Data Analytics for Banking & Fintech: Use Cases

Since the financial industry is currently undergoing a digital transformation, institutions are under constant pressure to deliver new products and services to their customers. This compels them to stay updated with the latest trends and technologies. As a result, data analytics is experiencing a surge in demand, fueled by the widespread adoption of AI, ML, and other data-driven solutions.

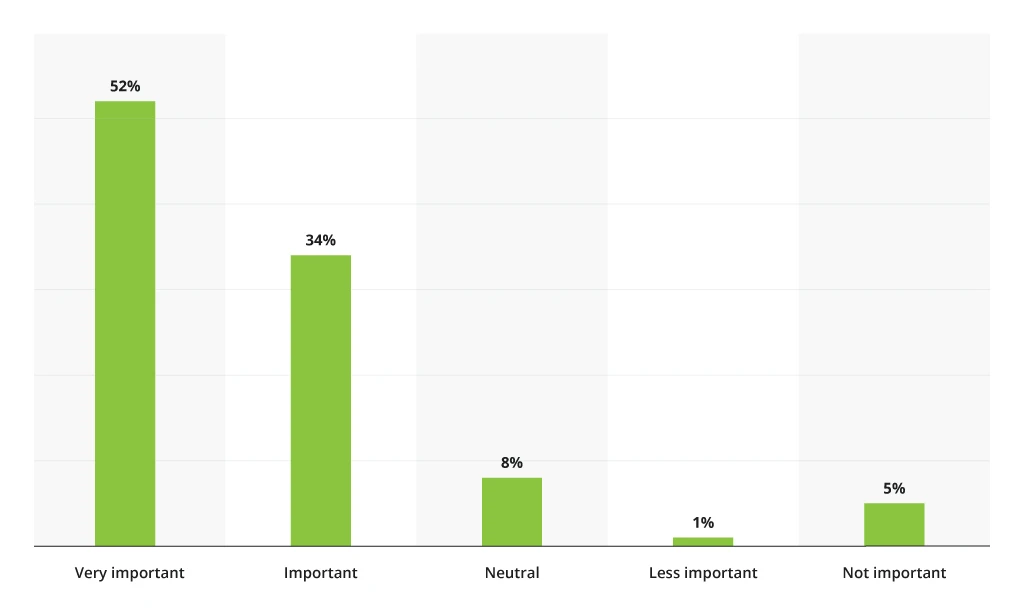

The global market for big data analytics in the banking industry alone is projected to reach $24.28 million by 2029. This astronomical figure highlights the transformative potential that data analytics holds for financial institutions — FinTech Future’s industry report shows that comprehensive data analytics is important for 86% of respondents.

The Role of Data Analytics in The Banking Sector

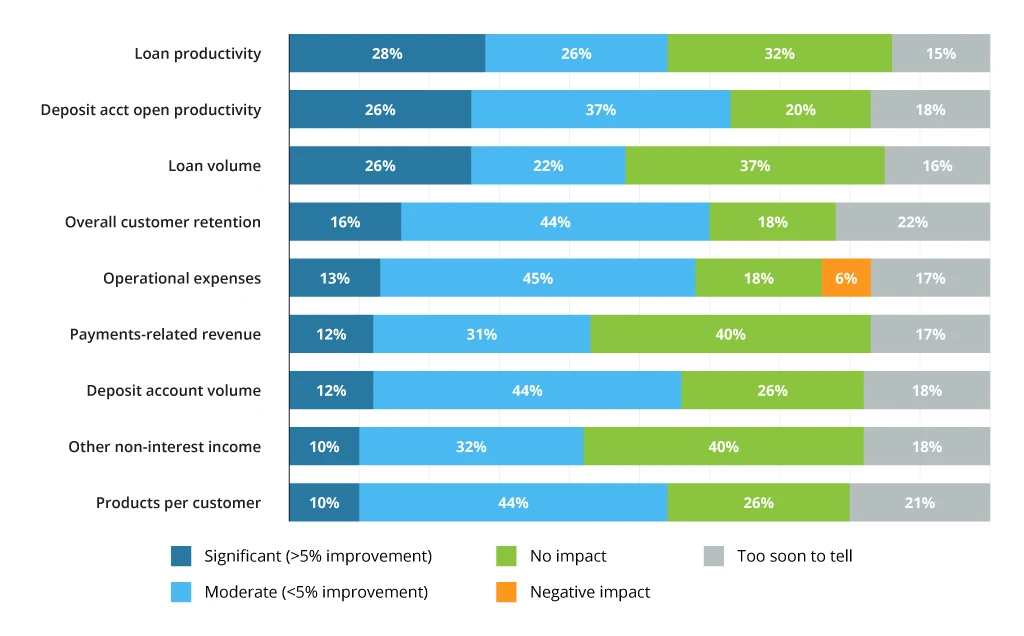

The report by Cornerstone Advisors compiled data on the impact of digital transformation on key performance indicators in the banking industry.

Despite its positive impact on business metrics, currently only 20% of institutions are more than halfway through their digital transformation strategy.

However, a new era is dawning. According to Statista, the number of open banking users worldwide is growing at an average annual rate of nearly 50% a year. This creates the need for data analytics — to figure out how best to use all this data, who should have access to it, and when. Therefore, banks need robust data analytics capabilities to effectively manage access, identify optimal usage scenarios, and ultimately, extract valuable insights from their data.

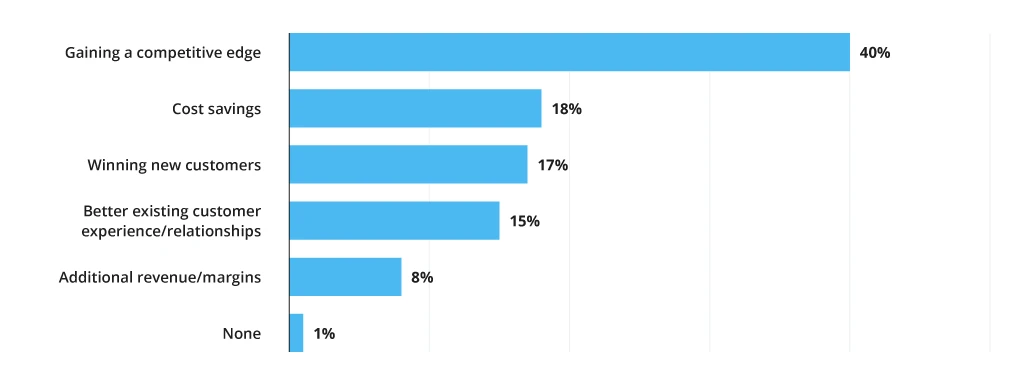

Also, a data platform's centrality in an organization's IT ecosystem depends on whether its benefits and purpose are well appreciated. Organizations, navigating diverse business currents, seek unique advantages. Whether disrupting industries, personalizing customer experiences, or optimizing operations, data analytics emerges as a powerful compass. For instance, 40% of organizations expect to get a competitive edge from their data analytics solutions.

With all the factors stated above, financial institutions rely heavily on the data platform as the backbone of their IT infrastructure. Let's take a more in-depth look at the ways in which a data platform can be useful to the financial industry.

Use Cases of Data Analytics in Banking and Financial Services

A 360-Degree Customer View

A 360-degree view of the customer is one of the most sought-after benefits of a data platform — according to the Accenture's 2023 report, 83% of global executives believe a single customer perspective is critical for delivering personalized experiences.

With the data platform, client information can be stored and updated regularly, enabling the bank to develop detailed client profiles that reflect its key areas of focus. In other words, it provides a comprehensive perspective of the client that is supplemented by data from many sources.

For instance, a CRM system stores crucial client information, such as their hobbies, marital status, potential interest in financial products, and responses to marketing campaigns. Meanwhile, clients' spending habits are tracked through the card system, and when combined with core banking, banks can get details about a customer's financial assets — credit, current account, deposit, securities and so on.

Having a full picture of the client's habits equips banks to better tailor their marketing efforts to offer users exactly what they need — whether it is a credit card, a savings account, auto or travel insurance, or a concierge service. Customer data is of most relevance to sales and marketing teams since narrowing in on a specific demographic allows for more personalized, engaging sales pitches.

Optimized Loan Process

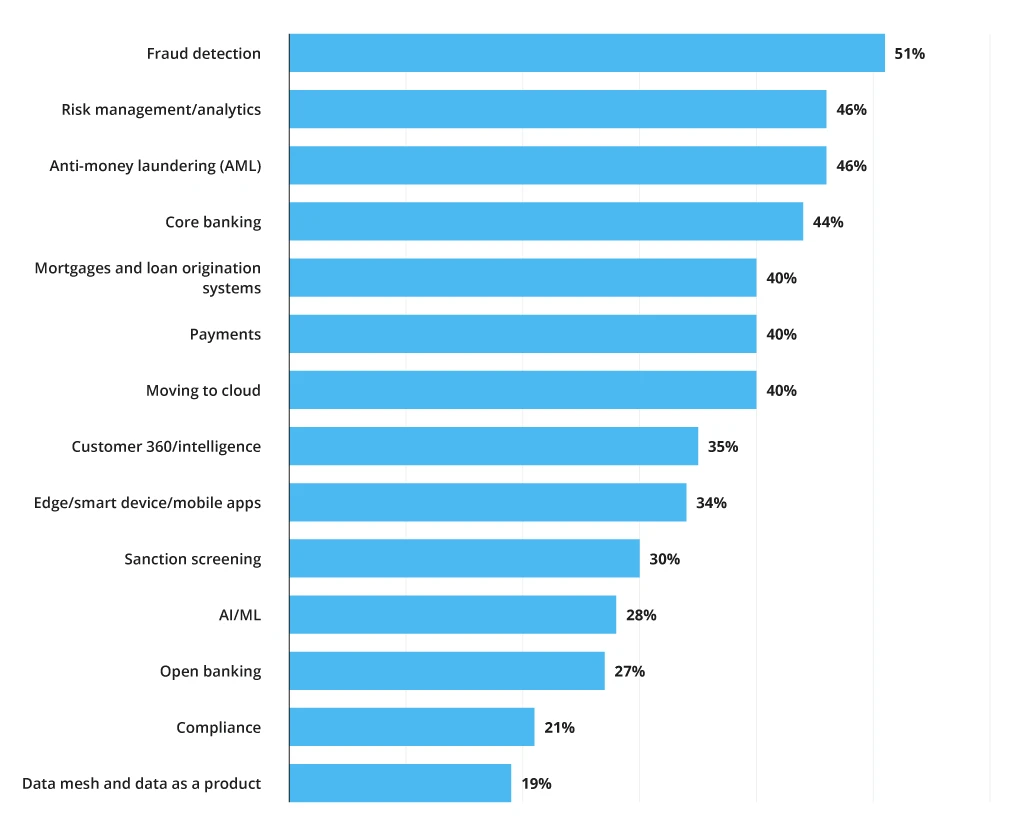

Data platform serves as a central location for all lending-related data, which contributes to streamlining the loan process, including loan origination, servicing, collections, risk management, and reporting. The study commissioned by MongoDB shows that 40% of respondents say they are planning to use data platforms for mortgages and loan origination processes.

Since data platform combines machine learning with big data analytics, it uses advanced algorithms to analyze historical data from various sources like credit bureau reports. This analysis results in models that can predict how big of a loan should be offered to a given customer depending on their credit profile and other relevant factors. Such a model also predicts the probability of defaulting on loans (if any) within a certain period after it is closed or disbursed.

Overall, data platforms boost the loan giving by automating the entire process, making it faster and more efficient. Their implementation also brings some additional advantages:

- Reduced paperwork and manual errors. Streamlined digital processes minimize reliance on paper documents and manual data entry, which leads to fewer errors and improved accuracy.

- Better customer experience. Faster processing times, transparent communication, and personalized loan options directly contribute to an improved customer experience.

- Regulatory compliance. Data platforms facilitate easier compliance with regulations since they maintain a centralized audit trail and ensure data security.

Adopting Data Analytics Tools

The data platform's true value lies in transforming raw data into actionable insights that empower decision-makers to optimize strategies and drive tangible business results. According to the McKinsey Global Institute, businesses that utilize advanced analytics typically outperform their counterparts by up to 10% in profitability.

State-of-the-art analytical tools handle enormous datasets in real-time, providing clear and pertinent insights into customer behavior, preferences, and market trends. These insights enable decision-makers to:

- Enhance product offerings. Discover previously unidentified product combinations that resonate with specific customer segments, resulting in increased sales and customer satisfaction.

- Fine-tune marketing campaigns. Customize messaging and targeting strategies based on customer insights, thus maximizing the effectiveness of marketing campaigns.

- Adjust strategies. Evaluate market trends to identify emerging opportunities or potential threats, enabling proactive adjustments to strategies.

Case in point. Infopulse implemented a real-time Financial Analytics Application for a top audit and professional services firm. By transitioning Finance databases to SAP HANA Advanced Financial Analytics and integrating Special and General Ledger data, Infopulse enabled near real-time data availability and boosted data processing speeds by up to 100 times. This automation reduced manual reporting efforts by empowering over 10,000 daily users with advanced analytics capabilities and facilitating more informed strategic decision-making.

Business Process Automation

Through the strategic use of the power of data, companies can optimize their operations and increase efficiency, which was named the top technology priority by 41% of respondents. This is especially relevant in banks, where there are a lot of manual operations that need to be automated.

Combining business process automation with data analytics unlocks significant advantages for the banking industry, thanks to:

- Automation opportunities: data analysis can pinpoint repetitive, time-consuming tasks, allowing banks to prioritize automation efforts effectively. Transaction logs, customer interactions, and internal process data can reveal bottlenecks and areas ripe for automation.

- Enhanced decision-making: data analytics provides valuable insights into customer behavior, market trends, and risk factors. Banks can leverage this information to automate decision-making processes, such as credit scoring, fraud prevention, and personalized product recommendations.

- Improved customer experience: automation frees up human resources to focus on personalized customer interactions. Chatbots and virtual assistants powered by data analytics can handle routine inquiries, while employees can address complex issues and build stronger relationships.

- Increased compliance and risk management: data analysis can be used to identify patterns and anomalies as a part of risk management. Automated systems can flag suspicious activity for further investigation, ensuring compliance with regulations and minimizing financial losses.

In general, the data platform guarantees that all necessary data is available when needed, regardless of whether it is stored in the bank's own databases or external systems. This is certainly an important feature for customer experience management and customer engagement.

Personalized Experiences

The ability to offer personalized experiences is one of the most important competitive differentiators in today's banking world. However, the World Retail Banking Report 2022 shows that 44% of customers claim that they are not getting enough personalization from their bank.

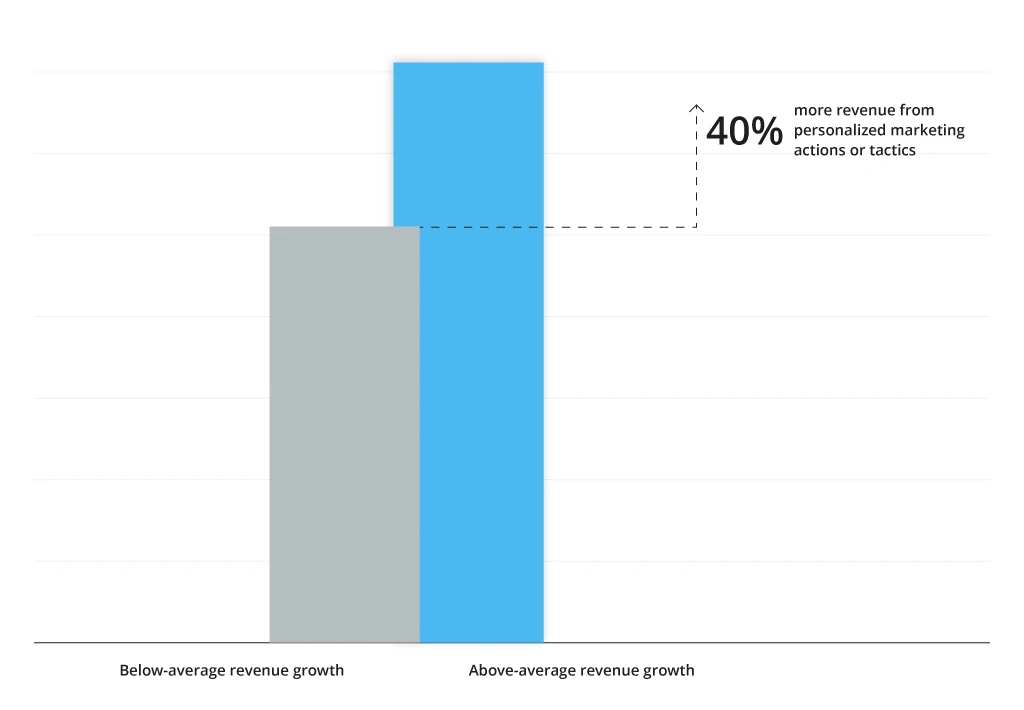

The sales and marketing strategy, which has been actively exploring new channels to reach its target audience, warrants serious consideration in utilizing data platforms. Some 71% of customers have high expectations that businesses will provide them with personalized interactions; another 76% express disappointment when these expectations aren't met, according to a McKinsey survey. Moreover, businesses that derive greater value from personalization tend to expand more rapidly.

Platforms are now shifting towards becoming online business helpers. This idea involves platforms analyzing customer actions in almost real-time using GSM or GPS data and utilizing it when needed. For instance, if the client wishes to visit a car dealership, it is worth instantly sending them a tailored offer for a car loan via an SMS or the application.

Also, if a customer has purchased a TV, banks can automatically offer to transfer the payment in installments and provide a credit program for purchasing subsequent goods. In other words, the platform's primary purpose is to monitor the client's wants and interests and, if not to work ahead of the curve, to at least not be late with the relevant offer.

Conclusion

The need for a data platform to help banks realize the full potential of their data and IT investments has become more important than ever before. To put it all together, we can say that it is currently impossible to imagine an organization without a modern cloud data platform that can replace most of the manual work (like generating reports, calculating different indicators, and analyzing the information provided) with the platform. With the help of data platforms, businesses can integrate different systems and create a unified environment to manage all their data in one place. This, in turn, helps them gain insights into customer behavior and make better decisions on time.

![Data Analytics Use Cases in Banking [banner]](https://www.infopulse.com/uploads/media/banner-1920x528-data-platform-for-banking.webp)

![Advanced financial analytics application [promo]](/uploads/media/promo-mob-280x183-advanced-financial-analytics-application-speeds-up-data-processing-by-100x.webp)

![Generative AI and Power BI [thumbnail]](/uploads/media/thumbnail-280x222-generative-AI-and-Power-BI-a-powerful.webp)

![Data Governance in Healthcare [thumbnail]](/uploads/media/blog-post-data-governance-in-healthcare_280x222.webp)

![AI for Risk Assessment in Insurance [thumbnail]](/uploads/media/aI-enabled-risk-assessment_280x222.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![Carbon Management Challenges and Solutions [thumbnail]](/uploads/media/thumbnail-280x222-carbon-management-3-challenges-and-solutions-to-prepare-for-a-sustainable-future.webp)

![Automated Machine Data Collection for Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-how-to-set-up-automated-machine-data-collection-for-manufacturing.webp)