What Is Hot in Telecom: Nine Tech Trends to Impact the Industry in 2024

The operation and maintenance of telecommunications services is a massive task that requires huge expenditures. In 2024, global spending in the telecom sector is projected to reach $1.536 trillion, which is a 7.8% increase compared to 2022.

Such high numbers are no surprise considering the fact that the speed and reliability of local networks directly influences how fast innovation will drive a particular sector or region. That is why telecom operators are making the most of cutting-edge technologies to address possible network challenges and meet the highest quality demands and standards. Experts in all things innovation, Infopulse expects this technology-fueled approach to continue picking up steam in 2024, resulting in the following trends.

Artificial Intelligence

AI is number one on our list for a reason. The worldwide market for artificial intelligence in the telecom industry was valued at $1.45 billion in 2022, and is projected to grow at a CAGR of 28.2% between now and 2030. Telecom companies are actively leveraging AI and ML for specific use cases:

- Customer support. AI-powered chatbots and virtual assistants can not only rapidly resolve customer queries — automatically or by re-assigning them to a more tech-savvy consultant — but also analyze customer data to further personalize services. This results in slashed business expenses, saved time, and enhanced customer experience.

- Predictive maintenance. Artificial intelligence also drives predictive analytics that facilitates detecting and resolving network issues long before the service disruption.

- Security. Empowered by sophisticated ML algorithms, AI systems can monitor the network in real-time 24/7, identify any deviations from the normal state and performance, and promptly respond to arising security issues.

Possible Challenges and How to Address Them

AI is indeed able to revamp key operations in a telecom business; however, there is the other side of the coin to factor in. For example, when analyzing customer data for more personalized offerings, data privacy and ethical considerations surface. Besides, the ever-growing volume of data complicates data management (including data security) and analysis. To ensure its high quality and accessibility of future insights, it’s essential to enhance your AI system with the relevant mechanisms on data cleansing, validation, and integration as well as advanced analytics and report generation tools.

Another challenge that might surface is integration with legacy systems and processes. Therefore, it’s better to choose phased adoption, gradually replacing those older solutions with AI-powered platforms — all while ensuring business continuity.

Internet of Things

In 2021, the global telecom IoT market size was valued at $19 billion, and in 2031, this number is expected to exceed the $185.5 billion mark, growing at a CAGR of 27.71%. The key use case explaining why IoT is getting traction in the sector revolves around equipment monitoring and hazard detection.

Sensors help telecom companies perform real-time surveillance of their hardware on sites by collecting data on machines’ health and notifying operators about any potential problems — to prevent telecommunications breakdowns. Also, when an unexpected incident or disaster is detected, those in control can shut down the equipment to stop a complete shutdown.

Possible Challenges and How to Address Them

- Cloud. Public cloud provides a robust foundation for IoT solutions, addressing challenges related to scalability, data management, security, and global reach. By leveraging the capabilities of public cloud platforms, organizations can accelerate the development and deployment of innovative and scalable IoT applications. You will need a cloud expert in place to ensure proper implementation.

- Incompatibility. IoT devices do not have standardized protocols for machine-to-machine communication. Moreover, they run on different operating systems and technologies that are not always compatible with each other. All these implications should be considered when deploying IoT networks and management platforms.

- Security. Connected devices are prone to cyber-attacks, so telco networks should have rock-solid security to protect customer data.

Check out our article explaining how a dedicated, properly managed SOC can help to improve a telecom’s security monitoring tasks and enable proactive defense measures.

5G Connectivity

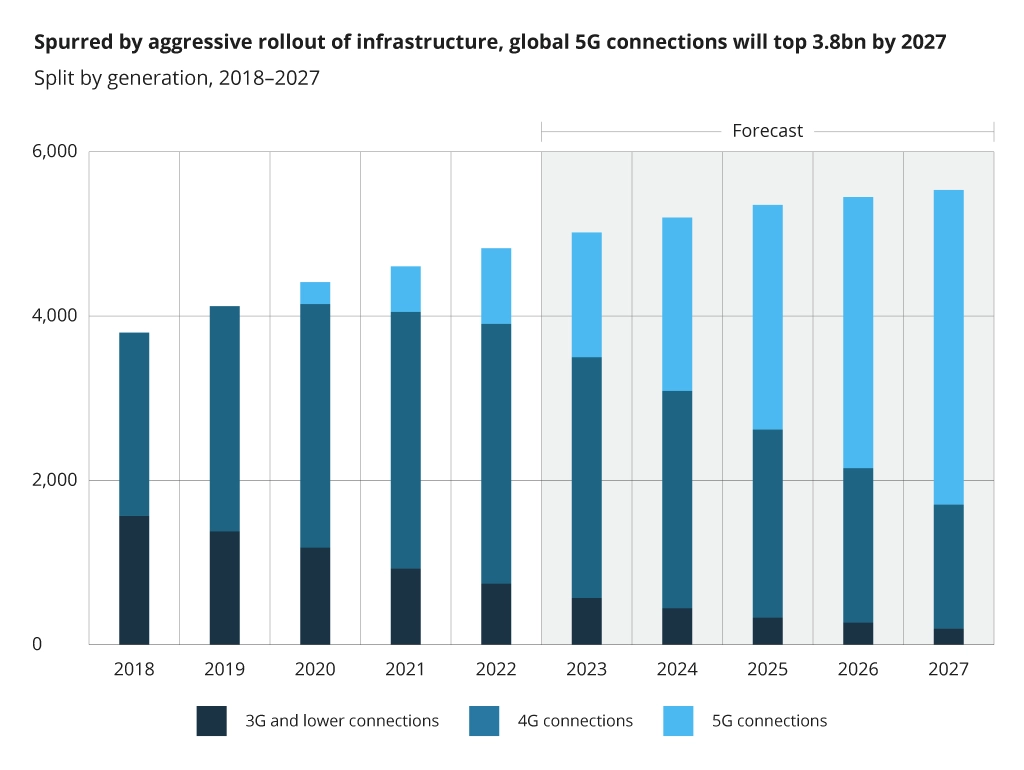

After the first boom in 2020, 5G continues gaining pace these days. By 2026, the number of 5G subscriptions is forecast to equal 5 billion, with 5G becoming the leading smartphone connection by 2025.

The growth of 5G in the telecom industry in particular is driven by the necessity to enhance connectivity speed and reduce latency. This enables the ability to support a huge number of connected devices simultaneously and expand telecom capabilities through the introduction of ultra-high-definition video streaming, VR and AR functionality, autonomous vehicles, smart cities, and other cutting-edge applications that require real-time data transmission and low latency.

Another use case where 5G finds its footing is by providing enterprises with private, high-performance networks in order to cover their tailored needs. These are usually low-latency, high-bandwidth applications in industries like manufacturing, logistics, or healthcare.

Possible Challenges and How to Address Them

- Cost. Both public and private 5G networks are quite expensive due to their upfront infrastructure operation and maintenance as well as the need to buy new spectrum licenses.

- Coverage for those in rural areas and less populated communities might not be available.

- Concerns about the adverse effects of this technology are rising, including 5G radiation and spectrum allocation issues.

If you lack relevant expertise and need consulting on 5G adoption and implementation, it can help to partner with a telecom tech expert like Infopulse.

Network Slicing

Another trend telecom companies will surely capitalize on in 2024 is network slicing, a 5G feature that allows telcos to virtually segment the network for specific use cases. This technology has already started gaining serious momentum — in 2022, the worldwide network slicing market was $518.4 million and is forecast to grow at a whopping CAGR of 51.1%, reaching almost $13.7 billion by 2030.

Network slicing is used by telcos to deliver more customized services to their clients from different industries. As each slice has its own network parameters like latency, bandwidth, and security characteristics, they can be allocated for particular use cases. For example, low-latency slices are a perfect fit for autonomous vehicles, while high-throughput slices are suitable for ultra-high-definition video streaming. Each network slice operates as an isolated virtual network, providing security and isolation for different applications, preventing interference and ensuring privacy.

Possible Challenges and How to Address Them

To ensure maximum efficiency, all the slices should be firmly isolated and should also be performing well. For this to happen, you will have to automate the provisioning and management of slices through robust, policy-driven mechanisms. Overall, you’ll need profound tech expertise in:

- Designing, implementing, and orchestrating the network;

- Tailoring the network slices for end-to-end services;

- Ensuring rock-solid security for network deployment and maintenance.

Cloud-Native Transformations

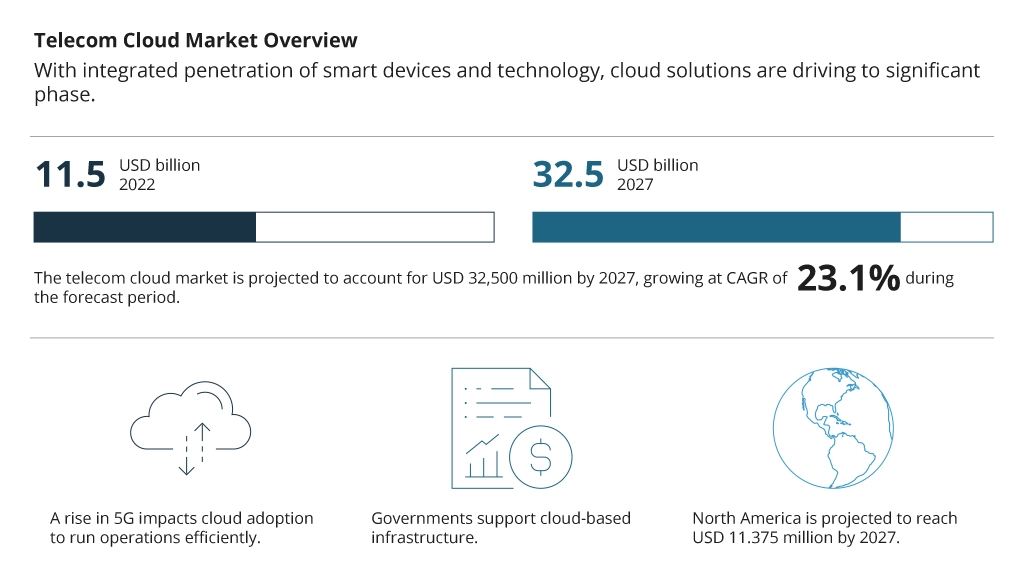

Cloud is another trend telecom companies will pay heed to in 2024. According to stats, the worldwide telecom cloud market surpassed the $11.5 billion mark in 2022 in revenue, and is expected to exceed $32.5 billion by the end of 2027, growing at a CAGR of 23.1%.

Indeed, telecom companies are taking off monolithic, hardware-dependent infrastructures and are adopting a cloud-native approach to increase the scalability and agility of networks and their functions. Telco operators can efficiently allocate resources based on traffic patterns, ensuring optimal performance during peak usage and cost savings during periods of low demand. Cloud-native environments allow for efficient resource utilization through multi-tenancy and resource pooling. This shared infrastructure reduces overall costs and promotes resource efficiency.

Microservices architecture allows telco operators to update, scale, and deploy specific services independently, promoting agility in development and operations. Cloud-native practices enable CI/CD pipelines, facilitating the automated testing, integration, and deployment of new features or updates. This accelerates time-to-market for telco services. And if a particular microservice fails, it doesn't necessarily impact the entire system, enhancing overall system (and network) reliability. Cloud-native applications can incorporate automated recovery mechanisms, allowing for the rapid detection and resolution of issues too. This contributes to increased system resilience and reduced downtime.

Possible Challenges and How to Address Them

Cloud transition is a complicated process that requires a high level of technical expertise and certain know-how about the migration pitfalls, how to avoid them, and ways to befriend the cloud requirements with your specific business needs. A cloud development company like Infopulse can help you with:

- Moving legacy on-premises infrastructures to the cloud by using expertise in containerization, microservices, and orchestration;

- Avoiding vendor lock-in by implementing multi-cloud or hybrid cloud strategies;

- Building and managing a cloud-native infrastructure;

- Automating processes like network orchestration and monitoring through continuous integration, testing, and deployment.

Cybersecurity Focus

This trend is driven by the alarming stats on cybersecurity breaches in the telecommunications industry. Namely, telcos face an average of 104,000 cyber-attacks per year, which is about three times higher than in other sectors. In 2022, the large telecom company, Optus, suffered a major data breach, when 9.8 million individual records were stolen. In December 2023, Kyivstar, Ukraine's top mobile operator, was hit by one of the highest-impact disruptive cyberattacks on the country since the start of the war with Russia. Users could not use mobile communication, mobile internet, home internet, or the company’s official website. Half of the country’s population – approximately 24 million people – were cut off from communications. These highlights are more than enough for telecom businesses to adopt a proactive security approach and invest more in advanced security measures. Examples include:

- Building robust cybersecurity strategies to protect networks and customer data against threats such as DDoS attacks, data breaches, and network intrusions.

- Threat detection by way of leveraging ML to perform 24/7 real-time network monitoring for identifying and responding to any suspicious activities as well as analyzing the detected threats to further introduce a predictive security posture.

- Security architecture reviews performed by third-party specialists who assess all the security layers across infrastructure, application, workflows, and people.

- Identity management solutions, powered by AI, that automate and fortify the access control process through robust multi-factor authentication, data encryption, and compliance with GDPR, W3C Verifiable Credentials, and Decentralized Identity Standards.

Regulatory Changes

Regulatory policies are often put in place to promote competition, protect consumers, address market failures, and encourage innovation. Understanding and anticipating regulatory changes is crucial for strategic planning and long-term sustainability in the telecommunications industry as they can have a significant impact on the industry's dynamics, operations, and revenue streams.

The telecom sector recently faced a number of regulatory changes that should be taken into account when performing business processes:

- Network neutrality rules — created to ensure that all data on the internet is treated equally by internet service providers in terms of speed and governments in terms of access, sparking significant effects on how telecom companies operate and compete.

- The EU Digital Services Act (DSA) — becomes fully operational in 2024 and imposes a new set of requirements on businesses related to content moderation and algorithm oversight to address cyberbullying, illegal content, and other issues. For telecom providers, this means introducing robust “notice and action” procedures.

Possible Challenges and How to Address Them

To adapt to these changes — at the same time resolving issues of data privacy, customer protection, and security — telcos must become familiar with the ins and outs of regulations. Telco operators must adapt to evolving regulations while addressing issues related to data privacy, security, and customer protection.

Edge Computing

The edge computing market is projected to grow from $53.6 billion in 2023 to $111.3 billion in 2028, at a CAGR of 15.7%. Edge computing brings computing resources closer to the location where data is generated and consumed. This reduces latency and enables faster processing of data. In combination with 5G, edge computing can drive the support for innovative capabilities like robotics, AI, massive IoT, autonomous vehicles, and AR/VR.

The distributed nature of edge computing can enhance network resiliency for telcos. This means that, unlike with a centralized solution, an outage at one edge site will not affect the connection at others along the network periphery. Moreover, when an application or a particular function fails at one location, it can be backed up at a nearby edge cloud site. Telcos also make the most of edge computing to rapidly process data, while complying with complex data sovereignty requirements.

Possible Challenges and How to Address Them

Establishing and maintaining reliable connectivity at the edge might be a challenge due to the need for high bandwidth and a robust infrastructure. To address this, think about employing edge caching, content delivery networks (CDNs), or network redundancy mechanisms.

Another pitfall refers to protecting sensitive data from breaches. In this case, you will need to focus on data encryption, data anonymization, authentication, patch management, privacy regulations compliance, and ML-based anomaly detection.

Due to the limited nature of edge devices, you might also face the challenge of storing and managing large volumes of data. Besides using some basic techniques such as data compression, aggregation, and filtering, make the most of the cloud to ensure better scalability and orchestration.

Open RAN

Open Radio Access Network (ORAN - Open RAN) is projected to reach a global market size of $15.6 billion by 2027, and at a CAGR of 70.5% over the 2022-2027 period. Such a spark in numbers as compared to the year 2022 ($1.1 billion) is driven by the fact that Open RAN is moving the telecom industry away from traditional RAN solutions, often built using proprietary, integrated hardware and software from a single vendor, and promotes interoperability, flexibility, and innovation by using open interfaces and standards. This makes it possible to take advantage of the best components from different vendors and adopt third-party software-based solutions, all while slashing costs and avoiding vendor lock-in.

Possible Challenges and How to Address Them

Multi-vendor adoption always presupposes challenges in standards interoperability, as well as compatibility and orchestration of various Open RAN components. To make these components from multiple vendors work together seamlessly, you might need to implement an automation framework for continuous interoperability testing and a robust cloud-based platform for automated operations management. Here is where the third-party specialists of Infopulse can assist with integration and compatibility testing automation, as well as the development of custom solutions for specific network requirements.

Where Do We Go from Here?

With the global telecommunications market size being projected to reach almost $2.6 trillion by 2031, it becomes clear that the competition among telcos will be even higher. To stand out of the crowd, be ready to enhance and personalize your service offerings with innovation.

Whether you need to increase your network speed, security, or compatibility, Infopulse is here to assist you with advanced tech implementation. Just drop us a line, describing your specific needs, and our telecom industry experts will get back to you to discuss the details.

![Telecom Tech Trends [MB]](https://www.infopulse.com/uploads/media/banner-1920x528-what-is-hot-in-telecom-nine-tech-trends-to-impact-the-industry-in-2024.webp)

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![Expanding NOC into Service Monitoring [thumbnail]](/uploads/media/280x222-best-practices-of-expanding-telecom-noc.webp)

![IoT as the Core of Digital Farming and Agriculture [thumbnail]](/uploads/media/280x222-iot-as-the-core-of-digital-farming-and-agriculture.webp)

![Defender for IoT [thumbnail]](/uploads/media/thumbnail-280x222-how-to-ensure-Iot-and-ot-security98.webp)

![Telecom Challenges into Opportunities with Consulting [thumnbail]](/uploads/media/thumbnail-280x222-telecom-challenges-into-opportunities-consulting.webp)

![Cloud-Native OSS for Telco [thumbnail]](/uploads/media/what-makes-telcos-lean-toward-containerized-cloud-native-oss-promo-baner-280x183.webp)