasing straight-through processing rates and customer satisfaction.

While MunichRe focused on life and medical insurance underwriting, Hiscox joined forces with Google to create an AI-powered system for underwriting a property sabotage and terrorism policy. Planned for release in the second half of 2024, the tool will reduce time on policy quote generation to minutes instead of days, allowing staff to focus on more complicated cases.

Beyond underwriting, machine learning can also help streamline the claims management process, reducing approval times without increasing fraud levels. Computer vision algorithms can rapidly assess visual evidence and capture data from the submitted notices of loss or witness statement reports. Compensation estimates can then be auto-calculated based on the company’s policies and the client’s insurance coverage to provide the user with the final settlement in hours rather than weeks.

Conclusion

Financial institutions have a wealth of data they can use to power AI-based decision engines. Deployed at scale, such advanced analytics engines can provide a significant competitive advantage in areas like customer experience, fraud prevention, risk management, loan origination, insurance underwriting, and wealth management.

Explore the possibilities of AI in banking with Infopulse. From creating intelligent assistants for customer support to building real-time financial analytics systems, our AI and ML team helps global financial leaders capture more value from emerging technologies.

![Data Analytics and AI Use Cases in Finance [MB]](https://www.infopulse.com/uploads/media/banner-1920x528-combining-data-analytics-and-ai-in-finance-benefits-and-use-cases.webp)

![Generative AI and Power BI [thumbnail]](/uploads/media/thumbnail-280x222-generative-AI-and-Power-BI-a-powerful.webp)

![Data Analytics Use Cases in Banking [thumbnail]](/uploads/media/thumbnail-280x222-data-platform-for-banking.webp)

![AI and RPA Integration for Banking [Thumbnail]](/uploads/media/thumbnail-280x222-ai-and-rpa-integration-for-banking-possibilities-of-intelligent-automation.webp)

![Data Storage Security [thumbnail]](/uploads/media/thumbnail-280x222-data-storage-security.webp)

![Challenges of Big Data Analytics [thumbnail]](/uploads/media/thumbnail-280x222-challenges-to-consider-before.webp)

![Big Data Sources [thumbnail]](/uploads/media/thumbnail-280x222-big-data-sources.webp)

![Data Modelling Power BI [thumbnail]](/uploads/media/thumbnail-280x222-data-modelling-in-power-bi.webp)