How to Choose the Best Payment Gateways for Your Business

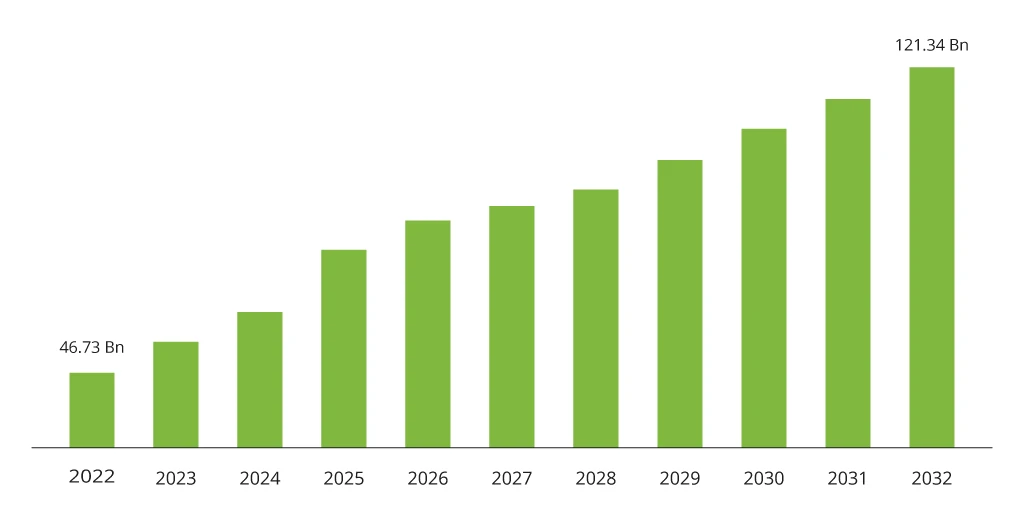

Well, choosing the right payment gateway is not an easy task. Dealing with payment gateways is challenging work that requires engineering expertise and domain experience. One of the main factors behind the adoption of payment gateway services lies in the increasing demand for mobile payments (85% of consumers who pay bills with mobile wallets are extremely satisfied with the service). A second factor contributing to the popularity of payment gateways is the increasing availability of high-speed internet across multiple countries. The range and the market share of payment processing solutions is only growing. In fact, between 2023 and 2032, the global payment processing solutions market is expected to grow by 10.1%.

What Is a Payment Gateway?

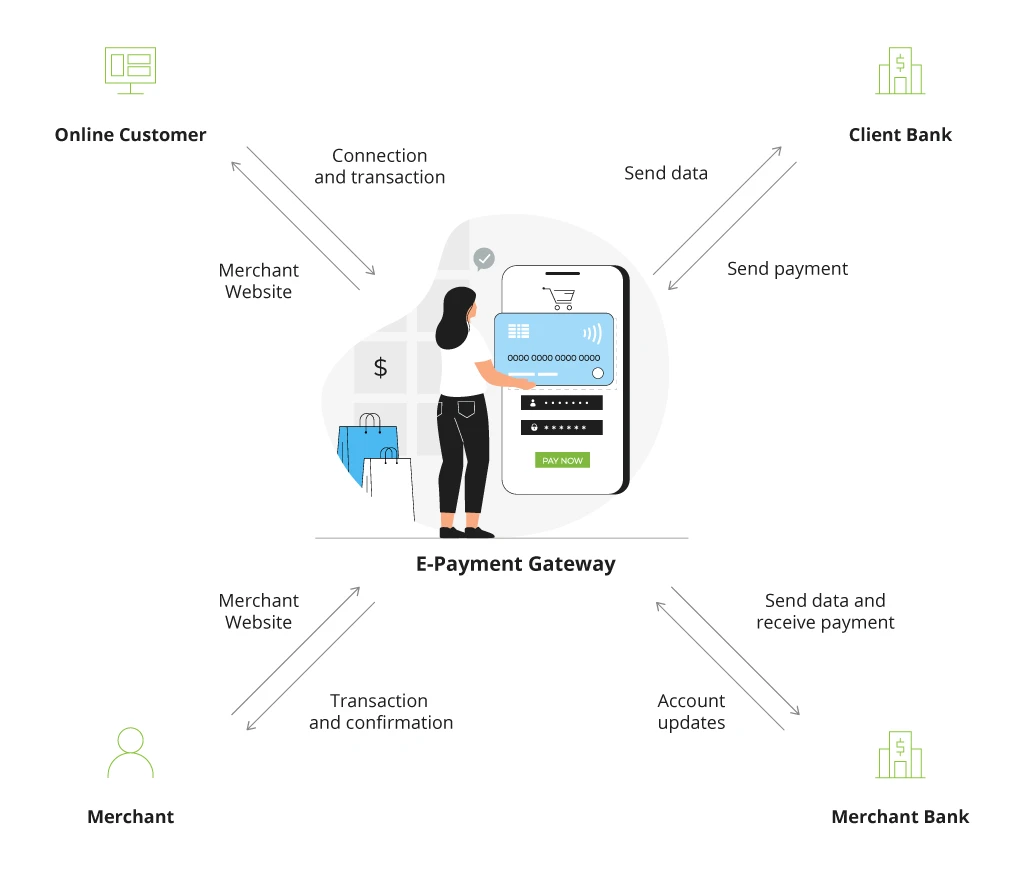

Along with payment processing and merchant accounts, a payment gateway is a critical component of online payment processing. It secures data transfers between a particular business website or a mobile app and the payment processing company. The best analogy for a payment gateway is a point-of-sale terminal from a retail store put in a digital dimension.

How Do Payment Gateways Work?

After placing an order and proceeding to the payment page, the customer selects the payment method and enters payment details. Via SSL (Secure Socket Layer), the customer’s encrypted information is sent to the payment gateway. The payment gateway performs fraud checks and then transfers the data to the payment processor, which, in turn, passes it to the bank and card association. The next task for the payment gateway is to send the payment processing approval or decline to the merchant.

Main Types of Payment Gateways

There are five main types of payment gateways: hosted, self-hosted, API-hosted, direct post, and integrated. Let’s review them one by one.

Hosted Payment Gateways

This type of payment gateway works using redirects. To make a payment, the gateways take users away from a business website and redirect them to a specific checkout page hosted by the third-party provider of the payment gateway, like PayPal.

What makes businesses favor it? Hosted payment gateways are mostly ready-to-go products, which is extremely convenient for startups or small businesses. By following the easy integration procedures, a business eliminates tedious compliance requirements and security concerns. It’s then the responsibility of the payment gateway provider along with all the rest of the payment processing nuances.

The challenging part. From the point of view of consumer psychology, redirects are triggers that may scare users away. Even if you have the most loyal customers, it doesn’t mean they trust and love PayPal or any other provider as much as they trust you. Entrusting your funds and clients to a third-party provider always means less control.

Self-Hosted Payment Gateways

Unlike a hosted gateway, a self-hosted gateway captures customer payment information directly on the business website. Examples of self-hosted payment gateways include Stripe and Shopify.

What makes businesses favor it? Self-hosted payment gateways give the business full control over user experience and the entire checkout process as the customer information is collected directly from the website.

The challenging part. Adopting a self-hosted payment gateway can be complicated as the company becomes responsible for payment data and has to manage all the security responsibilities. In addition, the company must comply with various data protection standards, like the Payment Card Industry Data Security Standard, etc.

API-Hosted Payment Gateways

To provide a smooth customer experience, businesses can also opt for another type of payment gateway – API-hosted. As the name suggests, the payment information is collected through an application programming interface or an API, and this gateway is more suitable for businesses that want to take complete control over their website’s design.

What makes businesses favor it? API-hosted gateways provide full control over the company’s website design, as well as the ability to process customer data directly on the website.

The challenging part. The business is fully responsible for securing a safe cardholder data environment to meet all data protection standards, such as PCI DSS or Payment Card Industry Data Security Standard.

Direct Post Gateways

Direct post gateway integration can be viewed as a technological solution that aims to address two objectives simultaneously. On the one hand, the checkout process takes place on the business’ websites, so there are no redirects to third-party pages. On the other hand, a proprietary server still doesn’t handle actual payment details or sensitive data.

What makes businesses favor it? Direct post gateways entail greater customization. It won’t deter your users, but will, instead, raise your brand awareness. The heavy lifting, including security matters, is once again done by the payment gateway provider.

The challenging part. Whether you approve or not, achieving peace of mind in payment processing often involves entrusting at least a portion of it to a third party, given the significant challenge of maintaining PCI compliance. However, once implemented, you seamlessly elevate yourself to the top tier, where businesses are prepared to take on full responsibility, earning appreciation from clients.

Integrated Payment Gateways

Integrated or non-hosted payment gateways offer on-site payments entirely handled by proprietary servers. Both the checkout and payment procedures are handled by the business's proprietary systems.

What makes businesses favor it? Integrated payment gateways have full control over all the stages of a client’s online payment experience. This method of payment gateway integration increases a brand’s reputation in the eyes of its clients. It’s a must-have for well-established businesses as users expect this level of commitment to security standards and a high level of user experience.

The challenging part. Since clients’ sensitive data is now entirely within the responsibility of business owners, they must ensure fraud protection and obtain PCI compliance. On top of that, businesses should have enough capacity to maintain a complex payment processing infrastructure.

The Essential Components of a Reliable Payment Gateway

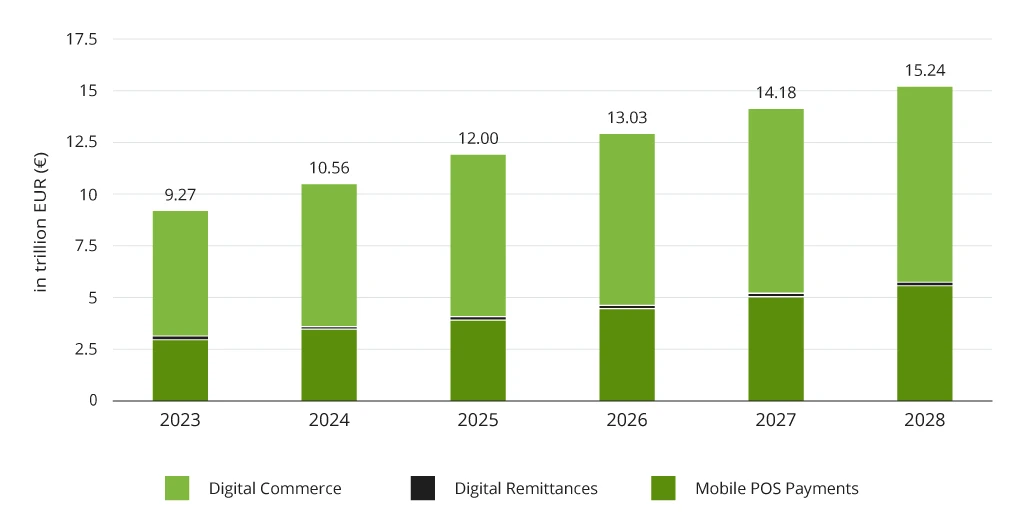

Evidence that people love online payments is clearly seen in the figures. It is expected that in 2024 the total value of digital payments will reach €10.56tn, with an annual growth rate of 9.60%, resulting in a projected total amount of €15.24tn by 2028.

Such affection fuels the growth of the payment gateway industry and market players engage in intense competition over clients. Meanwhile, this works well for business owners who plan to support their online payments with a reliable payment gateway. New features, extra security measures, and enhanced user experience are some of the positive outcomes of fierce payment gateway rivalry.

Payment Gateway Special Features

To ensure a smooth and secure transaction experience for both businesses and their customers, an effective payment gateway should encompass the following features:

Security

The ability to transfer payments online securely is a vital attribute of a payment gateway and should not jeopardize individuals' financial resources or personal information. To provide the ultimate protection, a payment gateway should focus on measures like the SSL protocol, PCI DSS certification, firewalls, tokenization, address verification and fraud-prevention tools, 3D security layer, data encryption, and even data security training for employees.

Encryption

Before sending sensitive payment information to the bank, the payment gateway encrypts it using the SSL encryption tool. Next, it validates the transaction data and decrypts the information to send the required details to the merchant account.

Payment Information Storage

The seamless experience of not having to repeatedly input payment details and personal information is a positive aspect contributing to an excellent user experience. Please be mindful that gateways should keep it secure once users save their information on a site or app. Once again, compliance to PCI DSS, PSD2, and other relevant directives, and encryption should be in place to help you.

Integration

To save time and development efforts, payment gateways should have the ability to integrate with various business platforms, shopping carts, ERP, and CRM systems. Learn more about building Custom Payment Gateways and Their Integration.

International Payment and Multiple Currencies Acceptance

Even home-based businesses dream of expanding their horizons and capturing the attention of the international audience. To succeed, payment gateways should support various payment types on top of the well-liked Visa and MasterCard. Consider mobile wallets, bank transfers, PayPal, or whatever online payment method is popular with your target audience and business environment.

How to Choose a Payment Gateway

The variety of payment gateways on the market and their different integration options often confuse users. We’d recommend you have a look through the aspects that might be the most challenging while integrating b2b payment gateways.

Processing Speed

The speed of money transfers from your clients to your bank account upon purchase is equally important for buyers and merchants. It is a distinctive feature of a modern end-to-end solution. Processing speed is crucial not only for e-commerce gateways but for any business that anticipates receiving payment for its goods and services. In the e-commerce sector, a seamless customer experience with a quick checkout process is a matter of utmost importance. Thus, it is essential to ensure that the payment gateway does not disappoint users with its slow processing speed.

Infopulse also holds its unique practical perspective on this. To achieve high processing speed and top-level performance, we recommend utilizing advanced Microsoft cloud technologies. Cloud transformation is a key to improving operational efficiency with accelerated workflow for business users. Besides, the integration of DevOps into the software development process helps to establish a quick deployment process without downtime.

Chargebacks

The corporate and funding policy of a payment gateway has its own intricacies mostly connected to chargebacks. Regardless of our preferences, chargebacks and disputes are inevitable in merchant-buyer relations. The task of a business owner is to ensure the following details before committing themselves to a specific gateway:

- What is the common chargeback delivery mechanism within a specific gateway?

- What penalties or fees should a merchant pay in case a chargeback takes place?

- What is a business owner supposed to do when a chargeback-related dispute occurs?

Merchants should maintain all chargebacks at a level of 1% of all transactions. Specifically, for e-commerce payment gateways, the rate falls between 0.10% – 0.30%. Otherwise, the merchant account risks being terminated or shut down. To be well-prepared, businesses should assess the real cost of a potential chargeback based on the fees charged to the merchant for each occurrence. On average, every chargeback is 25%, but it can also fall between $20-$100.

Recurring Billing

While businesses are looking for ways to establish more steady cash flows, payment gateways should be able to support such initiatives as recurring payments since they allow businesses to charge a fixed monthly fee. For buyers, it comes in the form of subscriptions.

The payment gateway must efficiently transmit your client's billing details to the merchant bank for monthly deposits into your merchant account. Despite being the primary choice for online payments, credit and debit cards pose challenges for successful recurring billing due to issues with handling expiration dates. To address this, alternative methods like direct payment from banking accounts should be considered.

Additionally, it's highly advantageous when payment gateways can support a complex recurring logic and business rules specific to a particular company. This includes personalized billing dates for each customer, or upgrades and downgrades based on your customers’ sign-up date. Unfortunately, many payment gateways struggle to keep pace with the demands of the subscription economy. The advice is to steer clear of outdated payment gateways and consider recurring billing support when planning to integrate a particular payment solution.

Mobile Payment Processing

Today, we’re witnessing the explosive growth of mobile payments. The mobile market size was valued at $369.5. and by 2032 it is expected to register a CARG of over 14.5%, claims a recent Mobile Payments Market report. Based on Infopulse's experience in developing payment processing solutions, making mobile payments seamless is crucial. While developing a high-performance online payment platform for an Irish state education agency, Infopulse not only optimized the system but also made it compatible with all OSs and handheld devices. The results were swift and impactful, as the solution fully meets the needs of thousands of the agency’s customers, enabling them to make instant payments while on the move.

Top 7 Payment Gateway Solutions

With a wide variety of payment gateways and a lot of factors to keep in mind while choosing a particular payment gateway provider, there are always frontrunners. Based on our findings, we compiled a list of the top 7 payment gateways providers.

PayPal

PayPal has mastered the art of winning consumer trust and loyalty. Enjoying global confidence and esteem, PayPal achieved a payment volume of $354.5 billion in 2023.

Distinctive features:

- Works with almost any merchant account, processor, and shopping cart

- Works with all leading eCommerce solutions, CRMs, sales management tools, and accounting systems.

Stripe

This payment gateway is the choice of 100,000 global companies, non-profit organizations, and governmental institutions, including the British government, Lyft, UNICEF, HubSpot, and Salesforce.

Distinctive features:

- Offers flexibility, scalability, and customization options

- Is available for businesses in 34 countries

- Pursues the developer-first approach to help businesses achieve true customization.

Apple Pay

Apple's payment gateway solution is designed for a mobile payment framework, empowering merchants to process payments through Face ID and Touch ID. Its primary emphasis lies on consumers seeking an electronic wallet to oversee their transactions.

Like PayPal, many other payment gateways facilitate retailers accepting Apple Pay payments. Through these services, businesses can receive payments from nearly 1 billion iPhone users globally, with over half of them utilizing Apple Pay.

Distinctive features:

- Offers global accessibility

- Ensures secure and convenient transactions through biometric authorization.

Amazon Pay

You can use Amazon Pay globally, especially in the US and most European countries. Hundreds of millions of customers in more than 170 countries use Amazon Pay daily to make transactions. Some of Amazon Pay’s customers include Lenovo, Lacoste, Washington Post, Wyze Labs, Inc., Kamikoto Knives, and Atom (text editor).

Distinctive features:

- Trustworthy fraud protection service

- Good reputation associated with Amazon as a well-known brand

- Pleasant user interface and ease of use

Adyen

This company from the Netherlands is a big player on the payment gateways market. Adyen’s clients include Microsoft, eBay, Uber, Spotify, Sephora, and Nike.

Distinctive features:

- Provides transparent fees with an explicit list of prices for supported payment methods on the website

- Supports almost all kinds of cards and digital wallets

- Presents itself as a payment gateway behind big and international operations.

Authorize.Net

A US-based company, Authrorize.net is a payment processing incumbent and has been working since 1996.

Distinctive features:

- Authorize.Net was acquired by Visa in 2010

- Pays attention to the community of developers

- Provides responsive and efficient customer support.

Square

A financial services and mobile payment provider, Square was founded in 2009 and now generates more than $3bln annually. Square quickly gained a foothold in online payment gateways and offers an intuitive and user-friendly experience to merchants.

Distinctive features:

- Number one solution for mobile payment processing, specially designed to accept payments on-the-go

- Offers a wide range of APIs

- Promises no extra fees, no long term contracts, and no lock-in.

Conclusion

What payment gateway provider to choose, how to integrate it, which features to look for? Get all the answers from an experienced IT provider with whom you can take advantage of the competitive market environment. Infopulse can help you select the payment gateway with the richest features and ironclad security to match your business needs.

![Data Analytics Use Cases in Banking [thumbnail]](/uploads/media/thumbnail-280x222-data-platform-for-banking.webp)

![Mobile Banking Trends [Thumbnail]](/uploads/media/thumbnail-280x222-mind-your-app-why-reinventing-mobile-banking-really-matters.webp)

![API as a Product in Banking [thumbnail]](/uploads/media/thumbnail-280x222-business-opportunities-of-api-products-in-banking-and-finance.webp)

![API Strategy for Banking [thumbnail]](/uploads/media/whys-and-hows-of-api-strategy-for-banking-280x222.webp)