How to Extend Oracle FLEXCUBE Capabilities for Core Banking?

Understanding these risks and aiming to improve their competitiveness, banks adopt modern banking software and shift their operations towards automation. Yet, 38% of executives report that transformations underperform against set KPIs. How to match the expectations with realistic outcomes? How to get maximum value from transformative efforts?

In this article we will review how to extend the capabilities of modern core banking software to fit the specific organization’s needs and processes. Today we will focus on ways to enrich the standard Oracle FLEXCUBE capabilities based on the real cases from Infopulse practice.

What Is FLEXCUBE?

FLEXCUBE is an automated universal core banking software created and supported by Oracle Financial Services. The system is used by financial organizations worldwide to deliver customer-facing core banking functionalities, enhance collaboration between bank employees and consumers, automate operations, launch new products and services faster, and ensure a single customer view for analytics and data-driven decision management.

In 2022, Oracle FLEXCUBE was named a leader in the Gartner Magic Quadrant for Global Retail Core Banking. The system is used for universal, retail, corporate banking, and microfinance, and also supports Sharia-compliant Islamic banking. Currently, 1,600+ banks in over 140 countries run Oracle FLEXCUBE, including Allianz Bank Bulgaria, Citigroup (USA), Wells Fargo (USA), MKB Bank (Hungary), and others.

The open-source environment of FLEXCUBE allows users to create unique business logic and interfaces. The system can also be integrated with third-party applications through APIs, all of which facilitates the following improvements for Banking & Finance:

- Migrate from legacy systems that are unable to support the bank’s expansion.

- Get a 360-degree customer view: FlexCube maintains a centralized customer database with personal information, transaction histories, account details, interaction records, and all other data about their banking relationships.

- Enable omnichannel banking, including online, mobile, ATM, and branch banking.

- Centralize data processing: Oracle FLEXCUBE consolidates data from different sources into a single system, including big data, AI, and other advanced improvements.

- Use advanced analytics and reporting to assess customer needs and create the corresponding product and service offerings.

- Provide high-level customer support: FlexCube has an integrated customer relationship management (CRM) module that provides personalized services and improves customer satisfaction and loyalty. At the same time, it gives capabilities for customer service automation that significantly streamlines related operations.

- Accelerate products time to market to respond to market changes and regulatory demands timely.

- Reduce operational expenses and increase revenue: process automation, lower IT maintenance and infrastructure costs, on-demand scalability, comprehensive cross-selling and up-selling features help banks operate more efficiently and profitably.

The decision to migrate to modern software doesn’t solve all the issues of legacy systems by default. Transition to a new core banking system is a complex multistage process. It often implies integration with other systems inside and outside the organization’s infrastructure to ensure uninterrupted operability and service delivery.

When Is It Necessary to Extend Standard FLEXCUBE Functionality ?

Here are some use cases and situations when banks may require custom extensions to Oracle FLEXCUBE features:

- Unique business requirements. Oracle FLEXCUBE customization becomes necessary when a bank or financial institution has specific business requirements that standard features of the core banking software cannot meet. Such could be related to complex product offerings, regulatory compliance, reporting, or customer segmentation.

- Integration with third-party systems. Many financial organizations have existing systems or applications that need to be integrated with FLEXCUBE. Customization may be required to ensure smooth integration and data exchange between these systems, enabling seamless workflows and improved efficiency.

- User interface (UI) and user experience (UX) enhancements. With FLEXCUBE, you can elevate UI/UX based on the organization's preferences and branding. It includes customizing dashboards, creating personalized workflows, and simplifying processes for users.

- Localization and compliance. Companies operating in different regions may be required to comply with local regulations and reporting standards. FLEXCUBE extensibility allows for the localization, including language support, currency conversions, legal and regulatory compliance requirements, tax calculations, and reporting.

- Scalability and future growth. As a financial institution grows and expands its operations, modifications may be necessary to ensure FLEXCUBE can accommodate the increasing volume of transactions, support new products and services, and adapt to evolving business needs.

- Competitive advantage. FLEXCUBE customization can also be used as a strategic tool to gain a competitive edge in the market. Financial institutions may extend the software to offer innovations, unique features, and differentiated services that set them apart from their competitors.

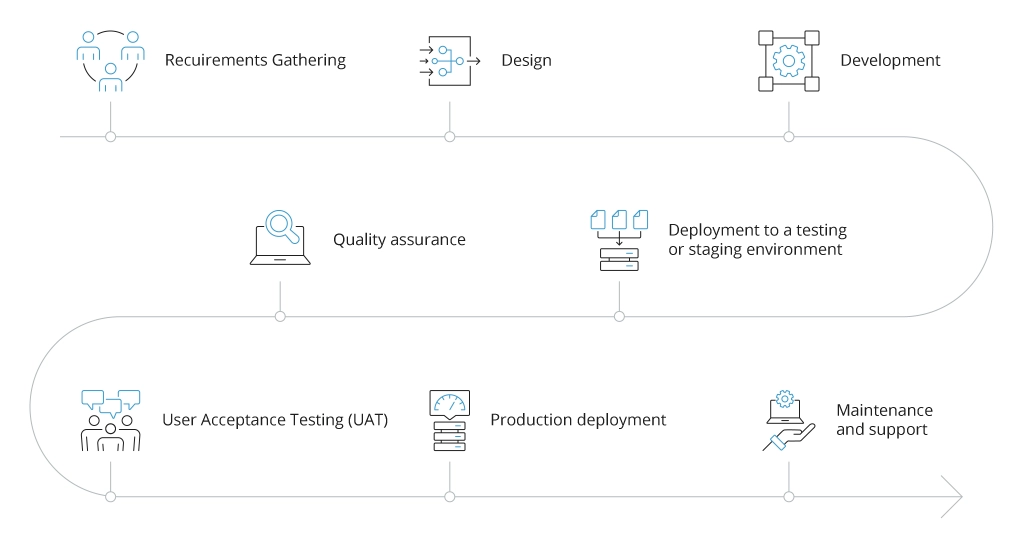

Oracle FLEXCUBE Extensibility Life Cycle

To ensure that the Oracle FLEXCUBE system effectively meets specific operational, regulatory, and performance requirements of the bank, it undergoes the customization process with several key stages:

- Requirement Gathering: To begin with, the bank identifies specific requirements for modification. They could include changes to the user interface, specific features, or integration with other systems.

- Design: In this stage, the bank works with FLEXCUBE consultants or developers to create technical designs, data models, and workflow diagrams based on the identified requirements.

- Development: Once the design is finalized, the changes are made by the FLEXCUBE development team. It may involve coding new functionalities, modifying existing features, or integrating additional systems.

- Quality Assurance: After the development is complete, the modifications undergo thorough testing to ensure they meet the required standards and are free from any errors or defects. It includes functional, integration, performance, and regression testing.

- Deployment to a testing or staging environment: Once the customizations have passed the testing phase, they are deployed to a testing or staging environment for further validation by the bank's end users. This is done to ensure that the implemented changes work as expected in a real-world scenario.

- User Acceptance Testing (UAT): The bank's end users, such as business analysts or operations staff, validate the customizations against their specific requirements. This stage helps to identify any issues or gaps that need to be addressed before the final deployment.

- Production Deployment: After successful UAT, the modifications are deployed to the production environment, where they become accessible to end users in real conditions. This stage calls for careful planning and coordination to minimize any disruption to normal banking operations.

- Maintenance and Support: Once the changes are live, ongoing maintenance and support are provided by the bank's internal team or Oracle consultants. It includes addressing any issues or bugs that arise and providing updates or enhancements to the customizations as needed.

Real Cases of Extending FLEXCUBE Functionality

To see how this flow works in practice, let’s review our hands-on experience with the initial implementation of Oracle FLEXCUBE for Allianz Bank Bulgaria and further projects to extend its standard capabilities to address the individual requirements of our client.

Oracle FLEXCUBE Implementation for Allianz Bank Bulgaria

Originally, Infopulse consulted Allianz Bank Bulgaria regarding the Oracle FLEXCUBE and its suitability to modernize their core banking systems. Consequently, the bank selected Infopulse to implement the Mortgages and Deposit Locker modules of FLEXCUBE to automate manual operations and enhance customer experience with streamlined safe deposit and mortgage services. The project scope included:

- Implementing Mortgages module with configuring 6 mortgage products and 16 different types of component accounting for mortgage agreements.

- Implementing Deposit Locker module with proper configurations for account creation deposit box fee, rental payment collection, and rental prolongation.

As a result, Allianz Bank Bulgaria gained:

- Improved customer experience with more flexible mortgage and safe deposit services.

- Higher employee satisfaction.

- Optimized operational costs and efficiency.

- Transparent view of deposit boxes for better security and management.

Read the full case study to see the technical details of the project and explore the full business value from the transformation.

24/7 Real-Time Incoming Instant Payment Service

Near real-time incoming payment processing was not only a highly expected service for bank clients, but also an obligation issued by the European Commission for all locally operating banks. To help Allianz Bank Bulgaria with that, Infopulse came up with the Microservices-based solution that reuses Oracle FLEXCUBE standard services and allows the following:

- Process inbound payment requests in less than 10 seconds 24/7.

- Automatically reattempt declined requests to ensure accurate processing.

- Manually accept or decline payments in case of failed initial validation.

- Automatically log and report all data from incoming instant payments process for further analytics and reporting.

Instead of the expected 3+ months, Infopulse delivered the solution in just one month. Processing vast amounts of data now takes only seconds to complete the payment request, which significantly raised customer satisfaction and boosted operational efficiency. Take a look at the full project description to see all the solution’s features and benefits.

Preference Packages Solutions based on Oracle FLEXCUBE

Aiming to continue its digital transformation, Allianz Bank Bulgaria decided to provide personalized terms of service to its clients based on the Relationship Pricing module of Oracle FLEXCUBE. As the standard module didn’t feature such capabilities, Infopulse engineers performed a range of customizations, which included:

- Implementing multiple preference packages with 30-40 rules for different operations in each.

- Implementing appropriate mechanisms to ‘catch’ transactions from other components inside and outside the FLEXCUBE ecosystem.

- Creating a custom accounting model to process monthly and yearly ‘Preference packages’ subscriptions.

- Implementing multiple historical data reports with Oracle BI for analytics and decision-making.

These tailored extensions for standard Oracle FLEXCUBE module brought Allianz Bank Bulgaria higher customer appeal and unique value proposition on the market, as the solution provided more comprehensive individual preferences for bank clients compared with other banks on the market. It also increased the bank attractiveness among the corporate clients segment.

Conclusion

Extending Oracle FLEXCUBE capabilities for core banking can be either a technical necessity or a powerful tool to stand out in the competitive market with a unique value proposition. With its ability to adapt to specific business needs, integrate with third-party systems, and comply with local regulations, Oracle FLEXCUBE prompts banks to migrate from legacy banking software to a more effective system.

As our practical experience shows, the extensibility of Oracle FLEXCUBE gives the ability to unlock greater efficiency, drive customer satisfaction, and open wider capabilities to expand on the market.

Infopulse is a certified expert in Oracle Financial Services Core Banking with successful experience in customizing FLEXCUBE. We can help tailor FLEXCUBE to your requirements, ensuring business continuity and operability during transition.

![Data Analytics Use Cases in Banking [thumbnail]](/uploads/media/thumbnail-280x222-data-platform-for-banking.webp)

![Mobile Banking Trends [Thumbnail]](/uploads/media/thumbnail-280x222-mind-your-app-why-reinventing-mobile-banking-really-matters.webp)

![API as a Product in Banking [thumbnail]](/uploads/media/thumbnail-280x222-business-opportunities-of-api-products-in-banking-and-finance.webp)

![API Strategy for Banking [thumbnail]](/uploads/media/whys-and-hows-of-api-strategy-for-banking-280x222.webp)